Dead Hand Proxy Puts and Shareholder Value

We study the impact of Dead Hand Proxy Puts on shareholder value. Courts and commentators have characterized these terms as defenses against hedge fund activism that threaten to reduce firm value by entrenching underperforming managers and thereby increasing managerial agency costs. Our findings contradict this view. Using three court cases as a natural experiment, we find that shareholders do not react negatively to the inclusion of a Dead Hand Proxy Put in a firm’s loan agreements. Not only do Dead Hand Proxy Puts not destroy firm value, they may even preserve it by deterring activists who would seek to extract wealth from creditors and other nonshareholder constituencies. We develop the policy implications of these findings and offer a direction for the evolution of legal doctrine in this area.

Introduction

Hedge fund activism is now a defining force in corporate governance. Having risen sharply over the last decade,1 hedge fund activism has entered a “second wave”2 or “golden age.”3 Activist hedge funds, acting alone or in “packs,”4 accumulate significant stakes in public companies5 and then seek institutional support in putting pressure on boards.6 Activists target firms they perceive to be undervalued and attempt to increase value through financial restructuring or through changes to management and business strategy.7

Shareholders benefit from hedge fund activism, at least in the short term.8 But creditors, in general, do not. From a creditor’s perspective, activist interventions threaten to increase repayment risk, either by leveraging up the firm to increase payouts to shareholders or through subtle changes in business strategy that have the effect of shifting risk to creditors and other constituencies.9 And incumbent managers, who typically lose their jobs after successful interventions, take an even less charitable view of hedge fund activism.10 The proliferation of defensive devices aimed at hedge fund activism is therefore unsurprising. Companies have adopted structural defenses to deter activists, such as low-threshold poison pills11 and bylaw amendments.12 In addition to these structural defenses, but perhaps less widely noticed, firms have begun to embed defenses against activists in their ordinary business contracts.13 This Article studies one such contractual term—the Dead Hand Proxy Put.

Dead Hand Proxy Puts trigger default and immediate repayment of corporate indebtedness in the event that a dissident slate of prospective directors wins a majority of seats on the target company’s board.14 Moreover, a Dead Head Proxy Put provides that only the creditor, not the shareholders or incumbent management, can waive the provision.15 The provision thus threatens to impose a significant cost on the corporation—repayment of the company’s outstanding indebtedness—if the incumbent board loses control in a proxy fight.16

The proxy fight is the activist’s ultimate weapon.17 Unlike bidders in a takeover battle, the activist’s endgame is not to buy the company but rather to exert control with a minority ownership interest—often no more than 10 percent of the target company’s outstanding shares.18 As a result, activists, unlike would-be acquirors, do not have sufficient financial backing to replace the company’s entire capital structure. The prospect of repaying the company’s outstanding debt can thus have a heavy deterrent effect on hedge fund activism. Moreover, once in place, the Dead Hand Proxy Put creates a strong incentive for shareholders to vote against an activist’s nominees in order to avoid forcing the corporation to incur the cost of repaying its debt.19 Furthermore, because only creditors can waive the provision, the incumbent board is powerless to prevent the default from occurring.20

Seizing on the defensive potential of the provision, the Delaware Court of Chancery moved to restrict it in a trio of recent rulings. In the first case, San Antonio Fire & Police Pension Fund v Amylin Pharmaceuticals, Inc,21 the court criticized the provision’s “eviscerating effect on the shareholder franchise” which might render it “unenforceable as against public policy.”22 In the second case, Kallick v Sandridge Energy, Inc,23 the court warned that the failure to approve dissident nominees could amount to a breach of fiduciary duty.24 Finally, in the third ruling, Pontiac General Employees Retirement System v Ballantine25 (“Healthways”), the court held that the deterrent effect of Dead Hand Proxy Puts allowed them to be challenged as a breach of fiduciary duty when adopted,26 thus unleashing a flood of shareholder claims aimed at eliminating the provision wherever it could be found.27

Commentators have likewise drawn on the analogy to takeover defense to criticize the potential of Dead Hand Proxy Puts to ward off activism and entrench underperforming managers.28 The premise animating the view of courts and commentators alike is that defensive provisions insulate managers from the market for corporate control, thereby increasing managerial agency costs and destroying firm value.29 Dead Hand Proxy Puts, in other words, function as entrenchment devices and, as such, destroy shareholder value.

We set out in this Article to test that proposition. If the prevailing view of courts and commentators is correct, the Dead Hand Proxy Put should decrease share price. We refer to this as the “entrenchment hypothesis” and devise a quasi-experimental research design to test it. Drawing on an original, hand-collected dataset of publicly traded firms that have adopted Dead Hand Proxy Puts, we analyze shareholder reactions to each of the Delaware Court of Chancery’s three Dead Hand Proxy Put rulings, comparing results for companies that have adopted the provision with results for companies that have not. Because the entrenchment hypothesis predicts a negative shareholder reaction to the provision and because each ruling restricts the provision, we predicted a positive share price reaction to each decision. We fail to find this, however, regardless of whether the companies are incorporated in Delaware and regardless of whether the companies are targets of shareholder activism.30 We find that shareholders do not react negatively to the inclusion of a Dead Hand Proxy Put in a firm’s loan agreements and, in at least some instances, they react positively to the provision. Our results thus fail to support the entrenchment hypothesis.

What explains these results? First, building on our companion paper finding that creditors discount the price of debt for firms that agree to the provision, Dead Hand Proxy Puts provide an important firm-level benefit.31 Nevertheless, our results are inconsistent with a simple story in which the benefit shareholders receive from the reduction in the cost of debt offsets the harm they suffer from the entrenchment potential of the provision.32 Instead, more persuasive explanations for our results emerge from a close focus on the nature of the compromise underlying the provision, from which a number of possibilities emerge. One possibility is that shareholders heavily discount the value of their votes and therefore are willing to trade their future value in exchange for an immediate discount in the cost of debt.33 Alternatively, the Dead Hand Proxy Put may represent an arrangement that effectively deputizes creditors as gatekeepers over beneficial versus destructive forms of shareholder activism.34

Fortunately, these alternative explanations point in a single direction for the formulation of legal policy. We have strong evidence of firm-level benefits from Dead Hand Proxy Puts and no evidence that the provision transfers value from shareholders to creditors (or managers). The provision, in other words, may create value rather than merely redistribute it. Dead Hand Proxy Puts should therefore not be banned, and entrepreneurial lawyers should not be rewarded for pressuring firms to eliminate them.35 Instead, courts should allow the provision to be liberally adopted. Nevertheless, due to the risk that managers will collude with creditors to use the provision for entrenchment rather than creditor protection, courts should scrutinize the conduct of boards when the provision is used in the context of a proxy fight, inquiring into whether waiver was sought, whether it was granted, and if not, whether it was validly denied.

From this Introduction, our Article proceeds as follows. Part I places Dead Hand Proxy Puts in context by reviewing the literature on hedge fund activism and private-ordering responses to it. Part II describes current judicial attitudes toward the provision. Part III presents the data used in our empirical analysis of Dead Hand Proxy Puts and supplies evidence on the effect of the provision on the price of debt. Part IV reports the results of our empirical tests on the effect of Dead Hand Proxy Puts on shareholder value. Part V evaluates possible explanations for our findings, and Part VI considers their implications for legal policy.

I. Activists, Shareholders, and Creditors

Corporate law has long focused on the conflict between managers and shareholders, sometimes failing to recognize the equally longstanding conflict between shareholders and creditors.36 Yet just as corporations present opportunities for managers to profit at shareholders’ expense, so too do they present opportunities for shareholders to profit at creditors’ expense.37 In this Part, we present hedge fund activism as one such opportunity, to which Dead Hand Proxy Puts offer a private-ordering response. We begin by reviewing the literature on hedge fund activism, focusing in particular on how hedge fund activism creates conflict between shareholders and creditors. We then discuss the evolution of private-ordering solutions to the conflict, situating the Dead Hand Proxy Put as a contractual provision designed to mitigate the conflict between debt and equity.

A. Shareholder and Creditor Interests in Hedge Fund Activism

Debates over the effects of hedge fund activism draw a sharp distinction between short-term and long-term results. Numerous studies find that the appearance of a hedge fund activist generates significantly higher stock returns upon announcement.38 Although there is some evidence from earlier sample periods that returns from activism have diminished with time,39 more recent periods of activism have shown positive abnormal returns consistent with earlier findings.40 The longer-term effect of hedge fund activism, however, remains contested,41 as does the question whether activists achieve shareholder gains by creating value or by merely transferring it from creditors or other constituencies.42

Critics of hedge fund activism argue that activists are overwhelmingly motivated by short-term goals at the expense of long-term performance.43 According to this account, activists pursue strategies to increase short-term payouts, such as financial restructuring aimed at increasing the company’s leverage in order to pay higher dividends while also cutting research and development and other costs essential to growth.44 By feeding market myopia, such strategies may discourage firms from pursuing longer-term goals, thereby reducing value over the long term.45 Supporters counter that activism increases long-term value by identifying and addressing underperformance.46 Payouts to shareholders may increase, but reducing discretionary control over cash flows imposes management discipline,47 encouraging efficiency and thereby increasing firm value.48

Creditors, however, have a different perspective on hedge fund activism. They are indifferent to shareholder returns, either in the short or long term, and care principally about the creditworthiness of the debtor and, ultimately, repayment of the debt.49 The prospect of hedge fund activism may increase risk for creditors by reducing the security of their loan and, ultimately, the probability of repayment. Indeed, several common activist strategies amount to transfers of wealth from creditors to shareholders. For example, activists engage in “asset dilution” by increasing firm leverage and payouts to shareholders, and they engage in “asset substitution” by pushing the firm into mergers and acquisitions.50 Each of these strategies increases shareholder wealth only by increasing insolvency risk, thus benefiting shareholders at the expense of creditors.

Empirical studies confirm this reasoning. A prominent study of bondholder returns from hedge fund activism found a negative 3.9 percent excess bond return upon the appearance of an activist and an additional negative 4.5 percent excess bond return over the remaining year.51 However, these results may not be consistent across all forms of activism. Another study, focused on loans rather than bonds, found increased interest rate spreads, indicating deterioration of credit quality, associated with activist interventions aimed at financial restructurings and forced mergers but found decreased spreads from interventions aimed at replacing underperforming managers.52 In other words, while hedge fund activism may increase risk to creditors, it is not quite so simple as shareholders win, creditors lose. Instead, creditors’ interests appear to be harmed by some but not all forms of hedge fund activism.

In any event, creditors are not powerless in their conflict with shareholders, nor are they helpless victims of hedge fund activism. Because they are in contractual privity with the firm, creditors can negotiate for debt covenants to constrain the privileging of equity over debt.53 In the next Section, we demonstrate how contractual provisions have evolved to address the shareholder-creditor conflict in the context of shareholder activism.

B. Event Risk Covenants and Dead Hand Proxy Puts

Dead Hand Proxy Puts are a contractual innovation to the change-of-control provision that has been standard in corporate debt agreements since the 1980s.54 Originally designed to protect creditors from a sudden increase in credit risk associated with leveraged buyouts and hostile takeovers, change-of-control covenants also have the potential to entrench incumbent managers.55 Dead Hand Proxy Puts respond to a gap in creditor protection under the standard change-of-control provision. The gap seems to have become apparent only with the advent of hedge fund activism.

1. The change-of-control provision.

The standard change-of-control provision in loan agreements and bond indentures provides for default and accelerated repayment of corporate indebtedness upon the occurrence of either of two events.56 First, default can be triggered by the outside accumulation of a control block of shares (the “control block trigger”). Second, default can be triggered by the changeover of a majority of board seats in a proxy fight (the “proxy fight trigger”).57 Nevertheless, in order to allow for ordinary board succession without triggering default, the standard provision incorporated an exception to the proxy fight trigger for new directors that are “approved” by the incumbent board.58 The exception permits ordinary board succession while maintaining the trigger for board changeover that implies a shift in strategy or direction, thereby threatening creditor interests.

Prior work on the change-of-control provision has been preoccupied with takeovers and therefore has tended to focus on the control block trigger in bonds.59 Studies of the wealth effects of the change-of-control provision have found that bond issuances with the provision reduce the cost of debt while also leading to declines in the debtor’s share price.60 However, these effects do not seem to have survived the end of the leveraged buyout era.61 More recent studies find that the basic change-of-control provision has become pervasive in corporate bond issuances.62

As for entrenchment effects, studies investigating whether change-of-control provisions are bundled with other common entrenchment provisions, such as poison pills and staggered boards, have not returned meaningful results.63 Although one such study finds that firms with change-of-control covenants are less likely to have poison pills,64 suggesting a substitution effect, by disregarding the “shadow pill”65 the study undercounts the number of firms with poison pills, leading to flawed results.66 Because a staggered board can be adopted only with a shareholder vote, its presence or absence is far more indicative of potential entrenchment than a poison pill is.67 The study finds no relationship between change-of-control covenants and staggered board provisions.68

2. The dead hand feature.

The standard change-of-control provision may adequately protect creditor interests in the context of leveraged buyouts and hostile takeovers, but the provision has a serious weakness in the context of hedge fund activism. Debtors can effectively waive the standard provision’s proxy fight trigger by “approving” a dissident’s slate.69 Approval, in this context, amounts to formally confirming that the dissident nominees are qualified to serve, but not necessarily endorsing or recommending those nominees for election.70 As a result, the debtor’s board can avoid default simply by confirming the qualifications of the dissident’s nominees. Moreover, the board’s fiduciary duties may require them to approve qualified nominees.71 The standard provision, in other words, gives the debtor’s board de facto waiver authority that they may be required to exercise.72

The potential defect in the provision—that “approval” might mean something less than “endorsement”—may not have been apparent in the takeover era, because in those days proxy fights were typically paired with tender offers as a means of dismantling the target company’s poison pill.73 As long as the proxy fight was paired with an offer to purchase shares, there would have been no gap in creditor protection; in the unlikely event that the target board “approved” the dissident slate, creditors remained protected by the control share provision, which would have been triggered upon consummation of the tender offer. Only in the context of hedge fund activism, in which proxy fights are not paired with tender offers, would the gap in creditor protection have become apparent. Because victory in a proxy fight, not acquisition, is the hedge fund activist’s ultimate objective, creditors remain vulnerable under the standard provision. The Dead Hand Proxy Put responds to this gap in protection.

The Dead Hand Proxy Put expressly disempowers the debtor’s board from approving dissident nominees in the context of a proxy fight.74 The contractual innovation of the provision is thus to reset the waiver mechanism of the change-of-control provision, updating it to the era of stand-alone proxy fights. Previously, waiver authority was shared by the creditor and, through the approval mechanism, the debtor. By eliminating the approval mechanism, the Dead Hand Proxy Put strips the debtor of de facto waiver power, allocating waiver authority exclusively to the creditor.

The reallocation of waiver authority empowers creditors to protect their own interests in the context of a proxy fight. This is a crucial innovation in the era of hedge fund activism. Activists use proxy fights to gain control of target companies.75 And activists, once in control, frequently seek changes that threaten creditor interests.76 Hence, a creditor that does not control waiver authority under the proxy fight trigger remains vulnerable to loss through hedge fund activism.

The Dead Hand Proxy Put brings the creditor back to the bargaining table. Once the provision is in place, an activist cannot proceed without replacing the company’s outstanding debt unless the creditor waives the provision. An event of default thus gives the creditor three options: (1) waive the default, (2) renegotiate the terms of the debt, or (3) demand immediate repayment. The debtor, having lost the ability to avoid acceleration by approving dissident nominees, no longer has any choice in the matter. The Dead Hand Proxy Put thus represents a private-ordering solution to creditor vulnerabilities in the era of hedge fund activism.

II. The Jurisprudence of Dead Hand Proxy Puts

Although the discussion above portrays the provision as a bargained-for response to a gap in creditor protection, the judicial response to Dead Hand Proxy Puts has focused principally on the conflict between managers and shareholders. This Part describes the current jurisprudence of Dead Hand Proxy Puts as revealed by three recent decisions of the Delaware Court of Chancery. Emphasizing the deterrent effect of the provision, the court has clearly and consistently portrayed Dead Hand Proxy Puts as potentially harmful to shareholders, ultimately going so far as to hold that mere adoption of the provision may constitute a breach of fiduciary duty. A common thread underlying each of these decisions is the court’s suspicion of devices that disempower shareholders and entrench managers. It remains to be seen, however, whether this is the correct lens through which to view the provision.

A. Amylin

Amylin is, at its core, a contract interpretation case. The dispute arose out of a proxy contest in which two activists each sought five seats on Amylin’s twelve-member board.77 Amylin had change-of-control provisions both in its bond indenture and its credit agreement, but only the credit agreement contained the dead hand feature.78 Had either provision been triggered, the result would have been accelerated repayment of $915 million in total debt at a time when the company had only $817 million in cash and cash equivalents.79 After the company warned its shareholders of dire financial consequences should the activists win, the activists and a group of shareholder plaintiffs sued the company to force it to remove any obstacle to the proxy contest.80 After a partial settlement of the litigation,81 which included an amendment to the credit agreement eliminating the dead hand feature,82 the only live dispute in the case was whether the terms of the bond indenture permitted the board to “approve” dissident directors, thereby avoiding acceleration.83

In holding that the bond indenture did indeed permit the board to approve dissident nominees, the court compared the language of the credit agreement, which plainly restricted such approval, to the language of the indenture, which did not.84 Thus finding the indenture trustee’s reading of the provision to be overly restrictive, the court then went beyond this narrow holding to assert that the presence of a dead hand feature in a bond indenture would have an “eviscerating effect on the stockholder franchise.”85 However, the court also noted that the presence of the provision in a credit agreement might be less problematic because it could be more easily waived.86 Finally, the court concluded by recalling the shareholder-bondholder conflict and the risk that corporations may agree to contract terms that “impinge on the free exercise of the shareholder franchise.”87 Because the right to vote belongs “first and foremost to the stockholders,” boards must carefully consider fiduciary duty when restricting that right in favor of another corporate constituency, especially debtholders, “whose interests at times may be directly adverse to those of the stockholders.”88 All of this language, because it was not necessary to arrive at the actual holding, is technically dicta. Yet it is instructive in revealing the court’s approach to Dead Hand Proxy Puts, which clearly echoes the concerns of the famous Blasius Industries, Inc v Atlas Corp.89

B. Sandridge

If Amylin was fundamentally a contract interpretation case with dicta touching on issues of fiduciary duty, Sandridge was a fiduciary duty case that squarely confronted the question whether and when a board might be required to approve a dissident slate. Although the answers to these questions plainly have some bearing on Dead Hand Proxy Puts, the change-of-control provision in Sandridge did not include a dead hand feature. Moreover, the holding—that fiduciary duty may, under some circumstances, require a board to approve a dissident slate—was resolutely fact specific, resting principally on the manifest lack of good faith of the target board.

In Sandridge, an activist hedge fund sought to replace a majority of the Sandridge board.90 As in Amylin, the Sandridge board warned its shareholders that voting in favor of the activist might cause material harm to the company by triggering the provision and thereby allowing the holders of $4.3 billion in notes to put the indebtedness back to the company.91 A shareholder plaintiff sued, arguing that because approval of dissident nominees was, as in Amylin, permitted under the terms of the indenture, failure to do so amounted to breach of the board’s fiduciary duties.92

The Sandridge court confronted the fiduciary duty issue under the Unocal Corp v Mesa Petroleum Co93 standard, after considering and then rejecting as an alternative the Blasius “compelling justification” standard in light of the ability of change-of-control provisions to serve creditors’ good-faith interests.94 Under Unocal, the Sandridge court stated the question would not be the reason for which the provision was adopted but rather the reasonableness of its effect in light of the threat facing the corporation.95 Boards must identify “a circumstantially proper and non-pretextual basis for their actions, particularly when their actions have the effect of tilting the electoral playing field against an opposition slate.”96 Because the board had failed to articulate a legitimate threat to bondholder interests from the dissident slate,97 the court found that the board’s likely motive in refusing to approve the dissident slate was merely to entrench itself, therefore failing under Unocal.98

Sandridge is thus one of the relatively few cases to apply Unocal and find a violation of the standard, suggesting perhaps that the test will be applied more stringently to defenses that block activism than it has been to defenses that block hostile takeovers.99 Ultimately, the case stands for the proposition that fiduciary duty may require the target board to approve an apparently qualified dissident slate. But what if the defensive provision does not allow approval to avoid the trigger? Is that provision automatically void as against public policy? Does the board violate its fiduciary duties in agreeing to it? And is the creditor complicit in aiding and abetting the breach in negotiating for and then enforcing the provision? The answers to these questions would have to await the court’s ruling in Healthways.

C. Healthways

Unlike the Amylin and Sandridge boards, the Healthways board was not in the midst of a proxy contest at the time of litigation. However, the company had been under shareholder pressure, initially to destagger its board, a demand to which the company ultimately acceded after amending its credit agreement to include a Dead Hand Proxy Put.100 Not long thereafter, an activist hedge fund with an 11 percent stake sent a public letter to the board expressing concern over the company’s leadership and recommending removal of the CEO.101 The company eventually accommodated the activist, offering the fund three seats on the board.102 A group of shareholder plaintiffs nevertheless sued, alleging that the board had breached its fiduciary duty in agreeing to the Dead Hand Proxy Put and that the lenders had aided and abetted the breach of fiduciary duty by including the provision in the loan agreement.103 The defendants moved to dismiss, arguing that the claim was not ripe for adjudication because the provision, unlike those in Amylin and Sandridge, had not been invoked in the context of a proxy fight.104

The Healthways court disagreed, denying the motion to dismiss and ruling that the claim was indeed ripe for adjudication due to the potential deterrent effect of the Dead Hand Proxy Put.105 In addressing the claims against the director defendants, the court relied on Carmody v Toll Brothers, Inc,106 a case involving a dead hand version of the poison pill,107 which the court treated as indistinguishable from the present case.108 A dead hand feature, whether in a poison pill or a poison put, the Healthways court reasoned, chilled proxy contests regardless of whether the proxy contest was in fact underway.109 Moreover, any directors elected under the dead hand provision and thereby deemed “noncontinuing” suffer the injury of being treated differently from every other member of the board, regardless of whether the number of noncontinuing directors ever triggered acceleration of the debt.110 In addition to Toll Brothers, the court cited Moran v Household International, Inc111 for the proposition that defensive provisions would be subject to scrutiny both when adopted and when invoked.112 Having thus laid the framework of its analysis, the court pointed to the fact that no evidence had surfaced to suggest that the board had carefully considered the provision in the credit agreement or sought to negotiate it away. The central focus of the court was the absence of the shareholder interest in this negotiation and the joint interest of management and creditors in perpetuating the incumbent management team.113 Likewise, the court viewed the creditor’s knowing participation in agreeing to the potentially entrenching provision, especially in the wake of Amylin and Sandridge, as sufficient to deny the motion to dismiss the aiding and abetting claim against the creditors.114

The Healthways court was at pains to emphasize that it did not hold Dead Hand Proxy Puts to be a per se breach of fiduciary duty.115 Nevertheless, in holding boards to a heightened standard of review upon adoption, the ruling creates a clear pathway for plaintiffs to challenge the provision. Unless persuasive evidence surfaces that a board carefully considered the Dead Hand Proxy Put before agreeing to it, suits challenging the provision as an infringement of the shareholder franchise would likely survive a motion to dismiss. The ability to survive a motion to dismiss means, as a practical matter, that defendants will settle, often for nonpecuniary relief—in this context an amendment to the credit agreement eliminating the dead hand provision—along with the payment of plaintiffs’ attorney’s fees.116 The predictable result of this combination of incentives has been a wave of actual or threatened litigation against companies with Dead Hand Proxy Puts and strong incentives, on the part of companies and lenders, to eliminate the provision.117 In this way, although Healthways did not in fact hold that Dead Hand Proxy Puts are per se illegal, the effect of the ruling, given the incentives of the parties at settlement, may have been much the same.

The jurisprudence on Dead Hand Proxy Puts thus clearly portrays the provision as a burden on shareholders. But is this an accurate characterization of the role and function of Dead Hand Proxy Puts? This is the subject of our empirical analysis in the next two Parts.

III. Empirical Evidence on the Incidence and Effect of Dead Hand Proxy Puts

We set out to study Dead Hand Proxy Puts empirically and to analyze, in particular, their effect on creditor and shareholder interests. To do so, we began by searching SEC filings for loan agreements and bond indentures containing the Dead Hand Proxy Put provision.118 Using Intelligize, an online platform that allows efficient searching of SEC filings and exhibits, we ran searches on the two forms of the provision we had encountered.119 In this way, we assembled an original, hand-collected database of debt contracts containing the term. We assembled our control group using the 2015 version of Dealscan, a database that contains most sizable commercial loans in the United States.120 We obtained company information from Compustat,121 equity prices from the Center for Research in Security Prices (CRSP),122 governance statistics from Institutional Shareholder Services (ISS),123 and information on hedge fund activism from FactSet SharkRepellent.124 After merging these data sources,125 we emerged with a sample of 53,132 loans covering 7,788 companies from 1994 through 2014. As described in the sections that follow, we used this dataset to test the incidence and effect of the Dead Hand Proxy Put.

A. Descriptive Statistics

Our searches yielded over 2,700 observations of Dead Hand Proxy Puts in loan agreements from 1994 through 2014. Over the same period, we found fewer than 60 observations of the provision in bond indentures. The prevalence of the provision in loan agreements as opposed to bond indentures may be explained by structural differences in the waivability of default.126 Because waiver is a realistic possibility for loans, not bonds, and because the dead hand feature is, at its core, a reallocation of waiver authority, creditors may have invested in negotiating for it in loan agreements, but not bond indentures.127

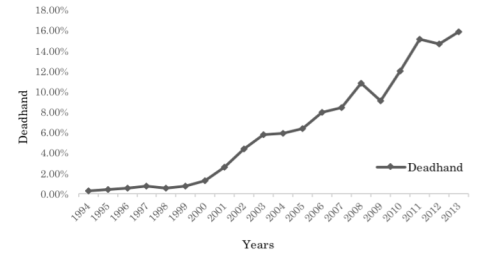

Focusing therefore on loans rather than bonds, we find evidence of a strong link between Dead Hand Proxy Puts and hedge fund activism, starting with the incidence of the provision, which (as demonstrated in Figure 1 below) has increased dramatically.

Figure 1. Dead Hand Proxy Put across Time, 1994–2014

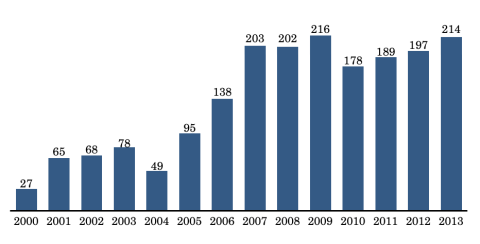

Dead Hand Proxy Puts increased from 0.24 percent of loans at the outset of our sample period to more than 16 percent at the end of the sample period. The provision became more prevalent in the early 2000s and increased sharply after 2008. As shown in Figure 2 below, hedge fund activism increased sharply over the same period.128

Figure 2. Activist Interventions across Time, 2000–2013129

The increasing incidence of Dead Hand Proxy Puts thus coincides with the rise of hedge fund activism.130

A further link between Dead Hand Proxy Puts and hedge fund activism can be seen by the types of companies adopting the provision. As shown in Table 1 in the Appendix, companies adopting the provision tend to be medium- to small-sized firms, with mean total assets of approximately $3.2 billion and median total assets of $946 million. When, in our companion paper, we compared the characteristics of these companies with companies in our control group, we found that companies adopting Dead Hand Proxy Puts are likely to be smaller, pay lower dividends, and have less total leverage than other firms.131 These are common characteristics of the targets of hedge fund activists, especially those of activists planning to increase leverage in order to increase payouts to shareholders.132 Our companion paper also tested whether companies that adopted Dead Hand Proxy Puts were more or less likely to be approached by hedge fund activists and found that firms adopting the provision are indeed more likely to be subject to future activist interventions, suggesting that the term is adopted in anticipation of hedge fund activism.133 Dead Hand Proxy Puts thus appear to be closely associated with hedge fund activism.

B. The Effect of Dead Hand Proxy Puts on the Price of Debt

Our account above identifies a benefit to creditors from the Dead Hand Proxy Put’s creation of a repayment option in the event of a successful activist attack.134 If creditors value this benefit, they should be willing to pay for it. In this context, paying for the benefit would involve discounting the cost of credit for borrowers willing to include the term. This is an empirical question. Are loans with Dead Hand Proxy Puts offered at lower interest rates than loans without the term? Our companion paper finds that they are.

We find that inclusion of a Dead Hand Proxy Put reduces firms’ borrowing costs in a manner that is both statistically and economically significant.135 Comparing the spreads of loans with and without the provision, we find that the mean loan spread is 222.86 basis points with the provision and 231.96 basis points without it, a difference that is statistically significant at the 1 percent level.136 In regressions controlling for debtor and loan characteristics, we find that the presence of a dead hand provision is negative and statistically significant across all specifications.137 In a further treatment effects model to address endogeneity concerns, we continue to find that Dead Hand Proxy Puts reduce the cost of borrowing.138 These findings are statistically significant at the 1 percent level across specifications.139

The economic magnitude of the reduction in borrowing costs associated with Dead Hand Proxy Puts is also substantial. Our results suggest that the dead hand provision may reduce the cost of debt by up to 50 basis points.140 This translates into substantial interest savings. Moreover, because most companies keep debt in their capital structure, we can assume annual savings over the life of the company.

Although we find the dead hand feature in loan agreements, not bond indentures, bondholders also appear to benefit from the presence of a Dead Hand Proxy Put in loan agreements. Bondholders react positively to the public announcement of loan contracts with Dead Hand Proxy Puts.141 Mean bondholder returns upon the public announcement of loan contracts with the Dead Hand Proxy Put are positive and statistically significant at the 5 percent level. By contrast, mean bondholder returns upon the public announcement of loans without the provision are insignificant. While the difference in means between the two cases is insignificant, the difference in medians is significant at the 10 percent level. This finding can be explained by the protection that bondholders receive via the cross-default provision in the bond indenture, triggering a put right for bondholders if an issuer defaults on other indebtedness.142 The Dead Hand Proxy Put in loan agreements thus seems to generate a positive externality for bondholders.143

In finding that creditors discount the price of debt for companies agreeing to Dead Hand Proxy Puts, our companion paper demonstrates an important firm-level benefit from the provision. Firm-level benefits do not necessarily translate into shareholder benefits, however, because the potential for entrenchment costs may more than offset the shareholder benefit from a reduction in the price of debt. Although our companion paper finds strong evidence of creditor- and firm-level benefits from the Dead Hand Proxy Put, it did not settle the question whether shareholders benefit from the provision. We seek to answer that in this Article, by focusing close attention, in the next Part, on the entrenchment hypothesis.

IV. The Entrenchment Costs of Dead Hand Proxy Puts

In spite of the benefit to creditors and the concomitant reduction in the price of debt demonstrated above, the Dead Hand Proxy Put may nevertheless harm shareholders by insulating managers from the market for corporate control and thereby increasing managerial agency costs.144 An implication of this view is that Dead Hand Proxy Puts, as a result of their entrenchment costs, should decrease share price for firms adopting them. This is the “entrenchment hypothesis,” and we set out in this Part to test it. First, we examine the association of Dead Hand Proxy Puts with known entrenchment provisions. Second, we perform an event study, analyzing shareholder reaction to each of the Delaware Court of Chancery’s three Dead Hand Proxy Put rulings. As discussed in greater detail below, neither set of tests finds evidence of significant entrenchment costs associated with the provision.

A. Relationship to Other Entrenchment Devices

What is the relationship between the Dead Hand Proxy Put and other corporate governance provisions? If the Dead Hand Proxy Put functions as a kind of “embedded defense,” what is its relationship with the firm’s “structural defenses,” such as staggered boards and poison pills?145 The entrenchment hypothesis suggests that the Dead Hand Proxy Put might function as either a complement to or a substitute for other forms of takeover defense. For example, given the provision’s ability to obstruct proxy fights and the pressure on firms to destagger their boards, it may be that Dead Hand Proxy Puts function as a substitute for the staggered board.146 Indeed, there is evidence that this is precisely what occurred with the adoption of the provision in Healthways.147 Alternatively, firms might view the Dead Hand Proxy Put as a complement to other defenses and adopt the provision to ensure maximal effectiveness of their panoply of defensive provisions. In this way, the entrenchment hypothesis might support a negative (suggesting substitution) or positive (suggesting complementarity) association with other defensive provisions but, either way, would seem to suggest an association with other defensive provisions.

Our first empirical test of this relationship was to examine the correlation between the Dead Hand Proxy Put and the staggered board provision. However, we found, in unreported regressions, no statistically significant relationship between the two provisions. We therefore broadened our approach beyond the simple staggered board provision to test the relationship between Dead Hand Proxy Puts and company scores on two widely used corporate governance indices: the G-index and the E-index.148

The G-index, developed by Professors Paul Gompers, Joy Ishii, and Andrew Metrick, scores twenty-four corporate governance variables.149 The E-index, developed by Professors Lucian Bebchuk, Alma Cohen, and Allen Ferrell, focuses specifically on a small number of entrenchment-related variables, including poison pills, staggered boards, golden parachutes, and supermajority voting requirements.150 On both indices, a higher score is associated with weaker protection of shareholder rights or, in the case of the E-index, greater managerial entrenchment. As shown in Table 1 in the Appendix, the mean G-index score of companies adopting Dead Hand Proxy Puts is 9.4, and the median is 9. The mean E-index score is 2.5, and the median is 3.

In order to test the impact of the factors contained in these indices on the adoption of Dead Hand Proxy Puts, we ran a set of probit regressions151 reported in Table 2 in the Appendix. Although we found a positive and statistically significant (at the 10 percent level) association between the G-index score and the adoption of Dead Hand Proxy Puts, suggesting that companies with weaker shareholder rights are more likely to include the provision in their loan contracts, financial variables are far more significantly related to the adoption of the provision.152 However, we could find no statistically significant association between the E-index and adoption of the Dead Hand Proxy Put.153 This is consistent with our finding of no statistically significant relationship between the Dead Hand Proxy Put and the staggered board, but it is inconsistent with the prediction, from the entrenchment hypothesis, that Dead Hand Proxy Puts should be associated with other defensive provisions. Dead Hand Proxy Puts appear to be neither a complement to nor a substitute for standard antitakeover provisions.

If, following the entrenchment hypothesis, Dead Hand Proxy Puts destroy shareholder wealth, shareholders with greater leverage—that is, those holding large blocks of stock—should be able to prevent managers from implementing them. We therefore sought to test whether firms with large blockholders, defined here as holders of 5 percent or more of a company’s outstanding shares, are more or less likely to adopt the provision.154 As shown in Appendix Table 2, we tested the impact of blockholding in two ways. First, we find no relationship between outside blockholders and the adoption of Dead Hand Proxy Puts.155 That is, companies with unaffiliated blockholders—those without intracorporate ties or roles in management—are no more or less likely to adopt Dead Hand Proxy Puts than other firms. However, we do find a strongly statistically significant negative association between inside blockholders and adoption of the provision.156 That is, companies with affiliated blockholders are significantly less likely to adopt Dead Hand Proxy Puts than peer firms. We interpret these results to reflect firms’ susceptibility to activism more than they reflect the potential entrenchment costs of the provision. Because activists are unlikely to view firms with large inside blockholders as attractive targets, creditors may choose not to invest in negotiating for the additional protection against activism in such cases. At the same time, if the Dead Hand Proxy Put seriously harmed shareholder value, we would have expected outside blockholders to use their leverage to block it.

In sum, our findings on the relationship of other entrenchment devices and the impact of blockholding do not support the entrenchment hypothesis. Instead, we find no evidence of a statistically significant relationship between the Dead Hand Proxy Put and other entrenchment devices. And outside blockholders appear uninterested in using their leverage to block adoption of the provision.

B. Shareholder Reaction to Dead Hand Proxy Puts

Shareholder reaction offers a more direct test of the entrenchment hypothesis. If Dead Hand Proxy Puts destroy shareholder value, shareholders should react negatively to them. Contrary to this hypothesis, in our companion paper, we found evidence that shareholders react favorably to the announcement of loans with Dead Hand Proxy Puts.157 However, we found no statistically significant difference in shareholder reaction to the announcement of loans with and without the provision, suggesting that the result may have been driven more by shareholder response to the extension of credit than to the terms of the loan.158

In this Section, we further test shareholder reaction to Dead Hand Proxy Puts by performing a set of event studies based on the three Delaware cases restricting Dead Hand Proxy Puts. We treat each ruling as an exogenous shock, forcing shareholders of companies with Dead Hand Proxy Puts to reevaluate the value of their shares. Because each case restricts the provision, Healthways most of all,159 the entrenchment hypothesis predicts a positive shareholder response to each ruling, especially Healthways. This, however, is not what we find. We describe the results of our tests of each case below.

1. Shareholder reaction to Amylin.

Table 3 in the Appendix presents the results of our test of shareholder reactions to the Amylin decision. Contrary to the prediction of the entrenchment hypothesis, we find a highly statistically significant negative shareholder response to the case. However, we find no statistically significant difference between the reaction of companies with or without the Dead Hand Proxy Put,160 suggesting that the shareholder reaction is not driven by the provision but by other factors. Amylin, recall, was a May 2009 decision. While early 2009 was not the height of the credit crunch, it was the midst of the financial crisis. It is thus possible, especially for the generally small- to medium-sized companies in our sample, that market-wide events may explain this result. Moreover, the result disappears when we further test the sensitivity to activism161 or to Delaware incorporation.162 We find no statistically significant result in either of these tests.

In light of these inconsistent results and the presence of confounding factors, we hesitate to draw any inference from our tests of the Amylin case. The remaining cases—Sandridge and Healthways—may provide better tests of the entrenchment hypothesis.

2. Shareholder reaction to Sandridge.

Table 4 in the Appendix presents the share price reaction to the Sandridge decision. Here we do find a statistically significant difference between median equity returns of adopters and nonadopters in their reaction to the case.163 Again, however, the underlying reaction points in the wrong direction. Though we had hypothesized a positive shareholder reaction to the decision, we find instead a strongly statistically significant negative median shareholder reaction to the decision. In other words, shareholders of firms with Dead Hand Proxy Puts reacted more negatively to Sandridge than the shareholders of firms without the provision. These results are consistent with our other tests but, because they suggest that shareholders often view Dead Hand Proxy Puts favorably, contrary to the entrenchment hypothesis.

Interestingly, when we interact the shareholder response to Sandridge with the firm’s susceptibility to activism, the results change.164 Here we find that shareholders of firms that experience shareholder activism reacted positively to the decision, as the entrenchment hypothesis predicts. This result, however, is only weakly statistically significant. Moreover, the result disappears when Delaware incorporation is added as an additional control.165 Hence, the results of our Sandridge event studies, while not entirely consistent, generally contradict the entrenchment hypothesis.

3. Shareholder reaction to Healthways.

Healthways promised the strongest test of the entrenchment hypothesis. Unlike the other two decisions, which were technically dicta as applied to Dead Hand Proxy Puts, Healthways directly addressed the provision, erecting substantial barriers to its adoption. Thus, if any of the three rulings was especially salient to shareholders, we reasoned, Healthways would be the one. As Table 5 in the Appendix shows, however, this was not the case.

Consistent with the entrenchment hypothesis, we do find that shareholders of firms with Dead Hand Proxy Puts reacted positively to the case, at least with regard to mean excess equity returns.166 But this finding is only weakly statistically significant, and, more importantly, there is no statistically significant difference between the reaction of shareholders of companies that have and have not adopted the provision. Without this difference, the finding that some shareholders reacted as predicted does not provide meaningful support for the hypothesis.167

The rest of the Healthways tests fare no better. Susceptibility to activism is not an important predictor of shareholder response,168 nor is Delaware incorporation169 or the combination of the two variables.170 Our tests of the Healthways decision, it turns out, have yielded the least conclusive results.

In sum, our empirical tests have produced evidence generally contrary to the entrenchment hypothesis. Not only do Dead Hand Proxy Puts appear not to destroy firm value, we have found evidence that shareholders in at least some instances react positively to the provision. Our tests of the Sandridge decision provide the strongest evidence contrary to the entrenchment hypothesis, because shareholders of companies with Dead Hand Proxy Puts responded more negatively to the decision than shareholders without the provision. Our tests of the other two cases produced no statistically significant difference between these groups of shareholders. The Healthways tests, in particular, are inconclusive. Nevertheless, taken as a whole, our empirical tests do provide evidence that shareholders are generally not harmed by the provision and that, in at least some instances, they may benefit from it.

V. Analysis and Implications

How can we explain our findings? The results of our empirical tests seem to fly in the face of the large body of evidence that shareholders respond positively to shareholder activism171 and negatively to provisions with the potential to entrench managers.172 This Part reviews a set of possible explanations, finding some more plausible than others. Ultimately, the most likely explanations in our view focus on the discounted value of voting rights and on the benefit shareholders receive from appointing creditors as gatekeepers over value-creating versus value-destroying forms of hedge fund activism.

A. An Excessively Conditional Entrenchment Effect?

Dead Hand Proxy Puts do not preclude hedge fund activism in the way that, for example, the combination of a poison pill and a staggered board precludes a hostile takeover.173 A Dead Hand Proxy Put operates as, at most, a tax on hedge fund activism. This can impose a significant marginal cost—hedge fund activists, unlike corporate raiders, typically do not have sufficient financing to replace the target company’s entire capital structure.174 However, a Dead Hand Proxy Put will be truly outcome determinative only when: (1) the activist can credibly threaten a control contest;175 (2) prevailing interest rates create an incentive for creditors to put the debt;176 (3) the company has inadequate cash reserves and access to financing to repay or replace the debt;177 and (4) the creditors are unwilling or unable to negotiate a waiver of the default.178 It is possible, therefore, that shareholders are not sensitive to this level of conditionality.

While we accept that Dead Hand Proxy Puts are by no means preclusive, we doubt that excessive conditionality explains our findings. First, two of the basic conditions—lack of access to credit and the presence of creditors unwilling to waive default—will be true of many financially troubled companies. Insofar as some activists target financially troubled companies, these conditions will be present in every such intervention.179 Moreover, as noted, the credible threat of a proxy fight is the basis of every activist intervention, regardless of whether a proxy fight is ultimately launched.180 As a result, the only truly variable condition is whether prevailing interest rates are above or below the level at which the loan was underwritten, and we doubt shareholders are unable to take interest-rate risk into account.

More generally, even if they are less preclusive than standard takeover defenses, Dead Hand Proxy Puts could have an important deterrent effect on shareholder activism. In the words of the Healthways court:

[B]ecause the proxy put exists, it necessarily has an effect on people’s decision-making about whether to run a proxy contest and how to negotiate with respect to potential board representation. As with other defensive devices, such as rights plans, one necessarily bargains in the shadow of a defensive measure that has deterrent effect. A truly effective deterrent is never triggered.181

Considering the consistently demonstrated positive effect on share price of an announced activist intervention, any device that would substantially deter activism also seems likely to impact share price. The fact that the Dead Hand Proxy Put does not, we argue below, may teach something both about how shareholder votes are valued and about shareholder attitudes toward particular activist strategies.

B. The Discounted Present Value of Future Votes?

Dead Hand Proxy Puts impinge on shareholder voting rights.182 Shareholder voting rights, in theory at least, have value.183 It would therefore seem to be a reasonable inference that a device that impinges on voting rights would have a negative effect on share value. We nevertheless find that Dead Hand Proxy Puts have no negative impact on share price. This may reflect shareholders’ tendency, demonstrated in the empirical literature on shareholder voting, to discount the value of voting rights except in circumstances in which the right to vote is especially salient.

The empirical literature on shareholder voting generally confirms the view that voting rights have value, but results vary depending on the methodology used. Studies that estimate the value of voting rights by comparing the prices of various classes of stock typically find that shares with stronger voting rights trade at a small premium.184 However, most of these studies suffer from small sample sizes, significant differences in liquidity between the treatment and control groups, and selection biases.185 Similar difficulties affect studies estimating the value of voting rights by comparing the price of privately negotiated block sales to the price of publicly traded minority shares.186 An alternative methodology that estimates the value of voting rights by focusing on the equity lending fee around shareholder record dates (when voting rights are set) returns mixed results.187 A more recent methodology measures the value of voting rights by comparing the price between a common (voting) stock and a synthetic (nonvoting) security designed to replicate the cash flows of the underlying common share.188 This method suggests that voting rights are not highly valued by shareholders unless the voting rights are made salient by the calling of a special meeting, the announcement of hostile hedge fund activism, or the announcement of a merger.189

The notion that the value of voting rights is deeply discounted by shareholders unless the voting rights are made salient by an exogenous event may help to explain the lack of shareholder response to Dead Hand Proxy Puts. The Dead Hand Proxy Puts in our study are generally introduced on a “clear day,” when there is no specific threat of hedge fund activism on the horizon.190 In such cases we generally find no evidence of a shareholder reaction to the impingement of voting rights that the Dead Hand Proxy Put represents.191 This finding supports the notion that shareholders discount the value of their voting rights and, by implication, the cost of any impingement to their voting rights, unless the voting rights are made salient.

Finally, it makes sense that our study would return weak results at best on the value of voting rights. Most studies of the value of voting rights are binary, comparing the value of voting and nonvoting shares. But Dead Hand Proxy Puts do not deprive shareholders of voting rights. They merely tax the exercise of those rights in a specific set of circumstances.192 Because this impingement of voting rights falls significantly short of outright deprivation, we would expect a proportionally smaller shareholder reaction to the provision.

C. An Efficient Shareholder-Creditor Bargain?

A third possibility is that the Dead Hand Proxy Put represents an efficient bargain between creditors and shareholders with respect to hedge fund activism. Hedge fund activism may be value-creating, or it may be redistributive—typically from creditors or other constituencies to shareholders.193 The Dead Hand Proxy Put can be modeled as a means of mitigating the shareholder-creditor conflict in the context of activism.194 In order to ensure that shareholders will not appropriate creditor wealth by means of hedge fund activism, the provision allocates exclusive waiver authority to creditors.

Because the beneficiaries of the provision under this account are creditors, we would expect shareholders to react negatively to it. Yet we find that shareholders do not react negatively to the provision when it is adopted nor do they react positively to the cases restricting the provision.195 In fact, several of our tests suggest that shareholders view the provision positively. This raises the question whether the provision creates some benefit for shareholders beyond the cost of capital reduction. How do shareholders benefit by allocating waiver authority exclusively to creditors? The key to this puzzle may be a more nuanced account of shareholder and creditor interests with respect to hedge fund activism.

Shareholders are often seen as the beneficiaries of activism due to the consistent bump in share price associated with activist interventions.196 Nevertheless, considerable debate remains over whether activism aimed at financial restructuring is consistent with shareholders’ long-term interests.197 Creditors’ interests, likewise, have been shown to depend on the motives of the activist.198 Creditors are harmed by activists who engage in financial restructuring and by activists that attempt to force an acquisition on the company.199 By contrast, creditors have not been shown to be harmed by activist interventions aimed at reducing entrenchment—for example, by replacing an underperforming CEO or reducing compensation packages.200 Indeed, such efforts may even benefit creditors by growing the pie and thereby increasing the likelihood of repayment.

If creditors analyze the waiver decision along these lines, their choices in enforcing the Dead Hand Proxy Put may benefit shareholders. Creditors have no interest in blocking all forms of activism; they have an interest in blocking only those that legitimately harm creditor interests, such as interventions aimed at financial restructuring or forced merger. Appointing creditors, through the waiver decision, to this gatekeeping role may be largely consistent with long-term shareholder welfare. Creditors would allow activist contests aimed at reducing entrenchment to proceed, thereby benefiting shareholders.201 And they would obstruct activism aimed at short-term financial engineering, potentially also benefiting shareholders. The harder category is forced mergers.

Activism ending in merger-and-acquisition activity is strongly associated with shareholder gains.202 Yet, because merger activity is a source of risk for creditors—indeed it is the risk for which the change-of-control provision was invented—they are unlikely to waive protection and allow the intervention to proceed. Nevertheless, Dead Hand Proxy Puts are unlikely to have a substantial impact on activist bids seeking to force merger activity. When the hedge fund’s endgame is acquisition, it is more likely to have access to capital to replace the target’s debt because that capital would be needed in the acquisition in any event. Moreover, because a merger would accelerate indebtedness under the control share trigger when consummated, the threat of acceleration from the dead hand feature is largely superfluous and therefore unlikely to deter the activist.203

Understood in light of these interests, the shareholder-creditor bargain underlying the Dead Hand Proxy Put takes on a different character. While it remains an ex ante shareholder commitment not to appropriate creditor wealth through hedge fund activism, it is not a commitment to foreswear all forms of activism. Rather, the provision establishes creditors as gatekeepers over hedge fund activism, obstructing financial restructuring and other redistributive forms of activism while allowing to proceed activist interventions targeting entrenched managers or seeking other changes not generally harmful to creditor interests. Insofar as this arrangement is consistent with long-term shareholder interests, we would not anticipate a negative shareholder reaction to the provision but rather a positive one. Our results are consistent with this account.

D. Trade-off in Equipoise?

Another possible explanation for our results is that the benefit from the reduction in the price of debt we demonstrated in our companion paper offsets any harm to shareholders. According to this account, the Dead Hand Proxy Put may well be harmful to shareholders, but the harm is sufficiently offset by the benefit they receive in the form of reduced borrowing costs. The lack of shareholder reaction to the adoption of the provision thus reflects perfectly offsetting costs and benefits—a trade-off in equipoise.

While we suspect that there may be some trade-off dynamics at play here, the simple version articulated above is inconsistent with our findings. A trade-off in equipoise would explain the absence of a shareholder reaction to the provision when adopted.204 But under this account, the exogenous shock of the Delaware rulings should have produced a sharp shareholder reaction. Because the rulings relieved shareholders of the cost of the provision but allowed them to retain the benefits of a lower cost of debt capital, shareholders should have reacted positively to the cases. They did not.205 Our results are therefore inconsistent with a trade-off in equipoise.

E. Lingering Entrenchment Effects of the Basic Change-of-Control Provision?

Finally, the absence of a negative shareholder response to the Dead Hand Proxy Put may reflect the fact that although the cases restricted the dead hand feature, they left intact the structure of the underlying change-of-control provision. It is, after all, the acceleration of indebtedness under the standard proxy fight trigger that makes a control contest so costly for hedge fund activists. The dead hand feature merely shifts the power to waive that provision. The cases that focused on the dead hand feature—especially Amylin and Healthways—thereby left the entrenchment effect of the basic provision untouched. Shareholders may thus have failed to respond to the restriction of the dead hand feature because the entrenchment effect inherent in the basic provision persists.

Although there may indeed be a lingering entrenchment effect from the basic change-of-control provision, we do not think this effect explains our results. In the absence of the dead hand feature, the basic provision empowers incumbent management to waive the change-of-control provision by approving the dissident slate, and Sandridge unambiguously holds that it would be a breach of fiduciary duty for the incumbent board to refuse to approve a dissident slate when there is no good reason not to do so.206 The incumbent board, in other words, must approve a dissident slate that is reasonably qualified for board service. Thus, at least since Sandridge, as long as the activist nominates a reasonably qualified slate, the standard change-of-control provision provides no protection at all. There should thus be a minimal entrenchment effect, if any, associated with the standard change-of-control provision. The dead hand feature, by contrast, makes it impossible for the incumbent board to approve dissident nominees. The entrenchment potential of the Dead Hand Proxy Put is thus substantially greater than the standard change-of-control provision, and we would have expected this difference to appear in the data. Therefore, in our view, the most likely explanations for our findings lie in the discounted value of voting rights and in the benefit shareholders receive from appointing creditors as gatekeepers over hedge fund activism.

VI. Lessons for Legal Policy

Several of the above explanations, operating separately or together, may account for our findings. Ordinarily, the existence of multiple possible explanations would pose a challenge for the formation of legal policy, but in this case, all of the potential explanations point in the same direction. Dead Hand Proxy Puts are a source of corporate value with no measurable harm to shareholders. This could be because the cost of the impingement on voting rights is negligible until the provision is used to defend against an activist intervention. Or it could be because as long as creditors exercise their waiver rights in good faith, they actually benefit shareholders by screening out the most damaging forms of hedge fund activism. Or it could be that once these benefits are taken into account along with the reduced cost of capital, shareholders benefit more from the provision than they suffer. The policy recommendation that follows each of these potential explanations is the same—a rule of deference when the provision is adopted.

The provision may nevertheless be misused. For example, entrenched managers, eager to protect themselves from an activist agenda aimed at reducing entrenchment, may ask creditors not to waive the provision even though the creditor’s interests are not legitimately threatened. Creditors, because they get important repeat business from corporate managers, not shareholders, have a strong incentive to do as managers ask. The result may be that Dead Hand Proxy Puts are enforced when they should be waived and, as a result, that they ultimately harm shareholders by excessively inhibiting hedge fund activism. For this reason, courts retain an important role in policing the use of the provision. We specify the appropriate standards in the first Section below, then situate our recommendations in light of existing jurisprudence in the final Section.

A. Deference When Adopted, Scrutiny When Used

Given the presence of benefits and the absence of demonstrable harms flowing from the Dead Hand Proxy Put, courts should defer to the parties in adopting the provision. In other words, courts should not allow the prospect of unproven potential fiduciary duty concerns to trump the corporate benefit of a reduction in the cost of capital and other potential benefits. In the corporate-law context, freedom-of-contract principles imply application of the business judgment rule.207 Alternatively, courts could apply the deferential version of scrutiny used in Moran, in which the adoption of a poison pill was approved on the basis of little more than the company’s concern that it might one day receive a hostile takeover bid.208 Following Moran, courts should defer to boards that agree to Dead Hand Proxy Puts unless plaintiffs can provide evidence that the adoption itself is a pretext meant to entrench management. For example, if evidence indicated that the provision was incorporated into a credit agreement at the insistence of management rather than the creditors, then further inquiry may be justified. But this really is the business judgment rule by another name.209 Courts should dismiss in the absence of evidence that the defendants’ proffered justifications for the provision are mere pretext.

However, due to the risk that creditors may enforce the provision to defend management’s interests rather than their own, courts should police its use under a standard of intermediate scrutiny. When the provision is invoked in a proxy fight, courts should inquire into the motives of the parties and examine whether waiver was sought, whether it was granted, and if not, whether enforcement of the provision is proportional to the threat to creditor interests realistically posed by the activist.

The Dead Hand Proxy Put becomes a fiduciary duty concern for a board when its trigger would damage the firm and therefore influence shareholder voting in the proxy contest. In this situation, fiduciary duty requires the board to seek a waiver of the provision. Failure to attempt to negotiate a waiver should be treated as a breach of fiduciary duty regardless of the board’s opinion of the activist and its agenda.210

Creditors, not managers, control the waiver decision, and waiver is not required. When creditor interests are clearly threatened—as, for example, when the activist’s agenda includes financial restructuring or plans to force a merger onto the target company—the creditor’s decision to enforce the provision should be respected by courts. However, failure to secure a waiver in situations in which the creditor’s interests are not plainly threatened—as when the activist’s agenda is focused on reducing management entrenchment—suggests a need for further inquiry and therefore access to some amount of discovery. Enforcing the provision in the absence of any legitimate threat to the creditor’s interests may expose the creditor to invalidation of the provision under the implied covenant of good faith and fair dealing.211 Moreover, further inquiry may unearth evidence suggesting that the target board did not negotiate for the waiver in good faith, supporting a breach of the duty of loyalty by the target board. Evidence that the target board and the creditor colluded in enforcing the provision to protect management (rather than the creditor) from the threat of shareholder activism may further expose the creditor to liability for aiding and abetting the target board’s underlying breach of fiduciary duty.212

A second step in the analysis, assuming the presence of a valid threat to creditor interests, is an inquiry into whether enforcement of the Dead Hand Proxy Put is proportional to the threat. An activist may take steps to mitigate a legitimate threat to creditors such that the flat refusal to waive the provision is no longer reasonable. For example, if an activist seeking financial restructuring also offers to guaranty the loan, perhaps by providing a commitment letter from a highly rated financial institution to back the guaranty, then a creditor’s continued refusal to waive the provision seems disproportionate to the actual threat. A disproportionate response is a further basis for inquiry into the relationship between the target board and the creditor, potentially leading to invalidation of the provision in violation of the implied covenant of good faith and fair dealing, liability of the target board for breach of fiduciary duty, and when the creditor is complicit in the breach, aiding and abetting liability. If, by contrast, the activist makes no such attempt to cure the threat to creditors’ interests, enforcement of the provision should be accepted as proportionate to the threat.

The resemblance between the test we have sketched and the Unocal standard is no coincidence. Like the threat-proportionality standard in Unocal,213 our test is designed to provide room for contracting parties to negotiate and enforce agreements in good faith. Moreover, our proposal extends the approach taken in Sandridge, which applied Unocal to an approval decision,214 to the context of Dead Hand Proxy Puts, in which approval is unavailable. The question therefore becomes waiver. In this context, Unocal ought to apply to the conduct of the board in seeking and obtaining waiver. While our approach is largely consistent with Sandridge, it is inconsistent with aspects of Amylin and Healthways, which we discuss immediately below.

B. Toward a Less “Ideological” Corporate Law

Blasius, like many of former Chancellor William T. Allen’s decisions, was extremely influential in the subsequent development of corporate law.215 The decision announced a “sacred space” for shareholder voting and emphasized the shareholder franchise as the “ideological underpinning” of corporate law.216 In spite of more recent rulings confining the actual standard applied in Blasius to a vanishingly narrow category of cases,217 the ideology underpinning the decision often reappears in cases on shareholder voting.218 In order for the jurisprudential standards we sketch above to work, courts must reject the elevation of the shareholder franchise to the status of a sacred and inviolate principle. Instead, under appropriate circumstances, courts should allow the right to vote to be traded for value, like any other term of an investment contract.

Of the three Dead Hand Proxy Put cases, the ideological view of shareholder voting is most apparent in Amylin, which squarely raises the question whether a board ought to have the power to burden shareholders’ voting rights in exchange for a lower cost of capital.219 In Amylin, the court demonstrated sympathy for the view that the corporation could not trade voting rights because the corporation does not own or control the right to vote shares—shareholders do.220 Reasoning from this view, because it amounts to the corporation obtaining a benefit by offering something to the lender that it does not control, the Dead Hand Proxy Put amounts to taking from shareholders to give to the corporation (and its creditors). It is like a home buyer receiving a lower mortgage rate in exchange for providing a security interest on someone else’s house.

This line of reasoning, however, is problematic for several reasons. First, taken to its logical conclusion, it suggests that the corporation can never encumber the shareholder franchise. But this is plainly contradicted by existing corporate-law jurisprudence, which permits staggered boards to encumber the franchise by transforming elections for board control into elections for one-third of the board at a time221 and which allows termination fees and other defensive provisions to encumber shareholder voting on mergers.222 Second, such ideological reasoning contradicts the nexus-of-contracts theory of the firm, which is frequently cited as the basis of modern corporate law.223 From this perspective, the corporation is a combination of the interests of various constituencies, not a thing unto itself.224 Corporate interests therefore do not conflict with shareholder interests. They are, rather, one and the same.225 Third and finally, elevating the shareholder franchise above all else means eliminating an entire class of potential value-enhancing trades. But the corporation is an investment vehicle, not a democratic republic, and the encumbrance of voting rights in exchange for a lower cost of capital—that is, greater cash-flow rights—is an option investors might reasonably select. Treating shareholder voting as sacred thus interferes with the larger corporate purpose of increasing shareholder wealth.

Likewise, although the Healthways court does not place as much emphasis on Blasius, by relying on Toll Brothers and declaring the dead hand provisions in the two cases indistinguishable, it invokes another ideological line of reasoning.226 The dead hand poison pill in Toll Brothers was invalidated, ultimately, on the basis of an antidisablement principle: the incumbent board could not agree to the dead hand provision because it had the effect of disabling a future board of noncontinuing directors from redeeming the poison pill even if fiduciary duty would have required it.227 Although the principle is now ingrained in Delaware law,228 it remains problematic because it suggests, in its strong reading, that corporations can never make binding contracts.229

Putting aside the wisdom of this principle in the abstract, it was not necessary to invoke it in Healthways because there are several important distinctions between the dead hand poison pill and the Dead Hand Proxy Put. The dead hand poison pill is a unilateral defensive action of the board, whereas the Dead Hand Proxy Put is a term agreed between the counterparties to a contract. Unlike the dead hand provision in a poison pill, which expressly inhibits board action, the Dead Hand Proxy Put merely allocates waiver authority under a contract to the counterparty to that contract. Moreover, unlike dead hand poison pills which preclude takeover, the change-of-control provision in a debt contract merely triggers a repayment obligation. This may be costly, but it does not, as we have seen, preclude activist intervention. By eliding these distinctions and instead emphasizing the antidisablement principle, the Healthways court issued an unnecessarily ideological critique of Dead Hand Proxy Puts. Unsurprisingly, the decision led to a wave of shareholder suits targeting the provision.230