Posner on Tax: The Independent Investor Test

Introduction

Few precedents drew Judge Posner’s ire like multifactor tests. As he said in one opinion: multifactor tests leave “much to be desired—being . . . redundant, incomplete, and unclear.”1

In this Essay, I endorse Posner’s devastating rejection of a tax law multifactor test in Exacto Spring Corp v Commissioner of Internal Revenue.2 This prototypical tax multifactor test governed the deductibility of salaries paid by corporations to their controlling shareholders by comparing the salaries with a list of factors that indicated deductibility or nondeductibility.3 Simply put, the test stunk. I also explain why the Posner critique applies to similar multifactor tests in corporate tax law.

I then describe and critique Posner’s replacement for the multifactor test—the “independent investor” test. In a nutshell, Posner proposed to evaluate the deductibility of the salaries in question by reference to investment returns of equity investors in the firm paying the allegedly high salaries.4 If the salaries leave investment returns that would be adequate for “independent investors” in the firm, then the salaries in question are presumptively deductible.5 Characteristically, Posner’s independent investor test shifts the judicial focus from a muddled list to the economic substance of a transaction.

Unfortunately, the independent investor test yields some peculiar outcomes. The test functionally makes equity a fixed claim while leaving other claims, such as salary, to absorb residual profits. This is the opposite of the conventional understanding of equity claims relative to salary claims. Using data from the Russell 2000 Index, I show that the mischaracterization leaves many cases in which salaries for controlling shareholders are essentially unconstrained by the independent investor test. In other cases, the independent investor test denies deductions for any positive salary. As a result, the independent investor test provides a flawed solution to the problem of policing salary arrangements between corporations and their controlling shareholders.

If closely held corporations have independent minority shareholders, however, then a simple variant of the independent investor test provides a robust test for reasonable salary. If independent equity investors in fact approve an executive’s salary, then it is presumptively reasonable. (This in fact occurred in Exacto Spring, as the opinion emphasized.) But when there are no such investors, the independent investor test proves unworkable.

Posner’s independent investor test, however, offers an ideal solution to a related problem in corporate tax—determining the deductibility of interest payments from corporations to their controlling shareholders. At present, this question is answered by another deeply flawed multifactor test. To determine whether interest payments in such transactions should be deductible, courts should ask instead whether a credit arrangement provided a return to the creditor in excess of what an independent investor would require. When interest payments to controlling shareholders exceed this “independent investor” threshold, interest deductions should be denied.

The success of this modified independent investor test demonstrates the vitality of Posner’s judicial emphasis on substance over form—in tax law and all other areas.

I. Multifactor Tests in Corporate Tax Law and the Posner Critique in Exacto Spring

While multifactor tests feature prominently in many areas of law, they are particularly popular in corporate tax law. Corporate tax must distinguish between ordinary corporate disbursements, which are deductible or depreciable from income,6 and payments to equity, which are not.7 If payments to equity were deductible by corporations like other corporate expenses, then corporate profits could always be reduced to zero by having dividends equal profits, rendering a corporate income tax ineffectual. Multifactor tests are the judicial favorite for distinguishing payments to equity from other corporate disbursements in a particularly thorny context—when holders of equity transact with closely held corporations as employees or creditors.

In ordinary contexts, it is easy to distinguish between payments to equity and other payments. Corporations make discretionary payments to only one party—equity. And corporations cannot deduct discretionary distributions to equity.8 With everyone else, corporations make the payments they are contractually obligated to, or analogous payments such as bonuses. Corporations deduct or capitalize these payments. The market protects against manipulation of these categories. Shareholders will not agree to excessive salary or interest payments, even though they are deductible, because the disguise reduces the shareholders’ residual claim on corporate income.

The lines get blurred, however, in closely held corporations. If the controlling shareholder of a corporation also is the corporation’s employee or creditor, then the shareholder/employee/creditor may induce the corporation to disguise (nondeductible) dividends as (deductible) salary or interest. The disguised payments reduce returns to equity, but they raise returns to debt or employment so that the shareholder/employee/creditor is indifferent to the label. And the disguised dividends reduce corporate income and erode the corporate tax base. Alternatively, if corporations benefit from a preferential tax rate (as they do today), then salary or interest income to controlling shareholder might be disguised as dividends. Whatever the direction of the disguise, tax authorities can no longer rely on a payment’s label as salary, interest, or dividend to determine the appropriate tax treatment.

In place of reliance on listed salaries and interest payments, the IRS and courts favor multifactor tests to distinguish between interest payments and dividends or salaries and dividends.9 As Posner, writing for the Seventh Circuit, explained, “Judges tend to be partial to multifactor tests, which they believe discipline judicial decision-making, providing objectivity and predictability.”10

Thus, a seven-factor test was applied by the lower court in Exacto Spring to distinguish between “reasonable” salaries paid to employee/shareholders, which are deductible from corporate income, and unreasonable salary payments, which are treated as dividends.11 In a similar type of case on the distinction between interest on debt and equity, the Ninth Circuit distinguished deductible interest payments to creditor/shareholders from nondeductible dividends using an eleven-factor test.12

In Exacto Spring, Posner delivered a many-sided critique of the multifactor test applied by the lower court. I cannot improve upon his critique, so I quote him at length. Posner observed that the multifactor test was “nondirective” in that “no indication [was] given of how the factors are to be weighed in the event they don’t all line up on one side.”13 As a result, the multifactor test “invite[d] the making of arbitrary decisions based on uncanalized discretion or unprincipled rules of thumb.”14 In addition, Posner concluded that “the factors do not bear a clear relation either to each other or to the primary purpose of section 162(a)(1), which is to prevent dividends (or in some cases gifts), which are not deductible from corporate income, from being disguised as salary, which is.”15 The multifactor test also “invite[d] the Tax Court to set itself up as a superpersonnel department for closely held corporations, a role unsuitable for courts.”16

Posner argued that the lower court’s puzzling ruling in Exacto Spring proved that these concerns were real rather than merely theoretical. “Having run through the seven factors, all of which either favored the taxpayer or were neutral, the court reached a stunning conclusion”—deciding against the taxpayer.17 After this puzzling outcome, it is hard to disagree with Posner’s conclusion that the multifactor test “does not provide adequate guidance to a rational decision.”18

Posner’s critique applies equally well to the eleven-factor test used to distinguish debt from equity for income tax purposes applied in Bauer v Commissioner of Internal Revenue.19 In Bauer, some factors favored the taxpayer while others favored the IRS.20 The tax court weighed the factors one way and found for the IRS, disallowing a corporation’s “interest” deductions on payments to its two primary shareholders because the payments functioned as dividends.21 Faced with the same facts and the same factors, the Ninth Circuit reversed, holding that the Tax Court had not applied the factors appropriately.22 Following Bauer, it is hard to predict which interest payments to closely held shareholders will be deductible in all but the most extreme circumstances. This is unfortunate because the question is a “frequent area of dispute between taxpayers and the IRS.”23

II. A Summary and Critique of the Independent Investor Test

To replace the multifactor test, Posner’s Exacto Spring opinion proffered the “independent investor test.”24 In other circuits, this test was developed as the “‘lens’ through which they view the seven (or however many) factors of the orthodox test.”25 Posner showed little patience for such “formality.”26 Instead, he offered the independent investor test as a replacement for the multifactor test.

A. Posner’s Independent Investor Test

The independent investor test returns the question of reasonable salaries to “basics.”27 As Posner emphasized, “The Internal Revenue Code limits the amount of salary that a corporation can deduct from its income primarily in order to prevent the corporation from eluding the corporate income tax by paying dividends but calling them salary because salary is deductible and dividends are not.”28 But Posner claimed that it is unlikely that a company can disguise dividends as salary and still maintain an adequate return to equity. As a result, “[w]hen, notwithstanding the CEO’s ‘exorbitant’ salary (as it might appear to a judge or other modestly paid official), the investors in his company are obtaining a far higher return than they had any reason to expect, his salary is presumptively reasonable.”29

Applying the independent investor test to the facts of Exacto Spring, Posner found that Exacto Spring Corporation paid its employee a reasonable salary. Citing the Tax Court’s findings, Posner noted that the corporation paid its employees an average of $1.15 million in the years in question30 and that the corporation earned about $1 million after deducting the employee’s salary.31 While the IRS’s experts concluded that “investors in a firm like Exacto [Spring] would expect a 13 percent return on their investment,”32 Posner highlighted that equity investment in Exacto Spring in fact yielded 20 percent per year, or $1 million.33 Because a 20 percent return ($1 million in earnings) on equity exceeds the benchmark 13 percent (which implies roughly $650,000 in earnings) of the independent investor test, Posner found that the salaries paid by Exacto Spring were reasonable.34

The independent investor test’s appeal is obvious. Rather than wrestling with a laundry list of factors, the IRS and judges ask one question: What is equity’s required return? If the rate of return exceeds a threshold that would satisfy an “independent investor” (as it did in Exacto Spring), then the salary is presumptively reasonable. And if equity’s return falls short of the benchmark, then the salaries paid to owner/employees likely reflect disguised dividends.

With this quantum leap in simplicity over the preexisting test, it is no surprise that the independent investor test Posner developed in Exacto Spring has been influential. It has been cited almost one hundred times in law reviews—a blockbuster case by corporate tax standards.35 It is the principal case for teaching the meaning of “reasonable” salary in two of the most prominent casebooks on federal income taxation.36

B. The Flaws of the Independent Investor Test

But the independent investor test is flawed in practice. Given the high volatility of returns on equity, there will be many opportunities for closely held companies to disguise dividends as salary but still have a court find those salaries presumptively reasonable. As a result, Exacto Spring’s independent investor test fails at its primary function—distinguishing disguised dividends from salary. It gives equity a high return without any volatility, transferring the volatility to salaries and other fixed claims.

The independent investor test as applied in Exacto Spring treats salary, and not equity, as a “residual” claim to excess or deficient corporate profits. Once Exacto Spring Corporation hits its benchmark return for equity, it can funnel all returns into salary and maintain the presumption of reasonability for that salary. If Exacto Spring’s profits fall short of the benchmark equity return with its existing salary structure, by contrast, then it must decrease the salaries it pays in order to maintain the same presumption. The variability in Exacto Spring’s business turns into variability in the salaries it pays rather than variability in the returns earned by its equity holders. Ordinarily, however, it is equity that bears this underlying risk. As a result, the independent investor test produces radically different outcomes for determining a reasonable salary when a business experiences ordinary volatility.

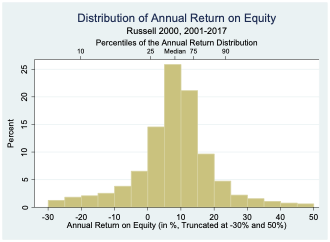

We can illustrate the flaws in the independent investor test using a combination of annual return on equity data from the Russell 2000 Index37 and the facts of Exacto Spring.38 Figure 1 presents the distribution of annual return on equity in the Russell 2000 between 2001 and 2017.39 This distribution gives a sense of the volatility in annual returns that an independent investor would expect from an equity investment.40 Volatility is high. An independent equity investor in the tenth percentile for annual return on equity earns -20 percent annually. The median independent investor earns 8.2 percent per annum, while the independent equity investor in the ninetieth percentile earns an impressive 23.5 percent annual return.

We would expect the high volatility in return on equity demonstrated in the data. Equity is the residual claimant of the firm. It receives a return only after all other claimants have been paid. Because equity is the residual, even relatively small fluctuations in revenues, combined with largely fixed costs, can produce highly volatile equity returns. Note, moreover, that the data presented in Figure 1 likely understate the volatility of return on equity for a firm like Exacto Spring. Publicly traded firms in the Russell 2000 are typically less volatile than smaller firms like Exacto Spring.

Figure 1: Distribution of Annual Return on Equity, Russell 2000, 2001–2017

Suppose that the volatility in return on equity depicted in Figure 1 approximates the volatility of the combined value of Exacto Spring’s equity earnings and its salary payment to its chief executive/controlling shareholder.41 How often does the independent investor test, using this data, produce unusual results for the maximum reasonable salary? (For a tabular presentation of the results discussed here, see Table 1.)

Suppose further that the true arm’s length market value of the executive’s salary is $1.15 million, which is what Exacto Spring’s executive in fact got paid.

At the beginning of the year in question, Exacto Spring had approximately $5 million in equity.42 After paying the proposed executive salary of $1.15 million, Exacto Spring had a 20 percent return left over for its shareholders, or $1 million—an equity return that would be at roughly the eightieth percentile for the Russell 2000 between 2001 and 2017, for a total cash available for salary and equity of $2.15 million ($1.15 million + $1 million). (See Row C of Table 1.) An independent equity investor would have been satisfied with only 13 percent, or $650,000 ($5 million x 0.13). As a result, the $1.15 million salary not only was presumptively reasonable; the salary could have been even higher. Exacto Spring could have paid salary up to $1.5 million without violating the independent investor test. (Column 4 of Row C.)

But now suppose instead that Exacto Spring had a bad year, earning -10 percent, or -$500,000 ($5 million x (-.1)) for equity (depicted in Row A of Table 1) (A total of $650,000 (-$500,000 + $1.15 million), is thus available for both executive salary and equity). This would be approximately a fifteenth percentile annual return on equity for a Russell 2000 firm. Fifteenth percentile years would undoubtedly be disappointing for investors but hardly unprecedented.

|

Row |

Return Percentile (Based on (1) |

Total $ (2) |

Return to Equity Holders to Satisfy Independent (3) |

Maximum ((2)-(3)) (4) |

|---|---|---|---|---|

|

A |

15th |

$650k |

$650k |

$0 |

|

B |

58th |

$1.8m |

$650k |

$1.15m |

|

C |

80th |

$2.15m |

$650k |

$1.5m |

|

D |

94th |

$2.95m |

$650k |

$2.3m |

This -10 percent return on equity falls far short of the benchmark of 13 percent. Applying the independent investor test, a court should find the executive’s $1.15 million salary unreasonable. To satisfy the independent investor test, Exacto Spring equity needs to earn $650,000, rather than its actual performance of -$500,000, a difference of $1.15 million. For independent investors to earn the benchmark 13 percent return, the executive cannot be paid anything. In a bad year, the independent investor test yields a maximum reasonable salary of zero—even a dollar of salary means that the independent investors earn below their benchmark return, failing the independent investor test for the maximum reasonable salary. (Column 4 of Row A.)

Perhaps the independent investor test is flawed when the firm performs poorly but provides a useful benchmark when the firm performs well. After all, the IRS is more likely to claim that a salary is an unreasonable disguised dividend when returns are high rather than low. Suppose that Exacto Spring has a very good year, earning a ninety-fourth percentile return on equity of 36 percent. Independent investors earn profits of $1.8 million. (See Row D of Table 1.) Because this return greatly exceeds the benchmark $650,000 return investors expect, the salary of $1.15 million would be presumptively reasonable. So far, so good. But what if the firm tries to press its luck and tries to add to the executive salary, disguising a dividend? The firm could double the executive’s salary to $2.3 million without running afoul of the independent investor test. (Column 4 of Row D.) The independent investor test thus gives firms considerable scope to disguise dividends as salary during good years.

Because equity returns are so volatile, the independent investor test provides little useful data for salaries. In bad years for equity (Row A), the test produces maximum reasonable salaries that are much too low. In good years (Rows C and D), the test produces maximum reasonable salaries that allow closely held firms to disguise significant dividends. With maximum reasonable salaries fluctuating so widely (note the variation of Column 4 in Table 1), the independent investor test treats salary, rather than equity, as the residual claimant.

The mechanics of the independent investor test thus perform poorly. Equity returns are too volatile for benchmarking salaries. But Posner’s opinion suggests another, less developed, application of the independent investor test that is workable and shows the theoretical strength of his test. In Exacto Spring, the chief executive was the majority shareholder, but he wasn’t the only one. Other shareholders held equity in the firm but didn’t work there.43 These independent equity investors provide an alternative check on the executive’s salary. Disguising dividends as salary will be rejected by these investors because salary goes entirely to the executive while dividends are shared pro rata by all equity holders. Thus, if the minority shareholders approve an executive salary, as they did in Exacto Spring, then we can be confident that the salary does not include disguised dividends. The independent investor test applied to reasonable salary lives, but only when there are actual, rather than hypothetical, independent investors to approve the salary.

III. The Independent Investor Test and Debt and Equity

In theory, the independent investor test works well. The volatility of equity returns, however, limits the test’s utility when applied to the problem of disguising dividends as salary. If there is only one investor/employee, then there is no independent investor to approve a salary, nor is there a meaningful restriction on salaries that can be backed out from returns on equity.

In other cases, however, independent investor returns are much less volatile. Consider public debt markets. While holders of publicly traded stock can reasonably expect returns, outside of capital gains, to range from a significant loss to a spectacular gain, bond creditors receive an annual, fixed coupon payment.44 Creditors are not residual claimants. Their return cannot be above their fixed claim. And their return is also unlikely to be below this fixed return unless the company wishes to face litigation over a default. As a result, debt returns vary much less from year to year than equity returns.

Because of debt’s relatively low volatility, the Posner independent investor test, applied to debt, can replace the fraught multifactor test currently used to distinguish debt from equity in closely held firms.

In Bauer, two owner/employees of a corporation regularly advanced credit to the corporation when the corporation needed capital.45 The credit was payable on demand but did not require regular payments of interest or principal.46 Each year, however, the corporation made an interest payment to the shareholders discharging the corporation’s accrued interest obligation under the terms of the debt.47 At times, the value of this interest payment was offset by the value of additional credit extended by the shareholders.48

The corporation claimed a deduction for the interest payments.49 The IRS disallowed the deduction, arguing that the advances from the shareholder/creditor to the corporation were equity and the payments from the corporation to the shareholders were nondeductible debt.50

The Ninth Circuit applied an eleven-factor test to resolve the question. But it devoted the bulk of its analysis to just one of the eleven factors—whether or not the corporation was thinly capitalized.51 The Ninth Circuit found that the corporation was not thinly capitalized and further noted that many, but certainly not all, of the other factors favored the corporation.52 The Ninth Circuit gave no indication about how the eleven factors were to be aggregated to produce a decision. But the court allowed the corporation to deduct the payments.53 As noted above, Posner’s critique of the multifactor test used by the court below in Exacto Spring applies with little modification to this multifactor test.

Posner’s independent investor test offers a considerable improvement over the multifactor test. The independent investor test asks: Do the interest payments from the corporation to its creditors exceed the normal return that an independent investor would expect on a similar loan to the corporation? If so, then the interest deductions should be disallowed. If not, then the deductions should be permitted. The independent investor test replaces a quagmire with a relatively straightforward inquiry. And the inquiry reflects fundamentals. If a corporation deducts interest in amounts similar to what they would deduct if credit came from a third party, then there is less concern that the corporation is disguising dividends as interest.

Because debt is much less volatile than equity, the independent investor test should provide reasonable guidelines to courts. In Bauer, the interest rate in question was 7 to 10 percent per annum.54 If this rate exceeded the interest rates earned by independent investors in credit markets by a considerable amount, then it is unlikely that the payments truly reflected interest. In fact, these interest rates were roughly in line with investment-grade bond yields during the same period, suggesting that excessive interest deductions were not being taken.55

Even applied to debt, the independent investor inquiry is no panacea. Very risky debt may yield returns similar, with similar variability, to equity. In these circumstances, the independent investor test provides little guidance to courts. As a result, the independent investor test’s application to debt must be confined to relatively ordinary capital structures.

Conclusion

In spite of (or maybe because of) its imperfections, the hypothetical independent investor test of Exacto Spring reveals two important virtues of Judge Posner’s tax jurisprudence relative to the multifactor test for reasonable salary that came before it.

First, judicial tests and decisions that focus on economic substance, like Judge Posner’s, can be critiqued and improved directly. If one substantive account is incomplete or does not apply well to changed circumstances, then it can be replaced with a better account. Multifactor tests, by contrast, often devolve into arguments about the importance of each factor, a far less productive dialogue.

Second, judicial tests focused on substance have much broader applicability than the multifactor tests that Posner criticized in Exacto Spring. The independent investor test can be applied, with suitable modification, to distinguish debt from equity and to distinguish salary from equity. The multifactor tests applied to these two problems, by contrast, share little in common. If tax law is a morass of multifactor test doctrine rather than simple Posnerian tests of economic substance, then we should not be surprised if many observers consider it excessively complex. As in so many areas of law, in tax Judge Posner showed us a better way.

- 1Exacto Spring Corp v Commissioner of Internal Revenue, 196 F3d 833, 835 (7th Cir 1999), quoting Palmer v City of Chicago, 806 F2d 1316, 1318 (7th Cir 1986) (quotation marks omitted). See also Teed v Thomas & Betts Power Solutions, LLC, 711 F3d 763, 766–67 (7th Cir 2013).

- 2196 F3d 833 (7th Cir 1999).

- 3See id at 834.

- 4See id at 838–39.

- 5Id.

- 626 USC § 162(a) (allowing “as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business”); 26 USC § 167(a)(1) (allowing “as a depreciation deduction a reasonable allowance for the exhaustion, wear and tear . . . of property used in the trade or business”).

- 7See, for example, 26 USC § 311(a)(2) (stating that “no gain or loss shall be recognized to a corporation on the distribution (not in complete liquidation) with respect to its stock of . . . property”); Exacto Spring, 196 F3d at 835 (describing dividends as “not deductible from corporate income”).

- 8The rule of nondeductibility is independent of the form of the distribution to equity. Neither share repurchases nor dividends are deductible.

- 9For a general critique of the use of multifactor tests in tax law, see Edward Yorio, Federal Income Tax Rulemaking: An Economic Approach, 51 Fordham L Rev 1, 44 (1982) (recommending that multifactor tests be avoided because “[a]n income tax rule that requires an evaluation of all or of a large number of facts is inevitably very costly”).

- 10Teed v Thomas & Betts Power Solutions, LLC, 711 F3d 763, 766 (7th Cir 2013).

- 11See Exacto Spring, 196 F3d at 834–35.

- 12Bauer v Commissioner of Internal Revenue, 748 F2d 1365, 1368 (9th Cir 1984).

- 13Exacto Spring, 196 F3d at 835.

- 14Id.

- 15Id.

- 16Id.

- 17Exacto Spring, 196 F3d at 837.

- 18Id at 838.

- 19748 F2d 1365 (1984).

- 20Id at 1368–71.

- 21Id at 1367.

- 22Id at 1371.

- 23Charles Rubin, IRS Wins Debt vs. Equity Case (JD Supra, Aug 1, 2016), archived at http://perma.cc/C6WH-TPJ8.

- 24Exacto Spring, 196 F3d at 838.

- 25Id. See also Dexsil Corp v Commissioner of Internal Revenue, 147 F3d 96, 101 (2d Cir 1998) (“[T]he independent investor test is not a separate autonomous factor; rather, it provides a lens through which the entire analysis should be viewed.”) (citations omitted).

- 26Exacto Spring, 196 F3d at 838.

- 27Id.

- 28Id.

- 29Id at 839.

- 30Exacto Spring, 196 F3d at 834 (“In 1993 and 1994, Exacto Spring Corporation, a closely held corporation engaged in the manufacture of precision springs, paid its cofounder, chief executive, and principal owner, William Heitz, $1.3 and $1.0 million, respectively, in salary.”).

- 31Id at 836 (“[The tax court] found that Exacto had earned more than $1 million in each of the years at issue net of Heitz’s supposedly inflated salary.”).

- 32Id at 838.

- 33Id at 838–39.

- 34Exacto Spring, 196 F3d at 839.

- 35A Westlaw search of citing references for Exacto Spring conducted in May 2019 lists 98 citations in law reviews.

- 36See James J. Freeland, et al, Fundamentals of Federal Income Taxation 343–50 (Foundation 19th ed 2018); Michael J. Graetz, Deborah H. Schenk, and Anne L. Alstott, Federal Income Taxation: Principles and Policies 243–48 (Foundation 8th ed 2018).

- 37The Russell 2000 Index is the broadest widely used US equity stock index. I use it because it includes many smaller public corporations. These corporations will be more similar to Exacto Spring than the larger corporations that are the focus of other commonly used indexes.

- 38Return on equity equals net income divided by shareholder’s equity (measured by net assets). It is a common measure of a return.

- 39The data was obtained from Compustat. Net income (NI) and shareholder’s equity (SHEQ) data were collected for each firm in the 2018 Russell 2000 for each year from 2001 to 2017.

- 40Figure 1 may understate the volatility in returns because it depicts the returns of large companies in the Russell 2000. Smaller companies, which are more likely to be the subject of the independent investor test, have even more volatile equity returns. See Malcolm Baker, Brendan Bradley, and Jeffrey Wurgler, Benchmarks as Limits to Arbitrage: Understanding the Low-Volatility Anomaly, 67 Fin Analysis J 40, 45 (2011) (stating that “[t]he top volatility quintile tends to be small stocks”). As a result, Figure 1 should be used for illustrative purposes only—to give a sense of just how variable equity returns can be.

- 41If salary is truly a constant fixed cost, then it does not change the volatility of earnings. (The variance of a random variable plus a constant is equal to the variance of the random variable.) See Variance (StatLect), archived at http://perma.cc/CU3G-6JT9.

- 42One million dollars in profit yielded a return on investment of 20 percent, implying that the underlying investment was $5 million. (0.2 = $1 m/x.) Exacto Spring, 196 F3d at 836, 838–39. (0.13 x $5 million = $650,000.)

- 43See Exacto Spring, 196 F3d at 837.

- 44Creditors can make a capital gain or loss if interest rates fluctuate. This analysis, like the analysis of equity returns, ignores capital gains and losses to focus on rates of return implied by cash flows.

- 45Bauer, 748 F2d at 1366.

- 46Id at 1367.

- 47Id.

- 48Id at 1366–67.

- 49Bauer, 748 F2d at 1366. See also 26 USC § 162.

- 50Bauer, 748 F2d at 1367.

- 51Id at 1368–71. The Tax Cut and Jobs Act of 2017, Pub L No 115-97, 131 Stat 2054 (2017), codified at 26 USC § 1 et seq, introduced a cap on deductibility for corporate interest payments. See 26 USC § 163(j). The cap, however, does not apply to corporations with gross receipts under $25 million. See 26 USC §§ 163(j)(3), 448(c). Most closely held corporations, the only category for which the debt/equity distinction matters, will fall below this cap and be allowed to deduct unlimited amounts of interest. More generally, the Tax Cut and Jobs Act of 2017’s reduction in the corporate income tax rate diminishes tax advantages of debt (taxed once, at the individual rate), relative to equity (taxed twice at the preferred corporate rate and again at the preferred dividend rate). As a result, the current rate structure reduces the likelihood of cases like Bauer.

- 52Bauer, 748 F2d at 1370–71.

- 53Id at 1371.

- 54Id at 1367.

- 55See Federal Reserve Economic Data (FRED) Graph: Moody’s Seasoned Aaa Corporate Bond Yield (WAAA) (Federal Reserve Bank of St. Louis), online at http://fred.stlouisfed.org/series/WAAA (visited May 13, 2019) (Perma archive unavailable) (fluctuating from roughly 7 percent in 1972 to between 8 and 9 percent in 1976).