Paying with Lumps

Introduction

Slices and Lumps, the remarkable new book by Professor Lee Fennell, begins from the title itself to tell a story about the instability of how the world is organized. Lumps can be natural things, formed in a bowl by humidity’s kiss, but slices are often the work of human intervention. When, then, should we leave or bring things together, or pull them apart? I want to suggest that for all its great insights into this fundamental normative question, Slices and Lumps itself leaves aside one important component of a policy-maker’s decision. For this, I do not blame Professor Fennell, since my position in recent print is that most other writers have neglected this component as well. The component, of course, is taxes.

Government can pay with lumps. Not necessarily nuggets of gold or amber, but instead by grouping consumers together so that some of them pay for the goods or services of others. This is not by any means an idea original to me (or my recent coauthors, Professors Jake Brooks and Brendan Maher); its most famous exponent is Richard Posner. But Posner’s project was largely to lay bare the fact that regulators often use these “cross-subsidies” to shift costs between parties. Mine is to ask when this mechanism is preferable to simply using taxation, or vice-versa.

A standard example of cross-subsidies is postal delivery. In the United States, postal rates are the same for two deliveries of equal distance, no matter whether the recipient is in Manhattan or Mudville. But rural delivery is often an order of magnitude more expensive. Urban correspondence thus heavily underwrites mail infrastructure throughout the rest of the country. As the postal experience also shows, this kind of price discrimination usually requires market power. Once the government has competitors on its profitable routes, its ability to cross-subsidize declines dramatically. In Professor Fennell’s terms, one might say that cross-subsidized mail delivery can only succeed when purchase of an urban-to-urban delivery is lumped together with the fixed costs of the whole postal system, rather than being sliced off into a discrete transaction for which the provider charges only marginal cost. A government can allow discrete pricing, but then it has to pay for its letter carriers with taxes instead.

A key normative question in many lumping / splitting decisions is therefore essentially one of public finance economics: When (if ever) would it be better to fund public projects through cross-subsidies rather than taxes? With Brooks and Maher, I recently devoted 35,000 words or so to that question. So what I’d like to highlight here is the way in which a decision to slice that might be highly desirable on other grounds may no longer look so good when the impact on public finance is in the picture. Or, of course, the opposite.

Maybe even more than for taxes themselves, the efficiency of a cross-subsidy depends on the elasticity of a consumer’s response to changes in price for the bundled good. Slicing therefore can frequently disrupt what were otherwise well-functioning cross-subsidy regimes. Professor Fennell of course is far too sophisticated to advocate slicing in all cases, but a general theme here in the book and elsewhere in her writing is the appeal of new legal and technological innovations in slicing. Some authors recently have praised “regulatory entrepreneurs” like Uber and other platforms for their work in essentially slicing up what used to be lumpy government-granted monopolies. My argument will instead be that these kinds of innovations are usually inefficient and inequitable, and should be in line at a minimum for hefty tax hikes.

On the flip side, we have some cross-subsidies in place today that could use disrupting. Professor Fennell’s recurring example of “tick widths” for stock pricing offers a nice entrée into the question of how government should pay for the public good of price revelation in securities market. I argue that private markets are able to produce the public good of pricing information largely because they are bundled together with a public bad: information asymmetry. New technologies could allow this bundle to be sliced apart, allowing us to consume sweet, well-disciplined markets without the bitter aftertaste of lemons.

I. Paying with Lumps

How exactly does it work for government to pay with lumps instead of taxes? Consider the Affordable Care Act. The ACA prohibits many insurers from charging higher prices to women or individuals with serious past health problems. But these are both groups that are more expensive, on average. For an insurer to stay solvent, it will now have to charge an average price per enrollee that is below cost for high-cost enrollees and above cost for those who are the lowest risk. In effect, men in good health pay for the coverage of child-bearing-age women and those with chronic illnesses. Of course, Congress could instead have simply let insurers slice these groups differently, charging women more, but with a tax-financed subsidy payment to make up the difference. Indeed, this is basically what Medicaid is.

Brooks, Maher, and I (“BGM”) argue that the ACA approach might be economically preferable to direct-tax financing. Among other points, we suggest that many individuals value health insurance at above its cost to them, making them willing to pay even though they also carry the load for others. And health insurance costs are calculated and collected far differently than taxes, which means that—unlike a standard tax hike—the incremental costs of insurance do not offer households an added incentive to misreport income or otherwise change their behavior to reduce tax. Against these advantages we acknowledge the point (emphasized recently by Elizabeth Warren’s campaign and experts aligned with it) that health insurance costs are relatively regressive, because they don’t increase much with income.

Notice, though, the vulnerability of the ACA “financing” system. If low-cost individuals are not always lumped together with everyone else, but instead can enter discrete contracts in which they get only the insurance they need at a low cost, cross-subsidies become very scarce. For that reason, health advocates were strongly opposed to a recent Center for Medicare and Medicaid Services proposal to authorize high-deductible (or otherwise unregulated) short-term plans. These are, in essence, plans that are cheap but appeal only to healthy people. The existence of high-deductible plans would make it easier for these low-cost folk to escape the burdens of cross subsidizing others.

II. When Bundling is Better

Bundles, then, work best if they are bound tightly together. In economic terms, the higher the elasticity of substitution between a bundled good and its alternatives, the worse it will typically perform. A bundled cross-subsidy can be thought of as a kind of sales tax on the bundled good. Public finance texts since Ramsey have observed that these kinds of taxes are highly distortive when demand is highly elastic. As Professor Fennell shows, and we’ve just seen with high-deductible plans, law can have dramatic effects on the ability of consumers to split up a bundle. So can technology. What happens when these two forces come into conflict? Can law respond nimbly enough to keep together bundles that technological entrepreneurs try to unwind?

Arguably, this is the story of how Uber and other ride-hailing services undercut the taxi system, or the growing popularity of so-called income sharing agreements. ISA’s threaten to destabilize—supporters might say “disrupt”—the student-loan industry. The federal government has a near-monopoly today on lending to student borrowers. Borrowers with the savvy to navigate the system receive an exceptionally good deal, in effect paying a small sliver of whatever income they earn in excess of the poverty line each year in exchange for their education. No one who can’t afford to pay pays. Since risky borrowers, such as poets or likely drop-outs, agree to the same terms as safer bets like engineers, there is a large cross-subsidy from safe to risky borrowers.

The income-share-agreement industry aims instead to target the safe borrowers only. By offering terms slightly better than the federal government, the ISA firm gets the reward of the government’s monopoly pricing on the profitable end of its portfolio, without bearing the costs of the at-risk students who are its greatest beneficiaries (in health care we would call this “cream skimming”). Over time, the federal government’s program will get costlier and costlier, threatening its political viability.

Again, some commentators have hailed the rise of unbundling platforms as an exemplar of beneficial regulatory entrepreneurship (or at least recognized that as a theoretical possibility). In this account, government is too slow to unwind bundled transfers that are no longer economically efficient. Nimble economic actors serve to bust up inefficient government-granted monopolies.

This certainly could be the case, but there are also good reasons to worry about the opposite effect. Arbitrageurs may swoop in where efficient cross-subsidies dwell, capturing the cross-subsidy without delivering any of the services that are supposed to be bundled with it. Here, government must be nimble enough to defend existing regulatory boundaries against inefficient arbitrage. But if the arbitrageur can succeed quickly enough, or monetize its potential future rents, it may have heavy lobbying artillery available to defend its position. That of course is the strategy Uber has pursued, as Barry and Pollman have explained.

This capturing of built-in rents delivers a potentially large and unintended subsidy to new businesses. Other commentators have looked for explanations for the rapid rise of the “platform economy,” particularly in the United States, but they haven’t recognized the role cross-subsidies play. The U.S. offers an especially fruitful source of cross-subsidies, due to budgetary pressures created by federalism: inter-jurisdictional competition and the state balanced-budget rules that come with it. That has offered more enticing targets for platform disaggregators.

Arbitrage’s disruptive potential would be of little concern if it were always easy to replace cross-subsidies, but probably the opposite is true. A conventional wisdom about cross-subsidies is that they are adopted because redistribution through taxation would be politically impossible. BGM are somewhat skeptical of this story, but they argue that there are a set of structural political differences between taxes and cross-subsidies that can make one or the other a much better fit for a given policy. For instance, they observe that in the United States, federal taxes are actually easier to adopt, but also much easier to modify over time, so that projects that require long-term certainty are better matches for a cross-subsidy. Arbitrageurs may therefore uproot transfers that cannot be reenacted, or can only be reenacted in ways that don’t serve their underlying policy well. Theorists are now beginning to think about how regulation can respond to these challenges (another excellent reference here is Professor Cristie Ford’s Innovation and the State).

One possible response would be to welcome innovations in slicing up bundles, but to tax them heavily. Economists think that taxes on “rents” (i.e., unique returns unavailable in a fully competitive market, such as those commanded by monopolists) can be efficient even at very high levels. So government could impose a tax on arbitrageurs—ISA providers, say—that is high enough to replace most or all of the value of the transfer embodied in the old bundle. This would soak up most of the “rent” the arbitrageur captures. If proponents of arbitrage are correct that innovators create new value, rather than simply redirecting government rents, the tax should be no obstacle to true value-creating innovation. If innovators need some government push to succeed, that payment should probably come from tax dollars, not the beneficiaries of the old project the innovator unwinds.

III. When We Should Lose the Lumps

While some bundles are efficient ways to produce public goods, some “naturally” occurring bundles—bundles that the law largely finds, rather than makes—might be better replaced with taxes instead. Securities markets offer a nice example. In general, securities markets benefit when trading parties are better informed. Asymmetric information creates “markets for lemons” in which buyers won’t pay full price for goods of unverifiable quality and sellers of high-quality goods won’t sell at the depressed price, further confirming the skepticism of buyers—which in turn drives down prices further, and so on. Better information about asset value also improves the liquidity of markets, which among other things means more parties will be able to agree on trades that create value for both sides. In both these dimensions, information even about a single discrete firm resembles a public good: it benefits all potential traders. Standard economic theory suggests it will thus often (though, as Professor Fennell aptly describes, not universally) be under produced.

Despite the positive externalities that information produces, market mechanisms have developed to create and disseminate information about traded firms and their values. I use the passive voice deliberately here to elide the question about whether it was government, private actors, or both that developed these mechanisms—not because I’m uninterested in the question, but because it’s peripheral to my focus. Let us say that given a certain set of background rules, it became efficient for market actors to behave spontaneously in ways that generated informational benefits for others.

As Professor Fennell notes, one common example of this phenomenon is the response of market-makers to “tick widths,” or the minimum price differential at which securities can be listed on a given market. In basic finance theory, “The tick size can . . . be thought of as taxing liquidity takers in order to subsidize liquidity provision.” While the realities of the modern marketplace make this proposition more complicated, the general idea is that a trading firm can profit off the gap between the true value of a security and the nearest fractional price at which it can be sold. The market, as a whole, benefits from enhanced liquidity, and this benefit is funded by the counter-parties of the market-making firms.

Stakes are much larger, but the economics are essentially the same, in the case of price (not regulatory) arbitrage. A classic arbitrageur in a securities market is one that has better information than others about the value of an asset. One arbitrage play is to bet against the asset. These bets, once observed by other actors, provide additional clues about the asset’s value, helping to bring prices in line. Arbitrage is thus the central “mechanism of market efficiency”: without relatively free price arbitrage, commentators now agree, there can be no efficient capital markets. Indeed, Professor Fennell notes that the difficulty of arbitraging individual home values is a serious obstacle to efficient pricing in the real estate market.

Who pays for the enormous social gains that arbitrageurs produce? In general, there are two sets of payers. The most obvious are the arbitrageurs’ counter-parties, the unfortunates who didn’t know, say, that a traded firm’s latest drug was likely to clear a key FDA hurdle. More subtly, every trade in which there is asymmetric information inches trading closer to a market for lemons. When buyers know that sellers may be better informed, the buyer becomes incrementally less willing to buy. If the buyer whose willingness to pay declines is the marginal buyer, the trading price may fall, triggering a potential (if perhaps slow-motion) cascade of lemons.

In their classic defense of insider trading, Professors Dennis Carlton and Daniel Fischel make just this point: insider trading is in this respect no different than any other trading with unequally informed parties. Both reveal potentially useful new information, and both increase the risk of a lemons problem. Again, to Carlton and Fischel, this is supposed to be a defense of insider trading, but it has never been clear why it isn’t instead an indictment of arbitrage. The informational benefits of informed trading (whether informed by insider knowledge or otherwise) may be a public good, but the asymmetry it draws on creates a public bad. (Put another way, information can both expand and reduce trade).

This helps to explain how arbitrage is able to arise somewhat spontaneously in private markets (albeit markets subject to a wide range of laws enabling participants to rely on representations by others and to keep the fruits of their wagers). The arbitrageur is generating a public good, which economic theory suggests should often be under-produced. Yet at the same time, they create a public bad, which the same theory claims is usually over-produced. Whether we arrive at the socially optimal level of information depends on how these two effects balance for each arbitrageur, as well as on other factors like the costs of executing an arbitrage trading strategy. Again, in housing markets, those costs are so prohibitive that arbitrage produces little public information despite economic actors’ ability to largely ignore its negative externalities.

This is a poorly designed financing system. Its essential problem is bad bundling. Our ability to finance each individual increment of new information is bound tightly with the information provider’s ability to engage in a trade. And it is not clear why the appropriate payers are counter-parties and other potential participants in securities markets.

Actually, the full description of who pays for price arbitrage is more complicated, and sometimes even more grim, than that. Different market actors, and at times entire markets, are more or less vulnerable to asymmetric information. We can imagine that securities on which nearly all traders are extremely well-informed are relatively impervious to serious lemons effects from minor arbitrage. Setting aside the possibility of insider knowledge of upcoming deranged POTUS tweets, arbitrageurs are not moving the price of one-year T-bills. But the marginal effects of increased asymmetry can be dramatic in market situations where, say, counter-party credit risk is very high (or other situations where markets lock up, such as in a “liquidity trap”).

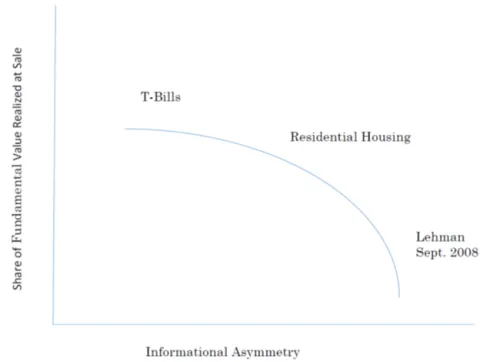

Figure One: The Marginal Cost of Asymmetric Information

I illustrate this in highly stylized form in Figure 1. The figure looks like the right-hand side of hill, with the X axis being increasing information asymmetry. We can call the Y axis the share of fundamental value an asset sells for. At some point, marginal moves to the right roll prices down off the crest of the hill. Near the bottom of the hill, I’ve labeled a point “Lehman Brothers Sept. 2008.”

The date is significant, of course, and serves to illustrate the point that the social cost of arbitrage—and indeed the identity of those who bear its economic burden—varies not just by asset class or firm traded but also by timing. An arbitrage system that looks as though it is paid for mostly by brokerage firms through very modest increases in bid-ask spreads may be subject to shocks in which the entire cost curve shifts dramatically to the right. And when that happens, of course, economic pain becomes much more widespread. In short, informed trading is a tax on financial transactions whose rate and incidence depends on the state of the market.

These features in some sense make the question of whether arbitrage is an efficient financing system a messy one, but in another sense they make it quite easy. Technically, as BGM argue, the issue is whether the total expected social cost of financing price revelation via the arbitrage mechanism is lower than the marginal cost of tax-financed public funds necessary for replacing that financing. Possibly one would also adjust these calculations using “social welfare weights” to account for their relative distributive effects. For housing markets, which I (arbitrarily, I admit) place somewhere near but to the right of the peak of the hill, there is probably a question about whether it would be desirable to enable more price arbitrage. But for securities markets, in some states of the world it seems plausible that the costs of arbitrage are sufficiently catastrophic that the question would not be especially close. One cannot, of course, simply turn arbitrage financing off and on when these events occur. So it might be that tax financing is altogether safer, and should be adopted under a kind of precautionary principle. On the other hand, precaution does not seem a hallmark of recent financial regulation.

A major counter-argument, of course, is that we use arbitrage because tax financing is impractical, but I think that argument lacks sufficient imagination. We can pay would-be arbitrageurs directly for their information services. To be sure, the classic difficulty with such schemes, as long embodied in debates about patents versus prizes and charitable contribution deductions against direct grants, is how government should go about assessing the value of its information bounties. Like patents, arbitrage has the advantage of simplicity: the arbitrageur’s reward is typically larger the more accurate her information and the greater the degree her information moves (improves) the market. This arguably tracks social welfare.

But also like patents, there are other ways to measure these same factors. One proposal for prizes involves the government tracking the sales of incentivized products, and making ex post payments to producers equal to a fraction of the total sales. The equivalent in the price revelation context could be a kind of government-operated price registry. Information entrepreneurs could post their beliefs about the price of an asset at a future time. At that set time, all posted beliefs are revealed for the market to observe. Entrepreneurs receive a payout based on a weighted combination of the market cap of the asset and the extent to which the market moves in the direction of the posted beliefs after it is revealed.

Of course, many other design issues abound, including the difficult trade-offs involved in deciding how much “skin in the game” must be attached to each bet. There must be some, otherwise algorithmic posters would post bets across the range of all possible prices. But increasing skin also reintroduces the fundamental liquidity constraint that is an obstacle to all arbitrage. In some versions, the resulting mechanism may resemble a large government-run investment bank making a market in derivatives. Even further along those lines, the proposal could also be taken as akin to the case for government involvement in clearing houses for derivatives markets.

Not every securities problem is as difficult. It would be straightforward to replace tick widths with tax and transfer payments. The argument for spreading the cost of liquidity at least across all market participants, if not all taxpayers, is hard to see counters for. There might be an argument that tick widths tend to assign costs disproportionately to liquidity demanders, but that could easily be replicated with a fee structure based on trading volume.

* * *

Whatever the answers to these questions, at a minimum I hope to make the point—really, just repeat Professor Fennell’s point—that bundling choices are enormously socially important. They lurk in places, like decisions about how public goods are financed, that few have noticed. And viewed properly, they help us to see the urgency for thinking about alternatives, however difficult it may be ultimately to change.