Is Efficiency Biased?

Efficiency is a watchword in policy circles. If we choose policies that maximize people’s willingness to pay, we are told, we will grow the economic pie and thus benefit the rich and poor alike. Who would oppose efficiency when it is cast in this fashion?

However, there are actually two starkly different types of efficient policies: those that systematically distribute equally to the rich and the poor and those that systematically distribute more to the rich.

Our collective failure to grasp this distinction matters enormously for those with a wide range of political commitments. Many efficient policies distribute more to the rich without the rich having to pay for their bigger slice. Because these “rich-biased” policies are ubiquitous, efficient policymaking places a heavy thumb on the scale in favor of the rich. Especially at this time of heightened concern about inequality, getting efficiency right should matter to a wide swath of the policymaking spectrum, from committed redistributionists to libertarians. We should support efficient policies only when the poor are compensated for their smaller slices or when efficient policies systematically distribute equally to the rich and the poor as we grow the size of the economic pie.

This Article points a way forward in ensuring that a foundational tenet of the law does not follow a “rich get richer” principle, with profound consequences for policymaking.

Introduction

Suppose that a city is considering building neighborhood parks, each of which costs \$1 million to build. The residents of a rich neighborhood are willing to pay \$2 million for the park, but the residents of a poor neighborhood are willing to pay only \$500,000, less than the cost of construction. Suppose as well that the park increases the well-being of the rich and poor by the same amount. Should the city build a park in the rich neighborhood, the poor neighborhood, both, or neither?1

A dominant policymaking ethos of our time—perhaps the dominant one—is the pursuit of economic efficiency.2 The typical efficiency-based economic analysis of law gives a clear answer: build the park in the rich neighborhood but not the poor neighborhood. Doing so is efficient. This goal of economic efficiency is reflected throughout the law, especially in administrative cost-benefit analysis3 and common law adjudication.4 It has reached such a status that one keen observer has called the notion that economic policy should be efficient (apart from explicitly redistributionist tax and transfer programs) the “Brookings Religion”—that is, the standard goal for policy analysts across the country, as exemplified by the work of the famous think tank in Washington, DC.5 The advocates of economic efficiency point to its ability to grow the size of the economic pie, making everyone better off.6 As they say, a rising tide lifts all boats.7 But efficiency’s critics, especially outside of economics, suggest that efficient policy pays insufficient attention to the needs of the poor.8 This view resonates with critiques of neoliberalism and the “Washington consensus” view that governments should adopt efficient, growth-inducing laws.9

This Article works from within economics itself to describe the hidden meaning of efficiency, identifying the particular bias against the poor in many, but not all, efficient policies. It makes three contributions. First, it introduces a new concept, “legal entitlement neutrality,” that classifies efficient legal rules based on their “bias” toward people of different incomes. Second, it characterizes conditions under which an efficient policy distributes more, less, or the same amount of legal entitlements to the rich and the poor. These conditions produce a heuristic rule: money is neutral. Otherwise, efficient policies are probably biased toward the rich. That is, in many cases—discernable based on criteria in this Article—one of the dominant paradigms in the law is biased against the poor, which is a particular concern given rising dissatisfaction with economic inequality as exemplified by the interest in the work of Thomas Piketty.10 Third, it offers implications for policy. In particular, by showing that efficiency is not just indifferent to the poor but is actually often biased against them, this Article offers an important reason to adopt less efficient legal rules that are less biased against the poor.

Understanding these claims requires some precision in understanding what “efficiency” is. When this Article asks, “Is efficiency biased?,” it refers to “Kaldor-Hicks efficiency,” the typical definition used in economic analysis of the law. Kaldor-Hicks (K-H) efficiency maximizes individuals’ willingness to pay for a policy change.11 This goal is particularly associated with scholars like former Judge Richard Posner but is a common goal for setting policies, as it is viewed as maximizing the size of the economic pie. When critics say that efficient policies are biased against the poor, they reference efficiency’s basis in “willingness to pay.”12 Because the rich have greater wealth, the view goes, they will tend to have a greater willingness to pay, and therefore policymakers maximizing efficiency will choose policies that benefit the rich over the poor.

In the 1970s and 1980s, when the efficiency norm rose to dominance in the economic analysis of the law, there was vigorous critique of the alleged bias of efficient policies against the poor.13 But remarkably, this foundational critique of the most common goal in the economic analysis of law, if not in all analysis of law, never quite crystallized. Opponents came up with powerful examples of bias against the poor, and had a strong intuitive account, but never reached a general critique of efficient policymaking’s biased distribution that carefully considered qualifications.14 Rather, the question largely went into hibernation. By revealing the inner workings of K-H efficiency and its application to legal rules, this Article provides that general critique but also qualifies earlier critiques, showing that efficiency is more complex than either its supporters or critics suggest.

The debate about bias in efficient policymaking went into hibernation in part because a view took hold among economic analysts that distributional consequences of efficient policies were inconsequential because taxes and transfers either should or do address distributional concerns.15 The mantra is to have efficient policies that may harm the poor, grow the economic pie as large as possible, and then slice the pie equitably by redistributing to the poor through taxes16 to address distributional concerns.17 That is, if the tax system achieves the appropriate distribution of income, then the distributive impacts of nontax policies do not matter.18

This Article makes a different—and, in the context of economic analysis, uncommon—assumption: the distributional consequences of policies “stick,” as a variety of political frictions described by political scientists suggests could be the case.19 A policy that hurts the poor does not lead to increased transfers to the poor, and a policy that benefits the poor does not lead to increased taxes on the poor. As a result, policies’ distributional impacts matter. What assumption is empirically correct is an open question, but this Article works out the implications under the plausible notion that distributional impacts stick.

In this context, this Article introduces the concept of “legal entitlement neutrality,” which means that, if one’s income changes, one’s efficient allocation of legal entitlements does not change. It thus classifies policies by their tendency to assign a larger or smaller amount of legal entitlements to different individuals on the basis of their income. By “legal entitlement,” this Article means stuff that the government allocates—for example, clean air, provision of parks, spending on infrastructure, or road safety. Legal entitlement neutrality is primarily a question of “fairness” in allocation: For a given type of efficient policy, do richer people tend to get more, less, or the same amount of stuff?

Two things should be noted about legal entitlement neutrality. First, “neutrality” in this Article refers specifically to this concept, not some broader platonic concept of neutrality. For example, in the view of many, a policy that increases well-being equally for everyone would probably need to give more money to the poor than to the rich because a dollar may buy more well-being for the poor than for the rich, owing to the rich’s greater resources.20 Bias here refers to an allocation of goods and services, not utility. Second, it refers only to efficient policies, not to other types of policies, which are not characterized by a presence or lack of legal entitlement neutrality.

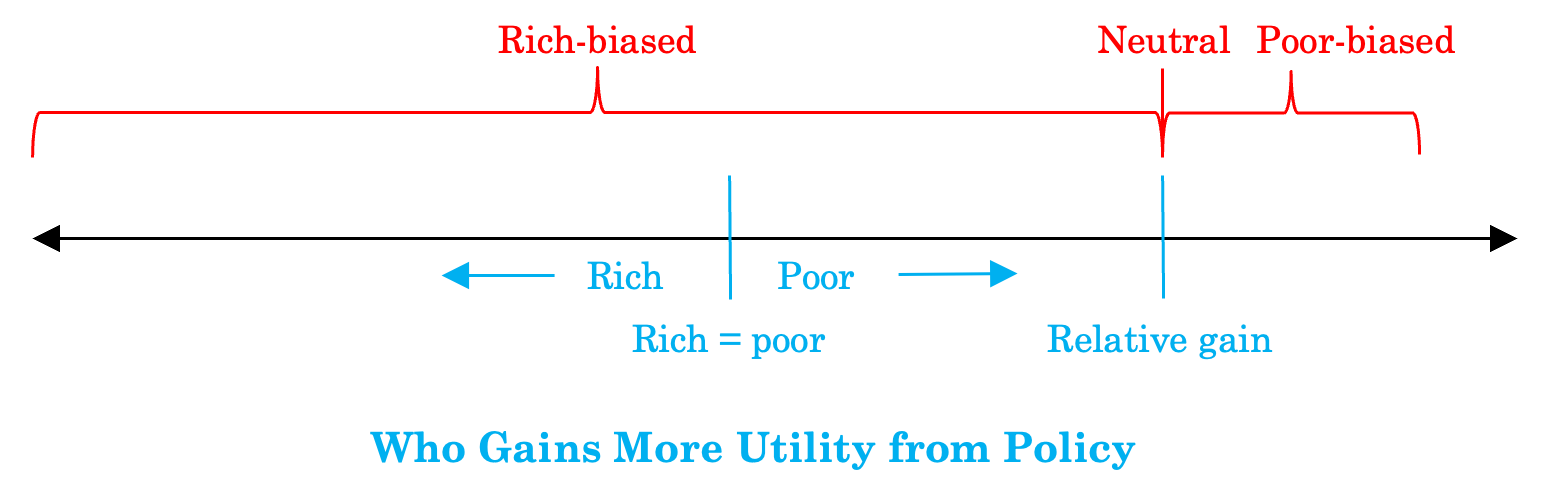

Efficient policies can be “poor-biased,” “rich-biased,” or “neutral.” A policy is poor-biased if, as one gets richer, one gets fewer legal entitlements from efficient legal policies. For these policies, the poor are willing to pay more than the rich for the legal entitlements (such as public bus routes, perhaps), so efficient legal rules endow the poor with more of them. Poor-biased policies are rare because it is unusual for the poor to be willing to pay more for anything than the rich. As a result, this Article focuses on the division between the more frequent rich-biased and neutral policies.

An efficient policy is rich-biased if, as one gets richer, one tends to get more legal entitlements from efficient policies.21 For these policies, the rich have a greater willingness to pay for the legal entitlement than the poor, so efficient policies endow the rich with more of them. There are lots of rich-biased policies because there are lots of things that the rich are willing to pay more for than the poor.22

An efficient policy is neutral if, as one gets richer, efficient legal rules do not change one’s legal entitlements. In particular, everyone has the same willingness to pay for one dollar in increased or decreased income: everyone’s willingness to pay for $1 is $1. Neutral policies are common in the law. For example, the willingness to pay of two identical laundromats, one owned by a rich person and the other by a poor person, to stop pollution from a neighboring factory that is reducing the laundromats’ profits by \$1 does not depend upon the laundromat owners’ incomes. Both owners are willing to pay \$1 to avoid the harm. Generally, business contexts that shift profits from one business to another (for example, in tort, contract, and corporate law) are neutral because everyone has the same willingness to pay for a dollar of profit. As this Article argues, subtle differences in policy context can lead to big differences in bias.

While any given neutral policy may benefit the rich or the poor, neutral policies grow the size of the economic pie without systematic bias toward the rich or the poor. It is thus plausible to believe that they have distributional impacts that even out across many policies. Such a belief is not reasonable for rich-biased policies, which systematically, as a matter of methodology, distribute more to the rich. After revealing this hidden division, this Article illustrates it using an extended example involving tort liability. The underlying math is described in the Appendix.

Notwithstanding this division between policies, overall efficiency analysis places a heavy thumb on the scale in favor of rich-biased policies because the rich—due to their greater wealth—are generally willing to pay more for the things that legal entitlements confer.23 Thus, rather than allocating resources to the poor, who are most in need, efficient policies tend to do the opposite: allocating resources to the rich, who are willing to pay the most. Efficient policies will therefore tend to allocate more valuable legal entitlements to the rich: more spending on transportation, more parks, and cleaner air in rich places than in poor ones. This Article calls this phenomenon the “rich get richer” principle of law and economics. In effect, unless their distributional consequences are offset, efficient polices tend to reinforce the existing wealth distribution: greater ownership of wealth entitles individuals to a larger allocation of policy entitlements—even if the rich do not pay for it.24 That is, rich-biased policies give disproportionate legal entitlements to the rich for free, exacerbating inequality.

Legal entitlement neutrality is important because many believe that at least some areas of government policymaking should not give more or fewer legal entitlements to people on the basis of their income. In particular, many hold the view that certain branches of government (often the courts and administrative agencies) should not redistribute,25 redistribution being the exclusive province of the legislature. Efficient policies, which often redistribute toward the rich, may seem problematic not only to those who favor redistribution to the poor but also to others, such as libertarians, who do not want the government to treat people differently because of their income, or to those who are concerned about the legitimacy of the state.26

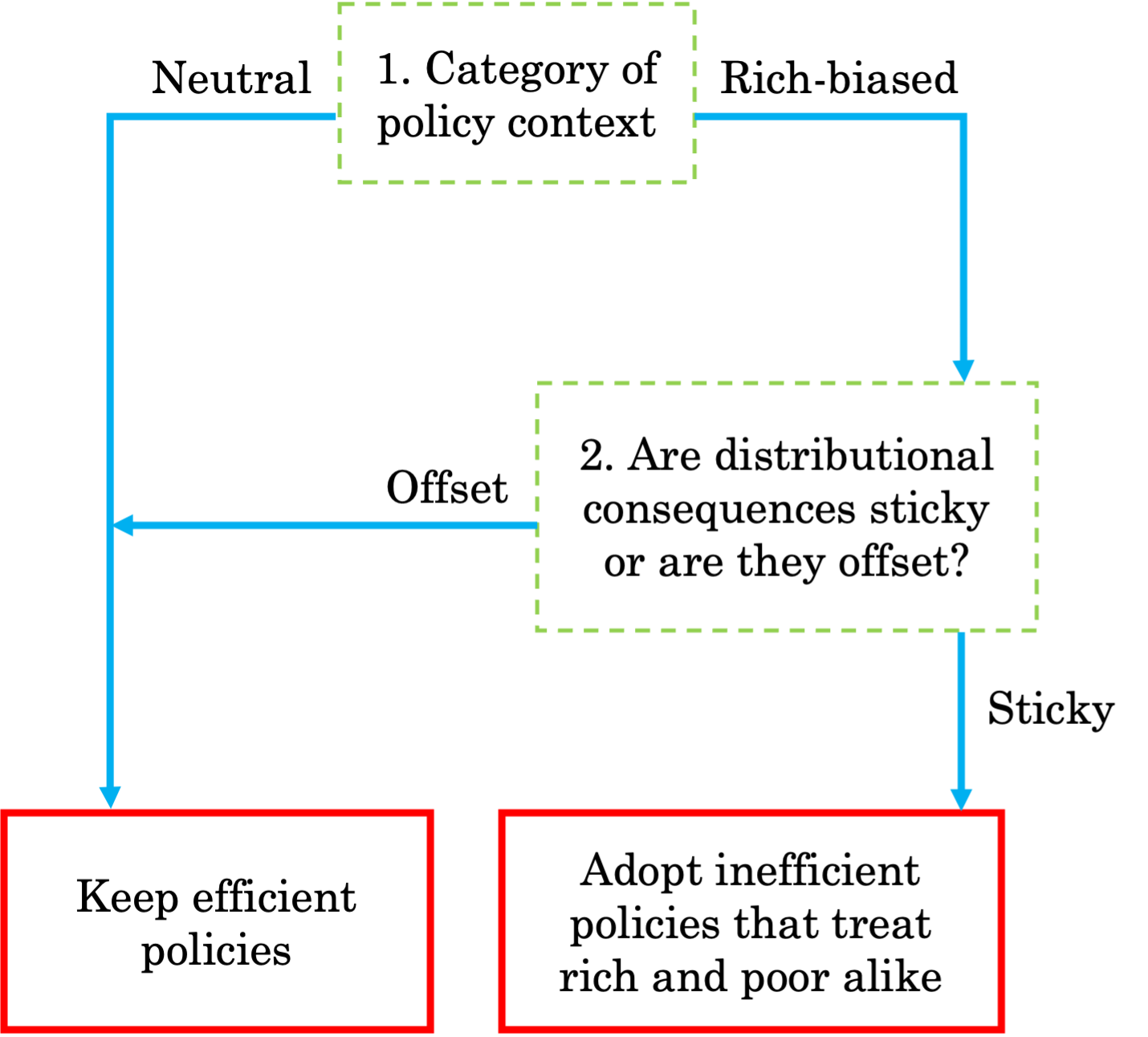

A detailed discussion of policy implications is beyond the scope of this Article. But the analysis does suggest a two-point rubric for addressing the distributional impacts of efficient policies. This Article provides guidance on when and why to consider adopting inefficient policies if one wishes to both avoid redistributing toward the rich and adopt policies that make everyone better off. The rubric can be applied whenever the law considers efficiency.

The first and threshold question is whether the context is one that is likely to lead to a rich-biased rule. For neutral policies, distributional impacts may even out over time: as a matter of methodology, there is no bias. For rich-biased policies, however, there is an inherent legal entitlement bias. Second, does the institutional context suggest that policies’ distributional effects will be offset or be sticky? For example, legislatures can more easily adjust policies to address distributional concerns; administrative agencies and courts are less able to do so, making it more likely that the perverse distributional consequences described here will stick.27 If the efficient policy is rich-biased and has distributional impacts that are sticky—and if we hold one of the broad range of normative commitments suggesting that distributing more legal entitlements to the rich without the rich paying for them is perverse—then such a policy should not be adopted. Instead, policy alternatives that are explicitly inefficient, with a goal of putting the rich and the poor on equal footing, should be adopted.

This Article proceeds as follows. Part I describes the precise meaning of efficiency. Part II describes the traditional view that policies should maximize efficiency, with distributional impacts addressed by taxes and transfers. This Article then departs from that conventional view by supposing that policies’ distributional impacts stick, making the distributive impacts of efficient policies an essential question. Part III introduces “legal entitlement neutrality” and illustrates the concept with examples. Part IV offers real-world illustrations of rich-biased policies from administrative law and torts. Part V discusses potential policy responses. Part VI responds to potential critiques.

I. Efficiency: An Explanation

Kaldor-Hicks efficiency is the typical metric used in law and economics and is the primary subject of this Article. Throughout this Article, references to “efficiency” or “efficiency analysis” mean K-H efficiency unless otherwise noted. K-H efficiency (also sometimes called “cost-benefit analysis”28 ) measures the willingness to pay of the parties affected by various policy options and then chooses the policy that maximizes the sum of the willingness to pay of those parties. (This Part gives an intuitive explanation, leaving the technical, mathematical definition of K-H efficiency to the Appendix.) By choosing policies most responsive to people’s preferences (as reflected by their willingness to pay), K-H efficiency thus maximizes preference satisfaction given both the current distribution of income and the constraints, like a limited budget, under which policymakers operate.29 Doing so maximizes so-called “social surplus,” or just “surplus”: people’s total willingness to pay for a given social arrangement.30

The desirability of K-H efficiency is based in part on the notion that it is relatively observable. In particular, unlike utility or well-being, which are not directly observable, willingness to pay is, at least in principle. The reason is that, in real-world markets, we observe people paying for things, and if someone pays for something, presumably she is willing to pay for it. Thus, by allocating legal entitlements to people who are willing to pay for them, K-H efficiency seeks the arrangement of goods, services, and externalities that the free market would achieve, taking the current wealth distribution as given.31 However, unlike in markets, in which parties actually pay for what they receive, K-H efficiency asks about hypothetical willingness to pay. That is, K-H efficiency is not about what parties did pay, but rather what they would have paid, and it does not require that people actually pay for what they receive.

Put a different way, by seeking to maximize willingness to pay,32 efficiency analysis promotes the allocation of goods, services, and externalities that would result if there were free bargaining and everyone who gained from the new policy compensated those who lost, whether or not the compensation actually takes place. If two parties are affected by a policy change, and one party would be willing to pay more for a policy change than another party would be willing to pay to avoid the change, the policy is efficient—regardless of whether there is actually a transfer from the beneficiary to the harmed party.33 Adopting an efficient policy ensures the total amount that people are willing to pay in aggregate for policies has increased. As former Judge Posner famously put it, in a sense, “wealth” has increased34 —not in that people have more money in their bank accounts, but rather in the sense of total surplus (willingness to pay for social arrangements) increasing. Adopting such efficient policies then respects people’s preferences by adopting the policies that they value most.

K-H efficiency is different from two other concepts also used for economic analysis. The first is Pareto efficiency.35 A policy is Pareto efficient if there is no alternative policy that makes someone better off without making anyone worse off.36 A policy that is Pareto efficient is thus an improvement on the status quo. However, Pareto efficiency has been criticized as unhelpful because, for most policies, making no one worse off is impossible due to the large number of people involved.37 Part of the appeal of K-H efficiency is that it delivers policy recommendations without the very stringent requirement that no one be made worse off. Indeed, K-H efficiency is also sometimes called “potential Pareto efficiency” because it is viewed as identifying changes that increase overall surplus and thus have the “potential” to be Pareto efficient after transfers from those who gain from the policy change to those who lose from it.38

Another concept used in economic analysis is “social welfare” or well-being. Though the goal can take a variety of forms, most typical is developing a measure of each individual’s utility level, summing those, and then choosing the policy that maximizes that sum of utilities (which potentially can be weighted).39 There are a variety of ways that social welfare maximization can differ from efficiency analysis. For this Article’s purposes, the most important way is that allocating money, goods, or other forms of legal entitlements to individuals with low incomes may increase utility because of the declining marginal utility of income resulting from money being less valuable to rich people, a conventional assumption in economics.40 Efficiency analysis, in contrast, does not directly consider the declining marginal utility of income and thus does not systematically allocate resources to the poor.

Some—most famously, Posner in the 1970s and 1980s—take K-H efficiency as the ultimate goal of government policy.41 More commonly, though, law and economics scholars take well-being as the ultimate goal of policy but nevertheless support efficient policymaking in many arenas for at least one of two reasons. The first is that efficiency maximizes the size of the economic pie that taxes and transfers can then redistribute to address concerns about distribution. Part II discusses that argument. Another argument is that, across a large number of efficient policies, distributional consequences will even out.42 The rich will benefit from some policies and the poor from others. But across a large enough number of policies, everyone is better off. So the best way to maximize welfare is to adopt efficient policies, which will ultimately maximize welfare. This view should be familiar to anyone who even occasionally reads the news and is associated with comments like “a rising tide lifts all boats”43 and (among critics) “trickle-down economics.”44

This popular view in support of efficiency has an analogous popular view opposed to it, often associated with critics of neoliberalism, who argue that efficiency pays insufficient attention to the needs of the poor.45 Perhaps most famously to legal scholars, Ronald Dworkin gave the examples of Derek and Amartya.46 Derek is poor, and Amartya is rich. Derek has a book that Amartya would like. Because of his poverty, Derek would be willing to part with the book, which he holds dearly, for \$2. Amartya, though he is not very interested in the book, is willing to pay \$3 for the book due to his great wealth. Thus, Dworkin points out that it would be efficiency-maximizing for the government to take the book from poor Derek and give it to rich Amartya, even without compensation.47 Rich Amartya is getting something from the government just because he’s rich, not because his well-being is enhanced more by having it.

This analysis is helpful so far as it goes—especially for making Dworkin’s point that utility and efficiency are quite different things. But it—along with other analyses from economists48 —leaves many questions unanswered, as it is just one example that does not extend to the huge range of issues to which efficiency analysis is applied. How broad is the critique? Are there exceptions? Is this just a narrow case?49 Tracing out more precisely the distributive implications of efficient policymaking is the task of this Article.

II. The Distributional Consequences of Policies: A Sticky Take

Law and economics typically justifies the goal of maximizing efficiency by arguing that efficiency actually promotes social welfare maximization because efficient policies maximize the size of the pie that can then be redistributed through taxes. The leading law and economics textbooks make an argument along these lines.50 Thus, there has been little reason for systematic study of distributional impacts of efficient policies, even as efficiency has become the goal of much policymaking and analysis; those distributional impacts have been taken not to matter because they are offset by other policies. This Part explains this conventional reasoning and then turns to the alternative “sticky distribution” assumption introduced in this Article.51

The idea that all policies except tax policy should ignore distributional effects is long-standing and has an impressive list of proponents, including Nobel Laureate Paul Samuelson,52 foundational scholar of modern public finance Richard A. Musgrave,53 and leading law and economics scholars Louis Kaplow and Steven Shavell.54 The classic argument for this idea in law and economics comes from Kaplow and Shavell. They introduced the “double distortion” argument that adopting an inefficient legal rule to benefit the poor by giving the poor larger damages in torts results in two distortions: both to the behavior being regulated (roads that are “too safe” because of damages that are larger than efficient) and to income earning (people have an incentive to earn less so that they can get larger damages).55 In an argument that has generated disagreement56 but is not the subject of this Article, they say that it is typically welfare-enhancing to adopt the efficient rule and then redistribute through taxes.57 The taxes distort, but they result in only one distortion instead of two, thereby enhancing welfare.

To lay observers, a more familiar example of this argument comes from trade policy. The longtime refrain from economists of (nearly) all stripes has been that countries should adopt free trade, notwithstanding potentially negative impacts on the poor, because trade increases the size of the economic pie, and those gains can be redistributed to the poor through taxes and transfers.58 Both the Kaplow-Shavell torts example and the trade example are driven by the same two-step reasoning: everyone can be made better off through efficient nontax policies plus taxes and transfers.

An assumption about politics that is typically implicit underlies this analysis: those taxes and transfers actually happen so that the political system will recover a fair distribution of income. This Article calls this the “distributional offset” assumption. As Kaplow notes: “There may exist a sort of political equilibrium regarding the extent of redistribution. Thus, there may be a tendency for policies—perhaps not individually, but taken as a whole over a period of time—to be implemented in a distribution-neutral fashion.”59 In other words, normal democratic processes like voting will yield offsetting distributional consequences because voters have preferences for a certain distribution of income and will thus seek to have any distributional consequences of policy changes offset.60

To be clear, few explicitly assert that the distributional offset assumption actually is true. The more common explicit claim in canonical texts is that taxes should be used, rather than that they are used—a normative claim rather than a positive one.61 But law and economics analysis that recommends efficient policies de facto makes that assumption implicitly; if the distributional offset assumption does not hold, then the logic that the distributional consequences do not matter breaks down. For example, an efficient policy may hurt the poor but benefit the rich by more than it hurts the poor. To those who want to promote social welfare, or other social goals, this policy may not be desirable if the distributional offset assumption does not hold.

And indeed, other traditions, in political science and elsewhere, suggest the reasonableness of a “sticky distribution” assumption—that is, that distributional consequences are not offset.62 A full description of this scholarship is beyond the scope of this Article, but it is worth sketching some reasons for why policy may not offset distributional consequences to reproduce an optimal distribution of income in the aftermath of a new policy. One reason is that inertia could arise from a variety of sources, including the many veto points that could thwart democratic will.63 Inertia is aided by the population’s ignorance (possibly rational ignorance64 ) of the specifics of how policies change.65 As a result, an agency or court could make law with distributional consequences that long endure. The distributional consequences over the short and medium run matter in addition to those over the long run; for example, with an 8 percent discount rate, a ten-year delay in offset is closer to no offset than immediate offset.66

Furthermore, the public choice approach raises the question of whether that long run point will ever arrive. Public choice models how economic interests organize themselves to exert influence over policy outcomes through lobbying, donations, and other mechanisms.67 For example, Professor Mancur Olson describes how, given the costs of collective action, small groups with concentrated interests tend to prevail over larger groups with more diffuse interests.68 Groups that receive benefits through policies, efficient or otherwise, may constitute just such entrenched interests, and it may be difficult to use taxes and transfers to benefit more diffuse losers from a policy change. Indeed, to the extent that higher-income groups receive benefits, there is evidence (admittedly contested69 ) suggesting that the preferences of lower-income groups matter little for policymaking and that instead only the preferences of higher-income groups matter.70

Empirically, little is known about whether the distributional impacts of various institutions’ policy choices stick. One piece of evidence shows that, after state courts order increases in school funding that largely benefit the poor, the distributional consequences are not offset at all through taxes or spending, even decades afterwards.71 This evidence is consistent with the sticky distribution assumption but not the distributional offset assumption. Other evidence on the response to court orders on prison spending points the other way: those court orders appear to be funded by cuts to programs benefitting low-income individuals.72

We don’t know the answer to what the best assumption about politics is, and this Article does not take a stand either way. But there is at minimum a plausible case that distributional consequences will not be fully offset. In any case, the correct assumption probably varies depending on institutional context, a point that this Article returns to in Part V. For now, instead of assuming that the distributional impacts of policies are completely offset elsewhere, this Article adopts the sticky distribution assumption. The stakes for this Article are that, unlike under the conventional assumption, the distributional impacts of efficient policies matter.

III. Legal Entitlement Neutrality

With that assumption about politics, this Article asks: What are the distributional consequences of efficient policies? In particular, this Article asks whether efficient policies satisfy the novel but intuitive concept of legal entitlement neutrality. This Article defines “legal entitlement neutrality” as follows: as one’s income increases, efficiency-maximizing policies are no more or less likely to systematically endow one with legal entitlements (including goods, services, or money). (See the Appendix Section B for a mathematical definition.) In other words, legal entitlement neutrality is a question of how stuff is allocated. For example, if you get richer (but stay the same otherwise), do efficient legal rules give you more of an entitlement to clean air? Some may find neutrality an important minimum threshold that courts and agencies should satisfy because, if the distributional consequences of policies stick, then systematically regressive policies would exacerbate inequality. In other words, some may believe that judges and administrative rulemakers ought not be concerned with redistribution and should be neutral with respect to the rich and the poor. This Part shows that the answer to this question about whether policies satisfy legal entitlement neutrality turns crucially on the type of policy under consideration.

Legal entitlement neutrality naturally divides policies into three types. Neutral efficient policies do not change their distribution of legal entitlements to individuals as their income increases. Rich-biased efficient policies distribute more of a legal entitlement to individuals as their income increases. Poor-biased efficient policies distribute less of a legal entitlement to individuals as their income increases. (The Appendix defines these terms mathematically.) As this Part explains, efficiency analysis places a heavy thumb on the scales in favor of rich-biased policies. This Part offers examples of each type of policy in turn and then returns to the generalization of legal entitlement neutrality. The Appendix provides a simple (and novel) formula for understanding what utility functions yield which type of policy and includes graphical representations to help understand the intuition behind this formula.

Before moving on, four clarifications are in order. First, legal entitlement neutrality is a feature of efficient policies; policies that are not efficient are not part of the categorization. Second, legal entitlement neutrality is not a question of whether, in any individual case, an efficient policy benefits richer people or poorer people. For example, as this Article shows, there may be a tort in which a poor person wins, but the legal rule is still neutral. Rather, the question is one of systematic bias as a matter of the methodology of efficiency. Third, legal entitlement neutrality is primarily a question of fairness, not utility. Utility can of course be implicated when people of different income groups receive different legal entitlements—and this Part discusses those implications. But one need not think in utility terms to appreciate the insight. Fourth, categorization is an empirical question and is one that uses tools already common (though imperfect) in cost-benefit analysis. Through the various methods that currently are used—such as surveying affected parties or using their market behavior as proxies73 —analysts can measure how willingness to pay changes with income.74 The answer to that question determines categorization: for rich-biased rules, willingness to pay increases as income increases; for neutral rules, willingness to pay stays the same; and for poor-biased rules, willingness to pay decreases at higher incomes.

The following Sections focus on two examples of the tort of nuisance––one neutral and one rich-biased. Both examples apply the “Hand formula”75 in determining whether a polluting factory has failed to meet its duty of care and is thus negligent, requiring it to pay damages; essentially, the costs and benefits of the harm are compared. A polluter pays the cost of its harm if and only if its pollution is inefficient—in other words, if the costs exceed the benefits of the pollution. (A similar analysis could be conducted with federal rulemaking, in deciding whether a rule should be imposed.) A plaintiff receiving damages is equivalent to receiving a legal entitlement—the legal right not to have happen to her whatever the defendant was doing.76 This Article compares the efficient legal treatment of poor and rich people being polluted on, first in a neutral context, with the factory polluting on a laundromat, and then in a rich-biased context, with the factory polluting on homeowners.

A goal of this Article is to show that, while the two examples may seem similar, they are actually examples of different categories of legal rules with very different implications for distribution and potentially very different policy implications. Although the focus is on the contrast between neutral and rich-biased rules, this Article then briefly discusses poor-biased policies, which are uncommon. This Part then turns to the predominance of rich bias in efficient policymaking, which this Article calls the “rich get richer” principle. Finally, this Part shows how to understand these results within a utility framework.

A. Neutral Policies

Consider first the neutral case in which the income of the owner of a laundromat—the party being polluted—does not matter for the efficient legal rule. Like the owner of the factory, the owner of the laundromat is profit-maximizing. To stop the emission of pollution, the factory can install pollution scrubbers at a cost of \$5,000 in reduced profits. Thus, the factory’s willingness to pay for the benefit of emitting the pollution is the \$5,000 that the factory saves by not putting in the scrubbers.

Of the two possible laundromat owners, start with the rich one. With the pollution, she needs to purchase an air purifier for $10,000 to produce acceptably clean clothes.77 As a result, the laundromat’s willingness to pay to avoid the cost of the pollution is $10,000 in reduced profits. The Hand formula’s efficiency analysis compares the costs and benefits of the pollution, asking: Is it efficient for the polluter to put in the scrubbers? If yes, then the factory is found to have failed to meet its duty of care; it is then held negligent and must pay damages.

Because pollution’s cost (\$10,000) exceeds its benefits (\$5,000), the efficient legal rule is to impose liability on the factory, holding it negligent in the amount of \$10,000. As a result, the factory faces \$10,000 in damages from not installing the scrubbers, but needs to pay only \$5,000 to install them, so the negligence rule thereby incentivizes the factory to install the scrubbers in the shadow of this prospective rule. Thus, the laundromat de facto has the right to clean air in this case. Column (1) of Table 1 summarizes these facts, with the willingness to pay (WTP) of each party and the resulting efficient legal rule.

Compare that case of a rich owner of the laundromat with the case in which every fact is the same, except that the owner of the identical laundromat is poor. The factory owner still has a cost of \$5,000 for installing the scrubbers, so its willingness to pay for the pollution is \$5,000. And the cost of the pollution to the laundromat owner is still the need to install an air purifier, which costs $10,000, so her willingness to pay to avoid the pollution is $10,000. The WTP numbers for both parties are the same: the costs of the pollution (\$10,000 for the air purifier) exceed the benefits of the pollution (\$5,000 for the scrubbers). As a result, the outcome is the same: the factory is negligent. It needs to pay damages, and the laundromat owner has the right to the clean air, as summarized in Column (2) of Table 1.

What drives the analysis is that the laundromat owner’s willingness to pay does not change with her income. A poor owner has the same willingness to pay to avoid pollution as a rich owner does: the cost of installing the air purifier. Thus, regardless of her income, the laundromat owner’s willingness to pay to avoid the pollution is still \$10,000.78 As a result, the same analysis applies even though the owner is poor. In this context, the negligence rule is a neutral rule.

|

Plaintiff income |

(1) Rich |

(2) Poor |

|---|---|---|

|

Plaintiff WTP to avoid pollution |

$10,000 |

$10,000 |

|

Factory WTP to pollute |

$5,000 |

$5,000 |

|

Receives legal |

Plaintiff |

Plaintiff |

|

Outcome |

Factory faces |

Factory faces |

More basically, rich and poor people have the same willingness to pay for a dollar of profit: one dollar. Indeed, it is generally the case that contexts in which dollars are all that matter—most prominently, when profits are all that matter to the parties involved—lead to neutral legal rules. Such rules are present, for example, in the contract or corporate law that governs relations between two businesses, financial regulation, or the panoply of other areas in which only money itself matters. In this example, the income of the owners of the laundromat doesn’t matter for their legal entitlement to clean air. They have the same willingness to pay to avoid the cost of the air purifier: \$10,000 because \$10,000 is worth \$10,000 to both a rich and a poor person. As a result, the legal rule treats rich and poor people the same.

Finally, consider two aspects of the economic pie, the size of which neutral efficient legal rules are maximizing. First, this economic pie consists of money. When the efficient legal rule is adopted, the economy produces more dollars. In this example, with the efficient legal rule, instead of forcing the laundromat to spend \$10,000 on an air purifier, the factory installs the scrubbers for \$5,000, producing an extra \$5,000 of money. Second, any given policy may benefit the rich or benefit the poor. For example, poor people benefit from the rule if the laundromat owners are poor, and rich people benefit if the laundromat owners are rich. But across a large number of efficient policies, the distributional impacts of such neutral legal rules could plausibly even out. Because any individual efficient legal rule has no bias, in aggregate many such rules may not have systematic distributional impacts.

B. Rich-Biased Policies

Contrast this neutral context with a rich-biased context. Suppose that the same factory is involved with the same pollution and the same potential air scrubbers. But suppose that, instead of polluting a laundromat, the factory is polluting homeowners whose health is harmed by the smog caused by the pollution.79 (To make the example as stark as possible, assume that the pollution makes people feel ill but does not harm their productivity as workers.) Consider the efficient liability rule here.80 Once again, start with a rich person. Rich people tend to be willing to pay a relatively large amount for amenities like clean air that produce good health.81 Suppose that a rich person is willing to pay \$10,000 for clean air. Because the costs and benefits are the same as the two cases (rich and poor) involving the laundromat, the same efficient legal rule results. The \$10,000 in costs from the pollution exceeds the $5,000 in benefits from the pollution, so liability is imposed on the polluter. In the shadow of this liability, the factory will install the scrubbers, and the homeowner will have the right to clean air. See Column (1) in Table 2 describing this scenario.

|

Plaintiff income |

(1) Rich |

(2) Poor |

|---|---|---|

|

Plaintiff WTP to avoid pollution |

$10,000 |

$2,500 |

|

Factory WTP to |

$5,000 |

$5,000 |

|

Receives legal |

Plaintiff |

Defendant |

|

Outcome |

Factory faces |

Homeowner |

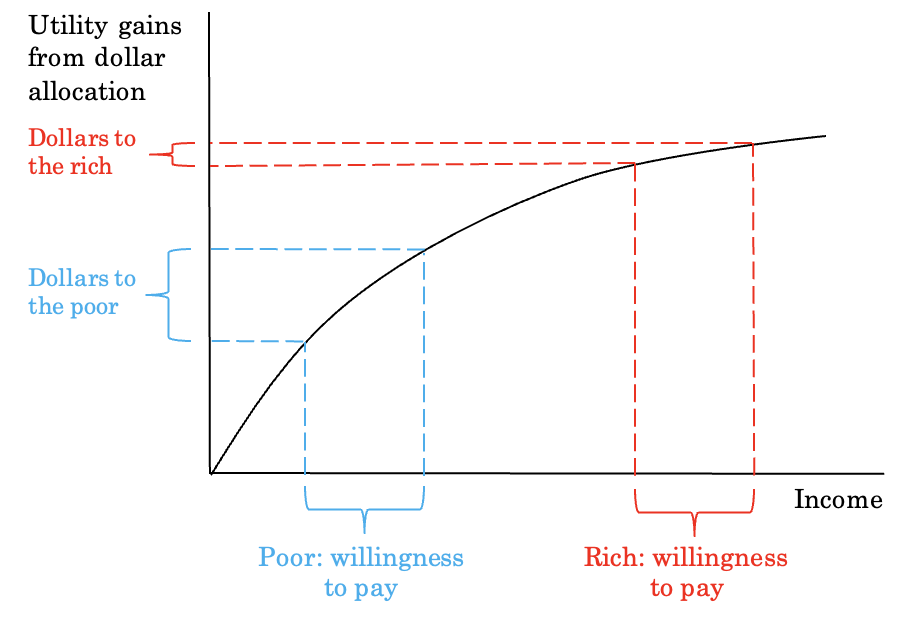

Contrast a rich homeowner with a poor homeowner, again with everything the same except for the income of the homeowner. Poor homeowners tend to be willing to pay less for amenities like clean air. Poor homeowners have limited funds; they have little that they are willing to spend on clean air because they have more pressing things to spend money on—things that the rich themselves have already purchased. Suppose, for example, that the poor homeowner would be willing to pay \$2,500 for the clean air. Then the efficient legal rule reverses: it is not efficient to impose liability on the factory because the \$2,500 cost of the pollution is less than the \$5,000 benefit of the factory not installing the air scrubbers. As a result, the poor homeowner is polluted on without compensation. See Column (2) in Table 2 describing this scenario.

In other words, the rich homeowner but not the poor homeowner has the right to clean air—even though the rich homeowner pays nothing for the right. The liability rule in this context is rich-biased because it is systematically more likely to allocate clean air to the rich than to the poor. This is because the rich are more likely to have a willingness to pay for clean air in excess of the \$5,000 cost of installing scrubbers. Homeowners do not pay for the policy, but rich homeowners get the clean air, and poor ones do not. Neutral rules, on the other hand, exhibit no such bias; some may benefit poorer people (for example, when the laundromat owner was poor), and some may benefit richer people (for example, when the laundromat owner was rich), but there’s not a systematic bias across legal rules because income does not matter for legal entitlement allocation.

Consider again the economic pie, the size of which the rich-biased policy is maximizing. For rich-biased policies, unlike neutral policies, money does not constitute the economic pie. We know this because, for the cases of both the rich and poor homeowners, the cost of the scrubbers for the factory—the only money involved in the example because the valuation of good health does not affect anything financial—is the same: \$5,000. Yet the efficient outcomes are different: the rich get the clean air, and the poor do not.

It is also not utility that is in the economic pie. It is plausible to think that the rich and the poor have the same utility from clean air. On that assumption, if it is utility-maximizing for the rich to have clean air, then it is also utility-maximizing for the poor to have clean air. (Part III.F illustrates this argument with an example.) Yet the poor do not get clean air in the example, meaning that this efficient arrangement is not necessarily utility-maximizing.

Rather, the economic pie for rich-biased efficient polices, as for all efficient policies, is made up of fictitious willingness to pay units. Let’s call them “WTPs.” For rich-biased policies, basing policy on maximizing the sum of WTPs disadvantages the poor, because the poor can generally afford to pay less for things. Effectively, the preferences of the poor count less than the preferences of the rich for making the WTP pie bigger because the rich are willing to pay more. That disparity is why, even if the rich and the poor have the same dislike of air pollution, when maximizing the size of the economic pie, the rich receive a legal entitlement to clean air while the poor do not.

This bias would matter little if rich-biased policies were rare. But policies that would be rich-biased if they are efficient are ubiquitous among the things that governments provide because the rich tend to be willing to pay more than the poor for goods. Indeed, as Appendix Section D shows, rich-biased goods are equivalent to what economists call “normal” goods, in which demand increases with income. Here are some examples:

- Siting polluting facilities: The main examples in this Section concern tort law and the decision of polluters to install pollution control equipment. State and local governments also have direct approval authority over siting polluting facilities, with similar consequences for pollution in rich versus poor areas: siting more factories in poor areas than in rich ones would be efficient because the poor (in many cases) have a lower willingness to pay to avoid pollution.82

- Public spending on pharmaceutical research: Rich people’s greater willingness to pay for their health makes it efficient to fund more research on diseases that afflict the rich than those that afflict the poor—both within countries and, even more starkly, between countries.83

- Road safety: The rich are likely willing to pay more for safe roads, suggesting efficient torts and spending policies that impose greater penalties when the well-off are harmed and greater public spending in rich areas to avoid such outcomes.84

- Spending on law enforcement and voting: Local governments choosing which neighborhoods receive more money for law enforcement or infrastructure (for example, personnel or machines) to make voting quicker face an inherent bias: rich people are willing to spend more for a marginal decrease in crime or to spend less time voting.85

- Infrastructure like parks or transportation: Legislatures decide whether to build public infrastructure and may choose to do so in richer neighborhoods that have a higher willingness to pay. Take the example of parks in a rich versus a poor neighborhood. The efficient policy is likely to build more parks in rich neighborhoods than in poor ones.86 And legislatures also decide between funding bus mass transit (often used by lower-income individuals, who have a lower willingness to pay) and airports (used on average by higher-income individuals):87 efficient policies will systematically spend more on what rich people want than what poor people want even if a given amount of spending would increase well-being for the rich and the poor by the same amount.

This list could go on. Anecdotally, there is some evidence that, in at least some of these cases, in practice the rich do benefit relative to the poor, who may, for example, be subject to more pollution (at least globally),88 less public pharmaceutical research spending that benefits them,89 more dangerous roads,90 less spending on law enforcement,91 longer waits to vote,92 worse parks,93 and worse transportation infrastructure.94 The point here is not that there actually are disproportionate legal entitlements going to the rich and the poor—much less that efficiency analysis has anything to do with that allocation. Indeed, if more polluting facilities are sited in low-income minority neighborhoods, that could be because of market forces like lower costs of acquiring land, the lack of political power of low-income minority communities, racism, a focus on efficiency-minded thinking, or other factors. It is often impossible to know. The point is that efficiency would justify such allocations—and that such differences in allocation would be large. For example, a recent analysis conducted for the Environmental Protection Agency suggests willingness to pay to avoid mortality roughly doubles as income doubles.95 Thus, it would be efficient to spend about twice as much to save the life of someone earning \$120,000 as someone earning \$60,000.

C. Poor-Biased Policies

It is not the case that willingness to pay always increases or stays even with income. Rather, some things become more valuable (in WTP terms) as income goes down, and thus poorer people get a larger legal entitlement than rich people under the efficient policy. As Appendix Section D shows, poor-biased goods are equivalent to what economists term “inferior” goods, for which demand increases as income decreases.96 For poor-biased polices, efficiency analysis is also biased but toward poor individuals. An example of a poor-biased policy could be spending on bus-based public transit. Consider a state transportation authority deciding whether to spend more money on buses in a poor city or a rich city of equal populations, each of which currently receives the same amount of state spending on buses. The transportation authority conducts its analysis to determine which city is willing to pay more for the increased spending. It may be that the poor city actually has the greater willingness to pay for the spending on buses because rich people—though they are willing to pay more for most things—are not willing to pay more for buses for the simple reason that they wouldn’t use the buses. They already own their own cars and prefer to use those, while poor people often do not own cars and thus would greatly value the increased availability of buses.97

Poor-biased policies are rare for an intuitive reason: rich people have more money to spend! And for those things on which the rich spend more money, they must be willing to pay more than the poor—or else the rich would not in fact be spending more than the poor. Empirical research on willingness to pay backs up this intuitive explanation.98 Indeed, it is difficult to think of many other plausible examples of poor-biased policies. Another example might be efficient spending by a legislature on building public swimming pools across communities. Spending more in lower-income communities might be efficient if the wealthy would be reluctant to use the pools, perhaps because the well-off can opt to build their own pools at their homes or in their subdivisions.

Even with these examples, the poor-biased policies are subcategories of larger categories of rich-biased policies. Buses are a subcategory of transportation infrastructure, and pools are a subcategory of public amenities infrastructure. That is not a coincidence. In any broad category of efficiency-oriented policy, like transportation infrastructure or public amenities, the rich are likely willing to pay more by virtue of their greater income. For example, the rich may not use buses, but they use roads, bridges, and airports—and are willing to pay quite a lot to commute to and from their well-paying jobs and to travel on vacations. The poor may be willing to spend more on buses but not on infrastructure overall. This result makes sense: the rich have more money to spend. Across all categories of goods, they must be willing to pay more—or else the rich would spend less than the poor. But the narrower the subcategory of overall consumption, the more likely that there will be something that the poor are actually willing to spend more on. When aggregated, however, there likely are few categories for which that is true.

D. Summary

Table 3 summarizes the examples of neutral, rich-biased, and poor-biased rules. The first column has the neutral case, in which the legal entitlement is clean air. The laundromat plaintiff cares about the clean air because the clean air affects the laundromat’s profits. Because everyone values a dollar of profits at a dollar, wealthier laundromat owners have the same willingness to pay for the clean air as the poorer laundromat owners. As a result, the rich do not get more of a legal entitlement. These policies are fairly common—whenever legal rules are determined by profits.

|

|

Neutral |

Rich-Biased |

Poor-Biased |

|---|---|---|---|

|

Legal |

Clean air |

Clean air |

Bus Service |

|

Why care |

Profits |

Health |

Transportation |

|

↑ income -> WTP? |

Same |

↑ |

↓ |

|

Rich get more legal |

No |

Yes |

Poor get more |

|

Frequency |

Common |

Very common |

Uncommon |

The second column has the rich-biased legal rule example of homeowners being polluted on by the same factory. It involves the same legal entitlement, clean air, as the neutral rule. But the reason that the plaintiffs care is different; in this case, the plaintiffs care because of their health. Because richer people tend to be willing to pay more to protect their health, more income means a higher willingness to pay. As a result, richer people are more likely to receive the legal entitlement, and poorer people are more likely to face pollution without compensation. Rich-biased policies are ubiquitous because the rich tend to be willing to pay more for most things.

The third column has an example of a poor-biased rule. Here the legal entitlement is bus service. People care about it because it provides them transportation. It is plausible that more income actually decreases willingness to pay for bus service because wealthier people already have alternative means of transportation like cars. As a result, the poor would get more of this legal entitlement of transportation spending on bus service. But policies like this are rare because the rich are typically willing to spend more than the poor.

E. The Predominance of Rich Bias and the “Rich Get Richer” Principle

Two points arise out of this summary. First, whether an efficient policy is biased is not as simple as it might seem from Dworkin’s rich-biased example of valuing a book.99 Efficient policies are not always rich-biased; rather, they can also be neutral and even poor-biased. Because the type of bias a policy exhibits may affect how one normatively views the policy (as Part V discusses), this division is important. Second, the basis of efficiency in willingness to pay means that there are likely far more rich-biased efficient policies than poor-biased efficient policies, resulting in a tendency for efficient policy to favor the rich. And this generalization—that a “rich get richer” principle underlies efficient policymaking—is key for understanding the effect of efficient policymaking in the absence of offsetting taxes and transfers.

Some hedging is necessary here because the overall distributional impacts of efficient policies (supposing that, for nontax policies, governments adopt only efficient ones) depends on the areas in which governments adopt policies. Suppose, for example, that the sole purpose of government (legislative, judicial, and administrative) is to provide bus service. Then policies overall would be poor-biased. Or suppose that policies affected profits only between businesses: then policies would be neutral.

But these hypotheticals do not reflect reality. Government policies affect myriad things. Imagine a scale with poor-biased policies on one side and rich-biased policies on the other. Neutral policies sit at the fulcrum. There may be more or fewer neutral policies—and more neutral policies will tend to create an overall more neutral distribution of efficiently-distributed legal entitlements. But adding more neutral policies to the fulcrum does not change the direction that the scale tilts. The category of neutral policies may be large or small; that’s an important area for future research, and it matters for the extent of overall bias. But for the direction of overall bias, what matters is the share of rich-biased versus poor-biased policies. And there is little doubt that governments affect the distribution of legal entitlements of far more rich-biased than poor-biased things. As noted earlier, rich-biased efficient policies are ubiquitous, while it is difficult to even come up with many examples of poor-biased policies. That is why economists call such rich-biased goods for which demand increases as people’s income increases “normal” goods. So, on the scale of efficient policies, the rich-biased policies likely far outweigh the poor-biased policies so that the overall distribution is rich-biased. Because the rich can benefit from these policies for free—without paying for them—efficient policy exacerbates inequality. Efficiency thus reinforces the existing wealth distribution: the rich get more just because they are rich.

F. Utility and Legal Entitlement Neutrality

Although legal entitlement neutrality is a phenomenon based on the empirically measurable (at least in principle) willingness to pay and need not make any reference to utility functions, some may find their intuition aided by explanation in utility terms. Those who either do not believe in, or are not very familiar with, the declining marginal utility of consumption may wish to skip this Section, as it is not necessary for the argument. In particular, the Article’s results do not hinge on utility in two ways: First, one need make no reference to utility functions to show the predominance of rich bias. That predominance depends only on higher willingness to pay by the rich. Second, one need not care about utility to care about the greater allocation to the rich. That said, one can understand the predominance of rich bias in utility terms, and many who care about utility may be quite concerned about rich bias.

This Article shows a new result in the Appendix, which is that whether a good is rich-biased, neutral, or poor-biased depends on a simple formula comparing two features of the utility function:

A good is rich-biased if and only if the marginal utility of consumption decreases with income more rapidly than the marginal utility of the good decreases with income.100

The intuition for this result is as follows: K-H efficiency is measured in dollars. Thus, as a person’s income increases, her willingness to pay for a good is measured by how much she would rather have another unit of that good versus another dollar of consumption. This comparison is precisely what determines whether a good is rich-biased.

This formula makes clear that efficient policies are tilted in favor of rich-biased policies. The rich get a higher utility from some policies, and poor people get a higher utility from other policies. If the question were who gets a higher utility, then policies might be roughly split between those that are rich-biased and poor-biased. But that is not the question. Instead, for a policy to be poor-biased, the extent to which the poor gain more utility than the rich must surpass a big hurdle: the rate at which the utility from the policy goes down with increased income must be even faster than the rate at which utility from income itself goes down with increased income.

To get a sense of the scope for rich bias, consider a simple numerical example. In particular, suppose that a policymaker is deciding where to shut down some polluting factories. As might happen in this situation, there is no practical way to compensate those who are harmed by pollution with the tax-and-transfer system. Suppose that there are two communities of equal population that are identical, except that those in Richtown each have \$9 of income and those in Poortown have only \$1 of income.101 Suppose further that each has the utility function u=log(x)+log(c), where c is the amount that individuals consume and x is how clean the environment is. This utility function (with a declining marginal utility of consumption) is a standard assumption in the economics public finance literature and receives support from hedonic surveys of income and happiness.102 Suppose that the policymaker has ten units of “cleanliness” (the opposite of pollution) to allocate because of a new technological development. The status quo policy is that Richtown and Poortown have one unit of cleanliness. (Initially, the environment is very polluted.) This setup is rich-biased because the clean air is equally valuable to rich and poor people and there is a declining marginal utility of consumption.

Consider allocations to achieve four different goals. First, the K-H efficient allocation is zero units of cleanliness for the poor and all ten units of cleanliness for the rich. Consumption has a declining marginal utility. And because the residents of Richtown do not value the marginal unit of consumption very much because they are already consuming so much, they are willing and able to buy all of the clean air. So all the clean air is allocated to the rich—without their having to pay anything for it.

Second, the allocation maximizing total utility, with no trading in cleanliness, is to split the cleanliness evenly between the two communities. This is because the rich and the poor each have the same utility function and the same initial levels of pollution, so pollution has the same effect on the utility of both types of individuals. An additional unit of cleanliness to individuals already subject to the same level of pollution affects all of the individuals the same.

Third, consider the allocation maximizing total utility if cleanliness rights can be traded in a Coasean fashion.103 Now, those units of cleanliness are convertible into money, and the marginal utility of income starts to matter. With this utility function and income levels, the marginal utility of income is nine times as high for the residents of Poortown as for Richtown.104 As a result, allocating 9.8 units of cleanliness to the poor and 0.2 to the rich maximizes total utility so that the poor people can trade cleanliness with the rich and thereby increase their consumption.105

Fourth, consider an even allocation of cleanliness with trading. By fiat, each person receives five units of cleanliness. Again, because the poor have so little consumption, they trade some of their cleanliness to the rich and thereby increase their consumption and utility.106

| Allocation of Cleanliness | Total Utility | Veil of Ignorance: % WTP to Avoid Efficient Allocation | ||

|---|---|---|---|---|

| Poor | Rich | |||

| Efficient allocation | 0 | 10 | 2.00 | 0% |

| SWF-maximizing allocation (no trading)107 | 5 | 5 | 2.51 | 45% |

| SWF-maximizing allocation (with trading) | 9.8 | 0.2 | 2.95 | 67% |

| Even allocation (with trading) | 5 | 5 | 2.80 | 61% |

Table 4 lists the sum of utilities under the four allocations. It shows how perverse the efficient policy can be if the goal is utilitarian and there are no tax-and-transfer offsets. While utility can be difficult to interpret, there are large differences in total utility among the options. The efficient allocation has the lowest utility at 2.00 because both consumption and cleanliness are highly unequal, and the individuals have a declining marginal utility from both—meaning that (holding total cleanliness and consumption fixed) moving either consumption or cleanliness to the less well-off party increases utility. Utility increases to 2.51 with the utility-maximizing outcome without trading because at least the distribution of cleanliness becomes equal. And it increases further to 2.91 with the utility-maximizing solution with trading because both cleanliness and consumption are equally distributed. Under the even allocation with trading—something not explicitly redistributionist—the total utility (2.80) is also substantially higher than under the efficient allocation because at least the high-marginal-utility party receives an equal share of the cleanliness.

The rightmost column gives an easier to interpret meaning to these differences in utility. Suppose instead that each person is behind a veil of ignorance and ask how much of their consumption they would be willing to pay to receive a given allocation instead of the efficient one.108 The differences are huge; an efficient allocation is not a good approximation of the utility-maximizing allocation. The individuals behind the veil of ignorance would be willing to pay 45 percent of their income to be certain to have an equal share of cleanliness regardless of their income, 67 percent of their income for equality in income and cleanliness as a result of a disproportionate endowment to the poor party, and 61 percent for an even allocation with trading allowed.

The example illustrates a key point: policies distribute entitlements (like the right to reduce pollution) that have value.109 If taxes and transfers do not respond to the adoption of an efficient nontax policy, then the efficient nontax policy may not be neutral. The efficient allocation misses an opportunity to use legal entitlements to address existing disparities, as we see in the case of tradability. But more importantly, when this good is allocated, not only is the declining marginal utility of income ignored, but also the fact that the wealthy tend to have a higher willingness to pay for the good will lead systematically to more allocation of the good to the well-off. It actually exacerbates existing inequalities and leads to lower total utility than a “neutral” distribution (like the even split of cleanliness, especially with tradability). So for this policy, government cost-benefit analyses that follow the efficiency criterion, and that are not offset by changes through taxes, will systematically choose policies that increase the utility of the rich more than the utility of the poor.

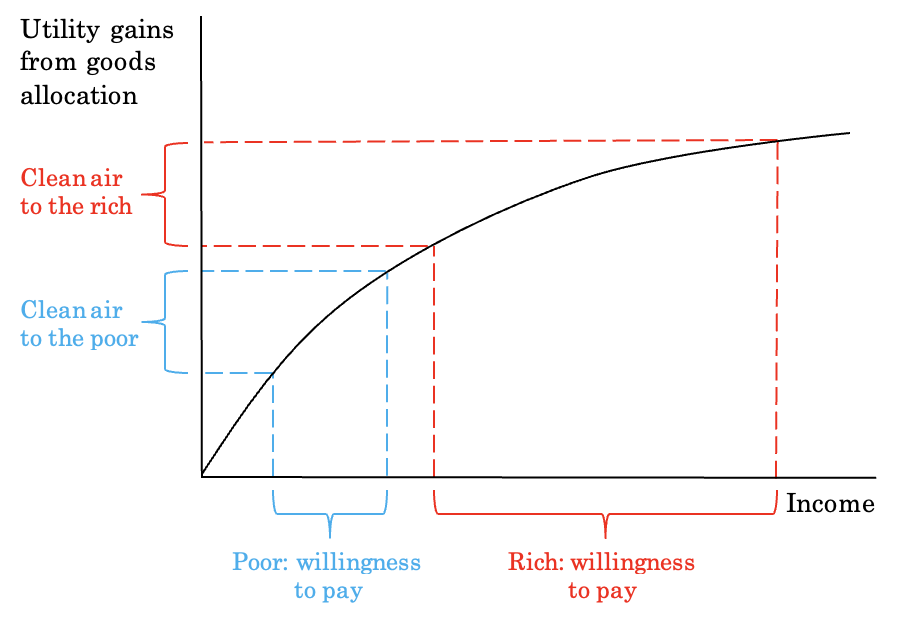

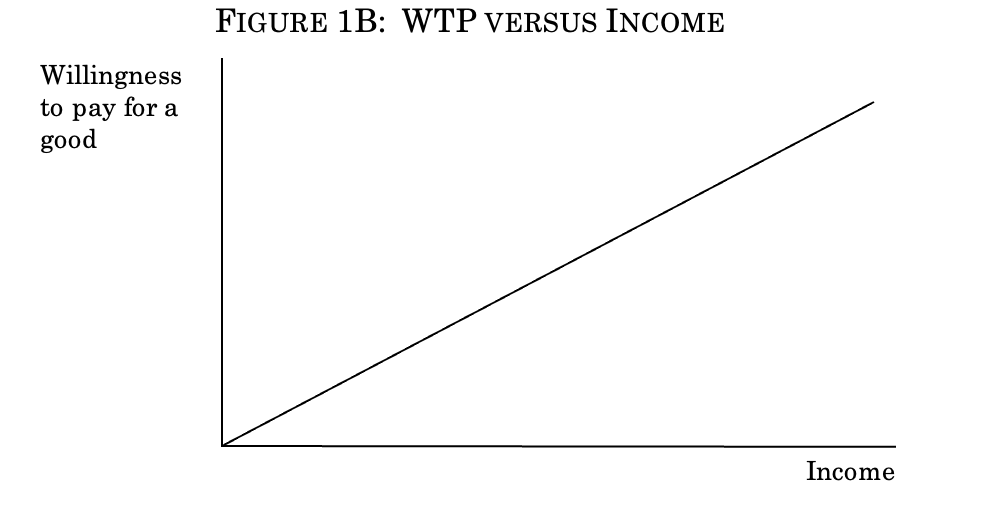

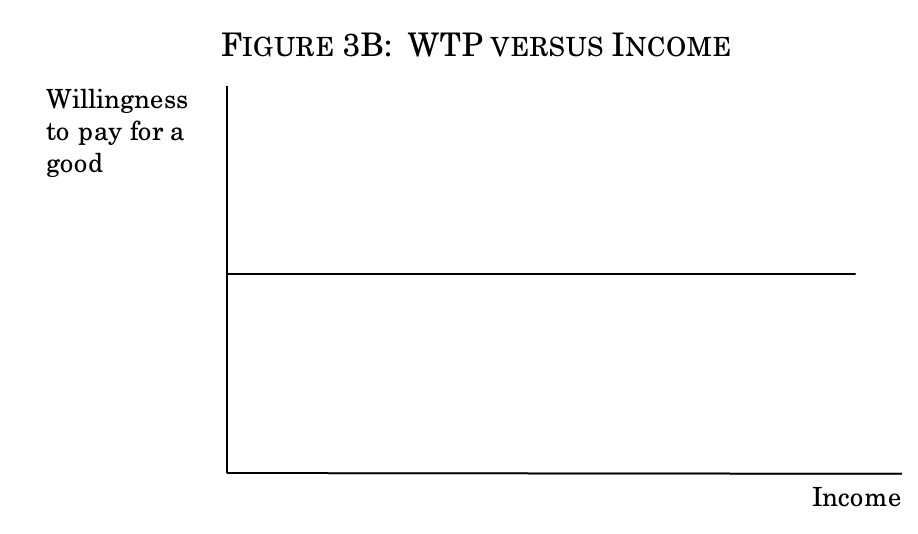

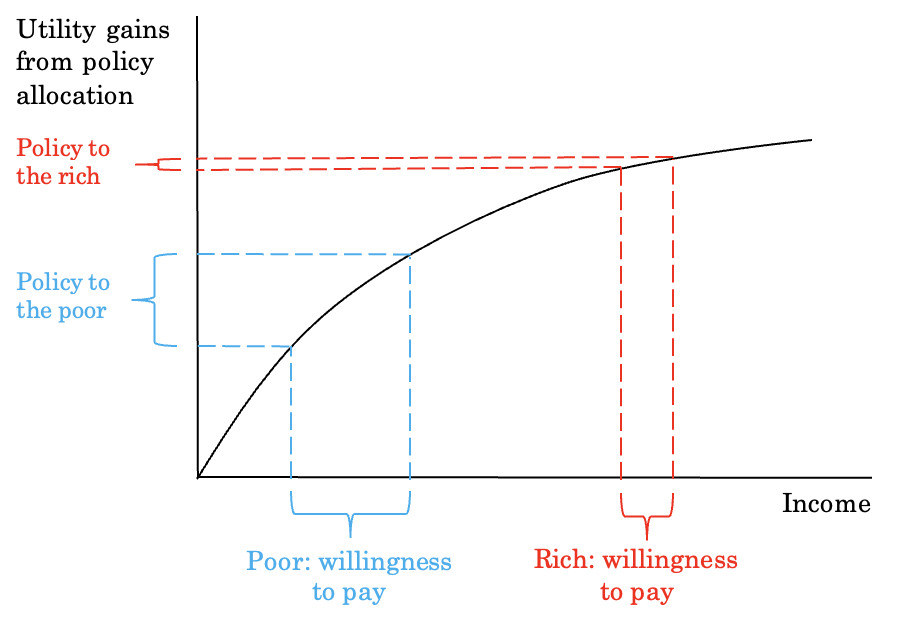

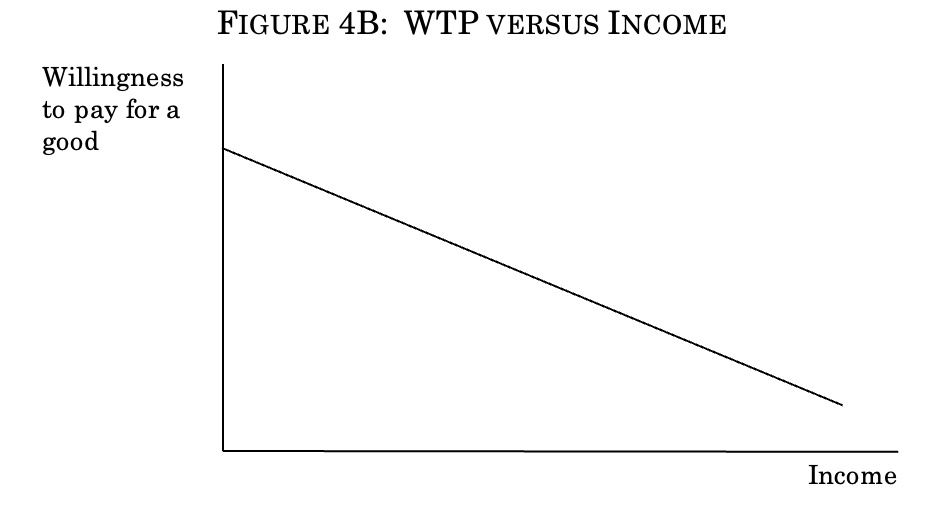

Figure 1 provides a graphical representation that helps explain what drives these results. Figure 1A shows the relationship between an individual’s utility and income—a curve that flattens out as one’s income increases. This pollution example involves two types of individuals with different levels of income, each of whom receives the same utility gains from an improvement in environmental quality. But even if the two types of people have the same utility gains, quite different amounts in dollars are needed to achieve these same utility gains. The y-axis shows equal utility gains for the rich and the poor groups. With connecting dashed lines, the figure then shows on the x-axis the dollar gains that would achieve those utility gains for each group. Because of the declining marginal utility of income (represented by the curved line), the amount of income it would take the rich to achieve the same utility gain is much larger. Dollars are “cheap” to the rich because they already have so many of them; thus, the rich need to receive a lot of dollars for a given utility gain. And this is precisely what drives the results in the example: the rich have a higher willingness to pay in dollar terms for the pollution reduction because dollars are cheap to them. As a result, efficiency analysis allocates the pollution reduction to the rich because, as Figure 1B shows, the willingness to pay for an allocation of goods goes up with income. The Appendix produces parallel figures for the neutral and poor-biased cases.

Figure 1: Relationships for Rich-Biased Policy

Figure 1A: Utility versus Income

Figure 1B: WTP versus Income

Again, nothing in this Article hinges on anything about utility functions. All we need to know is that empirically the rich tend to be willing to spend more than the poor on goods, which is why they in fact spend more. It is intuitive why they spend more: they have more money to spend. It could also be the case that they have different preferences or are able to borrow more easily or for a host of other differences. But what matters for efficiency analysis is the empirical difference in willingness to pay. Nevertheless, understanding the phenomenon in utility terms may ease interpretation of the prevalence and severity of the “rich get richer” principle.

IV. Examples of Efficient Rich-Biased Policies in Practice

To be influential, efficiency analysis need not explicitly be the decision-making rule that leads to a given policy outcome. Nevertheless, to help further concretize the ideas in this Article, this Part sketches a couple of the circumstances in which efficiency analysis is used explicitly in the law—particularly in rich-biased contexts because the business contexts in which neutral rules predominate are relatively straightforward. This Part first turns to federal regulatory cost-benefit analysis. It then describes how torts use efficiency analysis.

A. Federal Regulatory Cost-Benefit Analysis

Arguably the most prominent use of efficiency analysis by government actors is that by federal government administrative agencies, as required by executive orders originally dating to the 1980s and maintained by all presidents since then.110 According to federal guidance documents, federal regulatory analysis uses “benefit-cost analysis [to] provide[ ] decision makers with a clear indication of the most efficient alternative, that is, the alternative that generates the largest net benefits to society.”111 The potential for perverse distributive impacts is most stark when the analysis directly treats rich and poor people differently.112 For example, if the torts example used in Part III involving pollution affecting health outcomes were a federal regulatory proceeding, then the same distributional consequences would arise: a greater likelihood of pollution (without compensation) in poor neighborhoods than in rich ones. Sometimes, agencies use population averages of willingness to pay instead of disaggregating willingness to pay by the population affected so that rich and poor people are treated similarly.113 But sometimes they use different willingness to pay values for different income groups.114 And furthermore, Office of Management and Budget guidance suggests that agencies should use different values for different groups—for example, implementing different policies in different geographies due to differential benefits, presumably including some differential willingness to pay based on income.115 Moreover, at least one past top administrator of federal regulations (and prominent law professor), Cass Sunstein, has explicitly argued for using differential amounts of willingness to pay by income.116 This Section describes how transportation funding by federal agencies creates rich-biased rules.

In particular, the procedure for allocating Department of Transportation (DOT) funds affects how much it spends on modes of transportation that tend to be used by rich versus poor people. For calculating the benefits of transportation improvements, a key ingredient is the value of time saved in transportation as a result of the improvement. The DOT publishes a yearly memorandum on the Value of Time Travel Savings (VTTS) that adopts a higher VTTS for air and high-speed rail travel than for other surface modes of transportation for intercity travel, explicitly because the users of air and high-speed rail are richer than those of other surface modes of transportation.117 The memo explains that, “Since these modes charge higher fares to travelers who place a greater value on time saving, it is reasonable to derive a distinct VTTS from the higher incomes of their passengers.”118 DOT guidance adds that “[t]he value of travel time is a critical factor in evaluating the benefits of transportation infrastructure investment and rulemaking initiatives,” including competitive grant programs for infrastructure investment.119

This guidance affects the allocation of funds between transportation that rich people versus poor people tend to use. For example, every application for one of those competitive grant programs, the Transportation Investment Generating Economic Recovery (TIGER) program, must include a cost-benefit analysis.120 DOT guidance on preparing these applications instructs applicants to use the DOT’s VTTS.121 Thus, in funding TIGER grants,122 DOT relies on a higher VTTS number for airport projects (which are more likely to be used by the rich) than for bus projects (which are more likely to be used by the poor).123

As a result, because the monetary benefits of saving an hour of time for a rich person tend to be higher than the monetary benefits of saving an hour of time for a poor person, spending on transportation will be rich-biased, resulting in a bias in favor of more spending for the rich than for the poor for a given reduction in travel time.124 Thus, federal transportation spending has a built-in procedure that will tend to transfer more of a legal entitlement (transportation spending) to the rich, helping shorten their commutes, disproportionately easing their leisure travel, and disproportionately making them more productive.125

B. Torts

The primary example earlier in this Article concerned a tort against a polluter; it described the efficient duty of care required to establish the negligence standard, the threshold that, if exceeded, leads the polluter to pay damages.126 The Hand formula, which drove the determination of the negligence standard, is reflected in tort law. Indeed, the recent Restatement (Third) of Torts moved in the direction of focusing on the type of efficiency-oriented cost-benefit analysis described here,127 attracting some criticism for ignoring equity.128 The Restatement explicitly says that its “test can also be called a ‘cost-benefit test,’ in which ‘cost’ signifies the cost of precautions and the ‘benefit’ is the reduction in risk those precautions would achieve.”129 In estimating those costs and benefits, scholars see the Restatement as using the kind of efficiency analysis described in this Article.130 Of course, typically juries decide whether a duty of care has been met—and the extent to which juries are given instructions conforming with the Restatement is unclear (some suspect that it is infrequent131 ), but the efficiency-oriented Hand formula, with the distributional consequences described earlier, is clearly used at least sometimes.132

Efficiency analysis is apparent in other aspects of torts as well, particularly economic damages. In particular, workers are typically eligible for compensation for lost wages resulting from tortious behavior.133 Higher-income workers have higher wages and, thus, de facto have a larger legal entitlement. For example, consider a dangerous driver driving in a rich neighborhood versus a poor neighborhood. Drivers responding to incentives would expect to pay more if they cause an injury in the rich neighborhood than in the poor neighborhood. They may thus drive more dangerously in the poor neighborhood, increasing the likelihood of an accident there, thereby reducing the legal entitlement of poor groups to safe traffic conditions.134 But this is efficient: the rich are willing to pay more for not being injured than the poor are.

The purpose of this Article is not to lay out the broad spectrum of policy when efficient rules are adopted in ways that could lead to rich-biased rules. That is an important project, but one for another day. The purpose of this Part is merely to illustrate the concept with real-world examples—and to begin alluding to when efficient rules may be viewed as problematic, the issue that the next Part takes up.

V. Policy Implications

This Article is primarily descriptive, showing how different types of policies have different distributional implications. Nevertheless, this Part sketches potential policy implications of debiasing efficiency analysis, providing guidance on when and why to consider distributive consequences in economic policymaking and when to consider not adopting efficient policies if one has a goal of not redistributing toward the rich.

This Part takes “fairness” as a normative goal of institutions like courts and administrative agencies—in particular, not systematically distributing more legal entitlements to the rich or to the poor without compensating transfers. One could view this goal as a key attribute of the legitimacy of these institutions,135 as a requirement of Rawlsian fairness,136 as a libertarian goal of the government not picking and choosing policy winners, 137 or as a component of “folk justice.”138 Alternatively, one could view this kind of fairness as an instrumental feature of welfare; for example, as Part III.F shows, if both the rich and the poor suffer more in welfare terms as pollution increases, then it is welfare-enhancing to spread out the pollution between the rich and the poor rather than focus the pollution on the poor.139 However, because of the broad normative disagreement about the role of social welfare and redistribution in different ethical theories, this Article focuses on fairness, so defined. For example, some believe that, if welfare is the goal, federal agencies should redistribute toward the poor.140 On the other hand, while many may not want courts or administrative agencies distributing more legal entitlements to the rich than the poor because of efficiency analysis, they also may not want them redistributing to the poor either.

As a result, this Article adopts a fairly minimalist standard of fairness between the rich and poor in distributing legal entitlements while still taking advantage of opportunities that make all groups better off. To those unconcerned about the government distributing more legal entitlements to the rich than to the poor without the rich paying for them, the Article’s descriptive contribution stands even without these normative implications. But these implications are essential to those who hold any of the broad range of normative commitments suggesting that systematically distributing more to the rich is problematic.