A Simplified "Benefit" Prong for Secured-Creditor Surcharges

Who pays the debtor’s expenses that are incurred during the bankruptcy is a common debate. One potential option, especially in small to midsize corporate bankruptcies, is a secured creditor who can be surcharged in accordance with 11 USC § 506(c). Of that section’s three requirements, most litigation concerns the requirement that the expense “benefit” the secured creditor. A split has recently developed between courts, led by the Seventh Circuit in Trim-X, that require the bankruptcy trustee to exclusively intend to benefit the secured creditor and obtain secured-creditor consent and courts, such as the Fifth Circuit in Domistyle, that merely require that the secured creditor receive a benefit. This Comment suggests a new approach that permits surcharges when there is a connection between the expense incurred and the secured creditor’s collateral. This collateral-expense-connection approach is the best reading of the text of § 506(c) and the pre-Code case law that the statute codifies.

Introduction

There is no such thing as a free bankruptcy. Someone must foot the bill for all expenses incurred while a company goes through bankruptcy proceedings, from keeping the lights on to paying the attorneys. Who picks up that check persistently generates litigation. Parties going through bankruptcy often seek to force a secured creditor—one who has a right to property currently possessed by the debtor as collateral securing the creditor’s debt—to compensate for these costs. This arrangement, known as surcharging, is expressly permitted under § 506(c) of the Bankruptcy Code1 (the “Code”). But the specific criteria for a secured-creditor surcharge are subject to debate among the federal courts.

Recently, a circuit split developed over whether a surcharge is allowed when the bankruptcy trustee—the person appointed by the court to manage a debtor—incurs an expense intended to benefit not only the secured creditor, but other creditors as well.2 The difference in the two sides’ rationales highlights two different frameworks under which courts analyze all secured-creditor surcharge claims. The older view, called the forward-looking approach, focuses on secured-creditor consent to be surcharged. The forward-looking approach developed as a result of the Seventh Circuit’s opinion in In re Trim-X, Inc.3 In contrast, the more recent approach developed by the Fifth Circuit in In re Domistyle, Inc4 (the backward-looking approach)5 trains its attention on the connection between the collateral—property in which the secured creditor has a claim—and the expense. According to the Fifth Circuit, money spent directly on the collateral can be surcharged, while general expenses, such as attorney’s fees, cannot.6

The facts of Domistyle illustrate the salience of the split. Domistyle, a manufacturer and purveyor of home goods, owed Southwest Securities $3.69 million.7 In exchange, the bank perfected a security interest in Domistyle’s candle factory, which gave it a registered legal right to foreclose on the factory, thereby protecting itself from a complete loss of repayment in case of default.8 In addition, Domistyle owed money to several creditors that held no security interests. Domistyle could not pay these debts, so it filed for bankruptcy and made a plan to sell all its assets.9 The court appointed Milo Segner to be the bankruptcy trustee.10 Because Southwest Securities held a security interest in the factory, it stood to receive either the full value of the factory or $3.69 million, whichever was less.11 If the factory could be sold for more than $3.69 million, then the unsecured creditors would split whatever extra value remained.12

Shortly before Domistyle filed for bankruptcy, the factory was appraised at about $6 million, so Segner understandably believed it could be sold for much more than $3.69 million.13 Segner paid for security, repairs, utilities, and insurance premiums related to the factory.14 Southwest Securities never agreed to these expenses, but it did not try to stop them, either.15 At a cost of about $400,000, those expenses allowed Segner to keep the factory in approximately the same condition for the next year.16 Yet he was unable to find an acceptable purchaser.17 But suppose a wealthy neighbor eventually bought the property for just $3.4 million.18 Because there was no excess value for unsecured creditors, which might have been used to cover the upkeep costs, can Segner surcharge Southwest Securities the $400,000 he incurred? The Fifth Circuit’s backward-looking approach allowed a surcharge because Segner spent the money directly on the property that Southwest Securities’ security interest covered and Southwest Securities eventually received a benefit. But the Seventh Circuit’s forward-looking approach would have blocked a surcharge because Southwest Securities did not consent to the expense.

This difference is important and has implications beyond the courtroom. A surcharge is conceivable in every bankruptcy because the trustee invariably spends some funds on secured property, typically on expenses like appraisal fees or electricity bills. In the largest bankruptcies, secured creditors are so concerned about potential surcharges that they often negotiate with the debtor to exchange cash for a waiver of the surcharges before the bankruptcy begins. In such cases, the secured creditors and the debtor ask the bankruptcy judge to approve their agreement on the very day the bankruptcy is filed.19 Until the agreement is final, the debtor will not file. Under these agreements, the secured creditors provide the debtor with the cash essential to continued operation during the bankruptcy. The debtor, in exchange, waives any potential § 506(c) surcharge that may later arise. Such agreements are considered a “practical necessity” if the debtor is going to stay in business during the bankruptcy.20 The terms of these debtor-in-possession (DIP) financing agreements in large bankruptcies are determined, in part, by the viability of a potential surcharge under the particular approach selected by the court. Uncertainty in either the state of the law or its application can torpedo these essential negotiations.

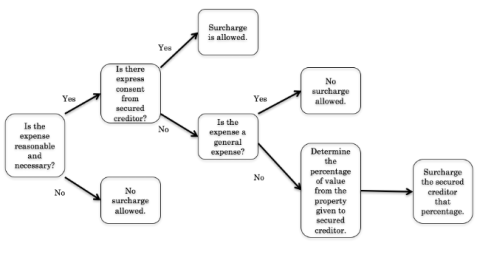

This Comment offers a solution that resolves the split in the law and provides a clear test on which courts and interested parties can rely. Part I reviews the aspects of bankruptcy law necessary to understand why secured-creditor surcharges exist. Part II examines both the split over whether a trustee must intend to exclusively benefit the secured creditor at the time the expense is maintained and the rationale underlying each of the main opinions. In Part III, the Comment offers a solution to the circuit split that roots itself in the connection between the expense incurred and the secured creditor’s collateral. The solution first assumes that the expense is reasonable and necessary, and that the secured creditor did not consent. The court should then look to whether it is a general expense—one that affects the whole estate—or spent directly on collateral. If it is a general expense, no surcharge is allowed. If it is an expense spent on collateral, a surcharge is allowed in an amount based on the percentage of the total recovery that the creditor receives. Then, Part III argues that this approach is the best reading of § 506(c)’s text and the law in effect before the Code’s enactment.

I. Bankruptcy Background

The availability of a secured-creditor surcharge depends on the details of the bankruptcy proceedings. Part I.A explores the role that creditors—both secured and unsecured—and the trustee play in a bankruptcy. Part I.B details the protections available to secured creditors that are unavailable to unsecured creditors. Part I.C then describes the expenses typically generated in a bankruptcy and who pays them.

A. The Parties in a Bankruptcy Proceeding

Different types of bankruptcy cases are filed under different chapters of the Code, depending on the type of entity filing and the goal of the bankruptcy.21 A business organization can file under either Chapter 11, when it hopes to continue operations,22 or Chapter 7, when it liquidates and sells all its assets.23 Occasionally, a Chapter 11 bankruptcy resembles Chapter 7, leading to a plan—called a liquidating trust—under which all the assets are sold.24 A secured-creditor surcharge can be attempted during either a Chapter 7 or a Chapter 11 bankruptcy, so long as it meets the requirements of § 506(c).25

The debtor often continues to control its own operations during a Chapter 11 bankruptcy. When it does so, it is called a debtor in possession.26 But the court must instead appoint a trustee if it finds that the debtor mismanaged the bankruptcy or if the appointment of a trustee is otherwise in the best interest of the estate.27 A trustee is always appointed in Chapter 7 bankruptcies.28 A trustee is an outsider appointed to protect creditors but holds substantially the same rights and responsibilities as the debtor in possession, including the right to surcharge secured creditors.29 Whoever controls the debtor, whether the debtor in possession or a trustee,30 owes a fiduciary duty of loyalty to put the interests of both secured and unsecured creditors ahead of her own interests.31 Yet, despite the fiduciary duty, a trustee’s desire to receive her fee32 creates the incentive, not faced by the debtor in possession, to attempt a surcharge.33 The debtor in possession profits by operating the debtor after the bankruptcy, but the trustee is paid only during the bankruptcy. Because the trustee can be paid only during the bankruptcy, she might use the debtor’s resources to seek an unlikely surcharge that would pay her fees. The debtor in possession, by contrast, would recognize that the surcharge is unlikely to be successful and instead dedicate those resources to turning a profit after the debtor emerges from bankruptcy.

There are two kinds of creditors—secured and unsecured. The secured creditor’s claim is secured by a specific piece of property.34 In order to gain priority in bankruptcy for a secured claim, the creditor must perfect its interest.35 The rules for perfecting secured interests are governed by state law, typically following Article 9 of the Uniform Commercial Code.36 The property is encumbered by the secured creditor’s right to the property, commonly called a lien.37 Outside of bankruptcy, if the loan goes unpaid, the secured creditor can foreclose on and take the collateral property.38 For example, a home mortgage lender is a secured creditor because it provides a homeowner with cash through a mortgage and, if the homeowner does not pay, the lender can foreclose on and resell the house, thereby limiting its loss.

The secured asset cannot be used to distribute value to other creditors until the secured creditor is paid in full.39 If the secured creditor cannot be paid in full because the value of its claim is larger than the value of the collateral, then the secured creditor receives an unsecured claim—also called a deficiency claim—for the remaining amount.40 In this situation, the secured creditor is considered “undersecured.”41 For example, suppose a secured creditor is owed $100,000 and has a perfected security interest in a warehouse. When the warehouse is sold for $60,000, the secured creditor receives the $60,000 as well as an unsecured deficiency claim for the remaining $40,000.42

Unsecured creditors, on the other hand, hold claims over all the assets of the estate, not just one particular asset. An unsecured claim cannot be paid until the secured creditors are paid the full value of the collateral that their claim encumbers and until the administrative expenses of bankruptcy are paid in full.43 Instead of payment in full, unsecured creditors receive a pro rata payment, meaning that each receives the same percentage of its total claim.44

B. Tools of Protection for Secured Creditors

At the moment a debtor files for bankruptcy, an automatic stay of nearly all actions against the debtor takes effect, including any foreclosure actions that secured creditors might file.45 During the bankruptcy, the trustee or debtor in possession can continue to use the property of the estate,46 including, in some cases, property that it merely possesses but does not own.47 The trustee may decline to use property in which the estate has no ownership stake and abandon the property to the creditor whose lien covers that property.48 The secured creditors can protect themselves by bringing a motion for relief from the automatic stay.49 Before the Code’s enactment (the “pre-Code” era), secured creditors could foreclose on a property during bankruptcy50 —at least until a 1973 rule change introduced the comprehensive automatic stay.51

In addition to a motion for relief from the stay, the secured creditor can also ask the court for “adequate protection” under § 363(e).52 Though never defined, the Code gives three examples of adequate protection: (1) a stream of payments, (2) replacement liens, or (3) the “indubitable equivalent”53 —that is, some other source of exactly identical protection. One example of a party seeking adequate protection would be a secured creditor that leased tools to the debtor. Seeking protection, the creditor might ask the court for adequate protection in the form of a bank account with funds set aside to cover any depreciation in the value of the tools during the bankruptcy.54

C. Costs in Bankruptcy and Who Pays Them

Though only the financially troubled enter bankruptcy, they still must pay certain expenses during the proceeding. There are two main types of expenses: (1) general expenses, such as fees for bankruptcy lawyers and the trustee, as well as company-wide overhead, and (2) expenses spent directly on property of the estate, such as appraisal fees, the costs of sale, security guards, maintenance costs, and electricity bills. A trustee incurs both types of costs pursuant to her fiduciary duty because they benefit the creditors. The trustee’s expenditure decision should not be affected by which creditors benefit from the expenses. However, the identity of the beneficiary is relevant for determining whether a secured creditor can be surcharged. Both types of expenses are considered “administrative expenses” that must be paid before a plan to reorganize debts can be confirmed in Chapter 11 or before any money can be paid to unsecured creditors in a Chapter 7 liquidation.55 Often, no cash is available to pay these expenses because the debtor spent most of its cash trying to avoid bankruptcy.56

When no cash is available, a debtor typically has just one conceivable source of cash to pay administrative expenses—the secured creditors, who may be surcharged when § 506(c)’s requirements are met, unless they reach a DIP financing agreement that waives such surcharges. Section 506(c) allows the trustee to recover a surcharge “from property securing an allowed secured claim the reasonable, necessary costs and expenses of preserving, or disposing of, such property to the extent of any benefit to the holder of such claim, including the payment of all ad valorem property taxes with respect to the property.”57 Bankruptcy expenses that cannot be surcharged are paid according to § 507(a)(2) after secured creditors are paid in full.58

The surcharge of secured creditors has generated a large volume of case law.59 The Supreme Court dealt with such surcharges in Hartford Underwriters Insurance Co v Union Planters Bank,60 but its focus was on who can request a surcharge, not when those claims are permissible.61 However, Hartford Underwriters instructs courts to adhere closely to the text of the Code in determining whether a surcharge is permissible.62

Section 506(c) has three requirements for a surcharge: the expense to be surcharged must be (1) reasonable and (2) necessary, and (3) must benefit the secured creditor.63 That an expense is “reasonable” and “necessary” is often uncontested. For example, the secured creditor in In re Delta Towers, Ltd64 conceded, without dispute, that utility charges were both reasonable and necessary.65 The interpretation of “benefit,” on the other hand, has engendered more controversy.

II. Courts Split over “Benefit”

The courts are divided over when an expense “benefits” a secured creditor as required to justify a surcharge. When the collateral sells for more than the secured creditor is owed, a surcharge paid out of the surplus is rarely questioned. But sometimes such a recovery is impossible—even the secured creditor cannot be paid off in full because the property is sold for less than its claim. Cases like these have led to a circuit split over what circumstances justify a surcharge to the secured creditor.

Part II.A examines the forward-looking approach, which denies a surcharge when the trustee intends to benefit other creditors in addition to the secured creditor on the theory that such intent, without consent, decisively determines that there was no benefit. Part II.B explores a recent case adopting the backward-looking approach, which ignores the trustee’s intent at the time the expense was incurred and asks only whether the creditor eventually received a benefit.

A. The Forward-Looking Approach

Beginning with Trim-X, some courts have held that a trustee can surcharge only if she intended to exclusively benefit the secured creditors at the time she incurred the expense. These courts reason that secured-creditor consent is required: the only way to determine that a secured creditor benefits is when it subjectively demonstrates its benefit through consent. When the trustee attempts to benefit other creditors, these courts refuse to find a benefit because a secured creditor would not consent to these expenses. This approach was later termed the forward-looking approach by the Fifth Circuit. This Section first looks at Trim-X itself and then examines the cases that followed in its steps.

1. Trim-X first required secured-creditor consent.

In Trim-X, the Seventh Circuit formulated the forward-looking approach to the “benefit” prong that was later adopted by other courts. That approach held both that the trustee must intend to benefit only the secured creditor and that the secured creditor’s consent was required. In the case, Commercial Credit Business Loan (CCBL) held a perfected security interest that encumbered certain assets possessed by the debtor, Trim-X.66 The trustee employed a security company to protect the assets and also spent money to have them appraised, hoping to sell the property to recover value for unsecured creditors, at least until appraisals determined the property was worth less than CCBL’s secured interest.67 The trustee eventually abandoned the property and attempted to use § 506(c) to obtain a court order requiring CCBL to reimburse him for expenses incurred in preserving the assets up to that point.68 The bankruptcy court awarded the trustee a surcharge—$1,000 for use and occupancy fees, $500 for security, and $350 in utilities69 —and the district court affirmed.70 The Seventh Circuit, on the other hand, questioned whether the expenses benefited CCBL, and determined that any expenses incurred before abandonment were not recoverable.71

The Trim-X court reasoned that there could be no recovery for expenses incurred with the intent to benefit unsecured creditors in addition to the secured creditor. Even though the court noted that the creditor eventually benefited from the expenses, the court still found that the expenses failed the “benefit” test because CCBL did not cause or consent to the expenses. According to the Seventh Circuit, under pre-Code case law, consent or causation by the secured creditor was “relevant” to the availability of surcharges, and neither had been proved.72 The court provided no other factors to consider besides consent and causation, implying that only expenses the secured creditor agreed to pay could benefit it.73 Thus, the court seemed to believe that to demonstrate benefit it must be shown that the secured creditor subjectively believed that it benefited from the expense, as demonstrated by consent.

This consent, however, can be implied. Implied consent, what the Seventh Circuit called “causation,” can be shown through the secured creditor’s affirmative acts or, as in Trim-X itself, through the secured creditor’s inaction.74 The court also connected secured-creditor consent with the trustee’s intent. So long as the trustee intended to benefit other creditors and was not exclusively focused on benefiting the secured creditor, CCBL would not be deemed to have consented. However, the court found that the secured creditor did consent (albeit impliedly) to the expenses incurred after abandonment; thus, any expenses incurred by the trustee after that date benefited the secured creditor and could be surcharged.75 In the end, the court vacated and remanded to allow the bankruptcy court an opportunity to explain whether the amount it had allowed the trustee to surcharge was “reasonable” within the meaning of § 506(c).76

By not considering any other way to prove the secured creditor’s benefit, the Seventh Circuit seemed to indicate that consent, implied or actual, was the only possible way to prove this factor and surcharge the secured creditor.77 Trim-X’s reference to “consent” and “causation” describes two sides of the same coin;78 a secured creditor either actively sought an expense and thus caused it to be incurred, or the creditor agreed to the expense, thus consenting to a surcharge.79 Unless a creditor actively seeks an expense, it does not cause the expense.80 Similarly, unless the creditor agrees to an expense—either expressly or through clear implication—it has not consented.81 Trim-X used the terms interchangeably; the difference between them seems to be whether the trustee or the creditor actively sought the expense.82

2. The progeny of Trim-X.

Other courts have followed in Trim-X’s forward-looking footsteps. Those courts have also held that expenses spent with the intention of benefiting anyone other than the secured creditor cannot be surcharged.83 Each of these courts cited Trim-X, and, as in Trim-X, these courts concluded that the secured creditor received no benefit unless the creditor’s consent demonstrated that it believed the expense would benefit it.

For example, the debtor in In re Estate Design & Forms, Inc84 possessed, when it filed for bankruptcy, a printing press that it had purchased from a company named Heidelberg.85 Because the debtor had not made any payments on it before filing for bankruptcy, Heidelberg asked the trustee to agree to lift the automatic stay and allow it to repossess the press.86 The trustee agreed, but not before appraising the press, suggesting that he hoped it could be sold at a price that would benefit unsecured creditors, in addition to Heidelberg.87 He then filed a motion to surcharge Heidelberg for the cost of storing the press, as well as other expenses.88 The bankruptcy court permitted the surcharge, but the district court did not, citing Trim-X to support its determination that the secured creditor gained no benefit until the trustee abandoned the property because Heidelberg never consented to pay the rent or any other expense.89 Until the press was abandoned to Heidelberg, the trustee was attempting to recover for the unsecured creditors; the secured creditor received collateral worth the same value had the property been surrendered earlier and benefited only to the extent it avoided a few expenses, such as the rent and heating costs of a space for the press.90

Cases that adopt the forward-looking approach focus on secured-creditor consent. Even when the trustee did not intend to benefit the secured creditor exclusively, if the secured creditor consents to the expenses, a surcharge may still be possible. This conclusion follows from Trim-X. Unless the creditor consented, thereby demonstrating a subjective belief that it would benefit from the expense, these courts would not find a benefit. This was true even if it seemed quite likely that the creditor did indeed benefit. Typically, these cases use “consent” to stand for “consent or causation,” as used in Trim-X.91 The creditor’s consent indicates that it believes the expense works to its benefit; otherwise, it would not consent.92

While these cases all recognize that consent is not mentioned in the text of § 506(c), many seem to treat it as a requirement. For instance, In re Wiltwyck School93 cited many previous cases for the proposition that consent was an important factor relevant to the benefit inquiry.94 In that case, in which the debtor sought costs for “preserving, maintaining and disposing of” a school building,95 the court found no consent because the creditor arranged for a sale and the debtor rejected it.96 It concluded that without consent, any benefit was too remote and uncertain to allow a surcharge.97 Also, in Trim-X itself, the Seventh Circuit indicated that consent was the only way to demonstrate a benefit.98 Meanwhile, other courts indicate that secured-creditor consent is an alternative, extratextual approach to determine whether a creditor received a benefit.99 According to these courts, the three requirements of § 506(c) present an “objective test,” while creditor consent is a “subjective test” that can separately justify a surcharge.100

After Trim-X, consent is usually relevant, even in general-expense cases. Courts may discuss consent in these cases in part because of Trim-X’s imprecise reading of the pre-Code case law.101 Note two important facts about general-expense cases. First, courts do not always carefully distinguish between general expenses of the debtor and those spent directly on a piece of property in the estate.102 This is a mistake—the distinction matters. While it may be easy to demonstrate that an expense benefits a secured creditor when it is spent directly on a particular piece of property—because the creditor may have had to pay that expense otherwise—it may be nearly impossible to determine whether a general expense benefits a secured creditor. In such situations, the creditor’s consent is a subjective means to show that a general expense benefits the creditor.

Additionally, in general-expense cases, the focus is on implied consent. While these courts look for consent, they do not require a formal contract between the trustee and the secured creditor to find consent.103 However, they do note that consent should be implied with caution.104 Mere cooperation with a debtor, or acquiescence to an attempted reorganization, is an insufficient basis on which to find consent. For example, In re Flagstaff Foodservice Corporation105 (“Flagstaff I”) considered a debtor that wanted to surcharge the secured creditor for attorney’s fees, arguing that the creditor consented because it used Chapter 11 to sell its collateral.106 The Second Circuit denied the surcharge.107 Providing expertise to help the debtor create a viable plan to reorganize its debts did not imply that the secured creditor consented to be surcharged; it was not sufficiently clear that the creditor believed it benefited from the expense.108 However, other courts have found implied consent to surcharge general expenses because the secured creditor clearly indicated in some way that it benefited from the expenses.109 For instance, In re Bob Grissett Golf Shoppes, Inc110 found that a secured creditor consented by implication to pay the fees of the trustee because it insisted on the appointment, knowing the debtor could not pay him, rather than protecting its property in another way.111

B. The Backward-Looking Approach

Trim-X’s approach is not the only one. A recent Fifth Circuit case, Domistyle, termed its approach “backward-looking.” Rejecting the exclusive-intent rule from Trim-X and its consent requirement, the court instead looked at the connection between the expense and the collateral. This Section first examines Domistyle and then discusses other cases that rely on a connection between the expenses and the collateral, even though they do not explicitly reject Trim-X.

1. Domistyle takes a different approach.

In Domistyle, the Fifth Circuit explicitly disagreed with the forward-looking approach of Trim-X and Estate Design, and instead employed what it termed the backward-looking approach.112 As described in the Introduction,113 the key asset in the case was a candle factory on which Southwest Securities held a lien for $3.69 million. Domistyle filed for bankruptcy in April 2013 and confirmed a liquidating trust, meaning that all the property would be sold.114 The trustee reasonably believed the factory could be sold for more than Southwest Securities was owed.115 The trustee attempted to sell the candle factory from August 2013 to May 2014, but never found a buyer willing to pay a price that would pay the secured claim in full and also allow the unsecured creditors to recover some value.116 During this time, he incurred various expenses to preserve the factory’s value.117 Eventually, the trustee filed a motion to abandon the factory, and Southwest Securities agreed to surcharges for future expenses.118 The trustee then filed a motion to also surcharge the expenses incurred before the motion to abandon.119 The bankruptcy court approved the surcharge, and the Fifth Circuit took a direct appeal.120

Claiming fidelity to the text of the Code, the Fifth Circuit permitted the surcharge.121 The court rejected the exclusive-intent rule promoted by Trim-X and Estate Design because the Code, according to the court’s plain-meaning interpretation, does not require intent to benefit the secured creditor.122 Instead, the question for the court was whether the secured creditor did, in fact, benefit.123 If it did benefit, it was inequitable to charge the estate expenses that benefited only the secured creditor.124 Because the court found that “Southwest [Securities] obtained some benefit,” as demonstrated by the testimony of a real estate broker, the surcharge was permitted.125 But, according to the Fifth Circuit’s opinion, there was no inequity when the expenses were general, such as the trustee’s fee, and benefited the entire estate. Thus, those expenses could properly be charged to the debtor and its unsecured creditors, but not the secured creditor, even if the secured creditor eventually received some benefit.126

According to the Fifth Circuit, courts should stress the “collateral-expense connection” to avoid this potential inequity.127 For instance, money spent to advertise the sale of the property, to pay for its utilities, or to protect it are all spent directly on the collateral, and have a collateral-expense connection.128 On the other hand, the trustee’s fee will not be connected to the collateral because the trustee manages all the debtor’s assets.129 There is no connection between her fee and any particular piece of collateral. According to the court, if there was no collateral-expense connection, there could be no surcharge; likewise, if there was a connection, a surcharge was possible.130 The court found consent irrelevant because it is not mentioned in the text of the Code.131

2. Other circuits use the collateral-expense connection to deny surcharges for a lack of “benefit” to the secured creditors.

Other circuits recognize the importance of a collateral-expense connection as well, often in the context of assessing whether general expenses, such as attorney’s fees, benefit the secured creditor. The Third Circuit refused to surcharge a secured creditor the amount of previously unpaid taxes in In re C.S. Associates132 because the incidental benefits that the secured creditor received from the collateral’s location in a particular city were not sufficiently related to the collateral.133 Given the lack of connection, the taxes did not benefit the creditor that held a lien on that collateral.134 The court did not even mention consent. Similarly, the Ninth Circuit in In re Cascade Hydraulics and Utility Service, Inc135 held that telephone utilities, taxes, and attorney’s fees were incurred for the benefit of the whole estate and not the secured creditor’s collateral.136 Because those expenses did not provide a direct benefit to the secured creditor protected by the collateral, they were not recoverable.137 Vague assertions of benefit were insufficient; instead, the debtor was required to show that the benefit was directly tied to a piece of secured-creditor collateral.138 In Cascade Hydraulics, the court also found that there was no consent.139

A divided Eighth Circuit panel applied this principle in Brookfield Production Credit Association v Borron.140 The debtors operated a turkey farm.141 After it was clear that they would not be able to reorganize their debt, the bankruptcy court lifted the automatic stay, allowing secured creditors to collect their collateral—crops, animals, machinery, and cash.142 When the debtors attempted to surcharge the secured creditors for unspecified expenses, the bankruptcy court refused because they could not show the secured creditors’ benefit as they “failed to ascribe actual expenses to specific items of collateral.”143 The district court and the Eighth Circuit majority affirmed the bankruptcy court’s decision, the latter with little discussion.144 Though the majority did not permit a surcharge, Judge Myron Bright would have reversed and remanded to allow the debtor in possession to demonstrate that the “expenses went to specific items of collateral.”145 He believed that the debtors might clearly identify how their expenses were connected to the collateral.146 Regardless of the outcome, both the majority and the dissent focused on the lack of collateral-expense connection in the factual record. Neither opinion even mentioned consent.

III. The Text and Pre-Code Practice Support a Collateral-Expense-Connection Approach

Courts should look exclusively to the connection between the secured creditor’s collateral and the debtor’s expense when determining if a secured creditor has benefited and can be surcharged. As noted above, courts employ either of two approaches to determine whether there was a benefit. The forward-looking approach turns on whether the trustee intended to exclusively benefit the secured creditor at the moment she incurred the expenses. This can lead to unjust enrichment if the secured creditor eventually gets a benefit, but avoids a surcharge due to lack of consent. It forces courts to focus on consent, which incentivizes trustees to bring more § 506(c) motions because they believe they can demonstrate implied consent more easily than an actual benefit to the secured creditor.147 Trustees would often claim that the secured creditor could have acted to stop the expenses but failed to do so, thus demonstrating implied consent, even when they cannot demonstrate that expense benefited the creditor. In contrast, the backward-looking approach asks whether there is a connection between the expense and the collateral and, if so, whether the creditor actually benefited, ignoring the trustee’s intent when she spent the funds. But it limits the power a secured creditor can wield over property the creditor will eventually possess, power exercised through giving or withholding consent.

This Part provides a solution to the split. Instead of adopting either the backward-looking or forward-looking approach, courts should look exclusively to the connection between the collateral and the expense to determine whether the secured creditor benefits, ignoring trustee or debtor intent altogether. Unlike courts employing the forward-looking approach, this approach treats secured-creditor consent as an exception to the rule, rather than a requirement for surcharge. Though this solution resembles the backward-looking approach, it differs slightly in that it assumes that reasonable and necessary expenses connected to collateral benefit the secured creditor. This approach not only simplifies the court’s task, it also provides a clear background rule that simplifies the high-stakes waiver-for-financing agreements that often must be negotiated before a large bankruptcy begins. Part III.A examines the text of § 506(c), concluding that it envisions a collateral-expense-connection approach. Part III.B argues that the pre-Code case law employs a collateral-expense-connection approach to surcharges and then confronts Trim-X’s contention that the pre-Code case law requires secured-creditor consent. Part III.C uses the collateral-expense connection to develop a comprehensive rule for secured-creditor surcharges. Finally, Part III.D confronts some possible shortcomings of the textual rule developed here.

A. Courts Must Focus on the Text, Which Favors a Collateral-Expense-Connection Approach

The section of the Code governing secured-creditor surcharges is § 506(c), which states that:

The trustee may recover from property securing an allowed secured claim the reasonable, necessary costs and expenses of preserving, or disposing of, such property to the extent of any benefit to the holder of such claim, including the payment of all ad valorem property taxes with respect to the property.148

The provision is typically seen as imposing three requirements: the expense to be surcharged must be (1) reasonable and (2) necessary, and (3) must benefit the secured creditor.149 This solution, which interprets the third requirement, remains faithful to the text of § 506(c). The Supreme Court has often said that lower courts must adhere closely to the text of the Code in their decisions, including in cases specifically dealing with § 506.150 If the text of § 506(c) is clear, courts should follow it.151 And § 506(c) is clear—it points to a collateral-expense connection. Courts should adopt this straightforward reading of the text because it provides a simple background rule critical in prebankruptcy finance negotiations.

1. The text supports a collateral-expense-connection approach.

The text of § 506(c) points courts to a collateral-expense connection for at least five different reasons. First, the language of “preserving, or disposing of” indicates a collateral-expense connection. Second, the one example of a permitted expense fits this approach. Third, a failure to adopt this approach would lead to absurd outcomes and leave judges with an impossible task. Fourth, unless the benefit is tied to the relationship between an expense and the collateral, no expense would fail the “benefit” requirement that does not already fail the “necessary” requirement. Finally, to avoid the absurd results, all the circuits to consider the issue require the surcharged creditor to be the “primary beneficiary,” an extratextual requirement that is best seen as an attempt to reach the same results as a collateral-expense-connection approach.

First, the surcharge is permissible for expenses spent “preserving, or disposing of, such property.” An expense that is not incurred for a specific piece of property can hardly be for the preservation or disposal of that property. For example, one could not say that attorney’s fees for managing the entire estate went toward preserving or disposing of a single piece of property. The fee would have been incurred even if that specific piece of property did not exist in the estate. Instead, the attorneys attempt to maximize the value of the entire estate. Perhaps, in a vague sense, because the trustee works to preserve the value of the whole estate, some modicum of her fee preserves the value of the individual property. But if that were decisive, then every reasonable and necessary expense could be surcharged because every reasonable and necessary expense is undertaken to preserve the total value of the estate. Such a result is not envisioned by the Code.152 In contrast, funds spent directly on the property, such as funds for a guard to prevent vandalism, do preserve the property. Similarly, funds spent to dispose of the property, such as the cost to advertise an auction, are connected to the collateral.

Second, § 506(c) gives an example of a surchargeable expense: “the payment of all ad valorem property taxes.” The drafting history of the Code makes clear that this is an example and not an exception.153 An ad valorem property tax is the basic property tax that a municipality charges for each particular plot of land.154 Because the tax is tied to a particular piece of collateral—a single piece of land—there is a clear collateral-expense connection. Though not decisive on its own, the fact that the only example given in the statute has a clear collateral-expense connection points toward adopting this rule.

Third, not adopting a collateral-expense requirement would lead to absurd outcomes, requiring Herculean judging to overcome. The Supreme Court has instructed lower courts to avoid absurd outcomes when interpreting the text of the Code.155 The text cannot mean that any expense is recoverable, so long as it benefits the secured creditor even a small amount. If that were so, secured creditors could be surcharged a tiny fraction of every expense incurred during bankruptcy because they plausibly benefit some small amount from each. For instance, a trustee could argue that, because her fee benefited the entire estate, it benefited the secured creditor at least a little bit. But there is no method for determining what percentage of that widely spread benefit went to the secured creditor. A simple calculation, such as charging the secured creditor a percentage of the fee based on the percentage of the total recovery it receives, does not actually take into account the benefit the creditor received. Some secured creditors may recover the same value no matter what actions the trustee takes while others see their recoveries rise dramatically; charging all based on a simple formula ignores this. If courts actually attempted to determine the benefit each creditor received, they would struggle to determine the various magnitudes of these numerous surcharges. This is more than just a difficult factual determination. Congress likely did not want to grind the bankruptcy process to a halt for the nickel-and-dime surcharges of every general expense.

Fourth, allowing any marginally beneficial expense to be surcharged, regardless of its connection to the collateral, would be flawed for another reason. Every expense that failed the “benefit” test would have already failed the “necessary” test.156 This is because only those expenses that harm the creditor would fail the “benefit” test, unless the expenses are so distant from the collateral that they do not affect the creditor’s recovery by even a penny—an unlikely result. It would never be necessary to incur an expense that harms the secured creditor because the trustee has a fiduciary duty to the creditor to act in its best interest.157 Without a creditor-expense connection, the “benefit” requirement would be rendered superfluous.158

Finally, to avoid these absurd results, many circuits (possibly aware of the normatively desirable outcome) add an extratextual requirement:159 every court to consider § 506(c) has come to a common understanding that the secured creditor should be the primary beneficiary of the expense.160 This requirement helps them consistently reach the same result as the creditor-expense-connection approach,161 which demonstrates that the collateral-expense-connection approach is on the right track. In nearly every instance, if there is a connection between the secured creditor’s collateral and the expense, then the secured creditor will be the primary beneficiary. For instance, the funds spent on guards in Domistyle were connected to Southwest Securities’ collateral and Southwest Securities was the primary beneficiary. It is hard to imagine an expense that would not be connected to the secured creditor’s collateral that nonetheless primarily benefited that creditor.162

2. The focus on trustee intent and creditor consent is not consistent with the text.

The reasoning of courts that consider exclusive intent or require consent when deciding whether an expense meets the “benefit” requirement is inconsistent with the text of § 506(c). If Congress wanted a surcharge to depend on consent or exclusive intent to benefit the secured creditor, it could have used those words in § 506(c).163 The word “benefit” does not include a hint of either notion. Instead, a creditor benefits when the value of collateral is preserved or increased,164 which can occur with or without the creditor’s consent and regardless of the intent of the trustee. Because § 506(c) does not mention trustee intent or creditor consent, courts should shift their focus to the collateral-expense connection.

The location of “benefit” in the statute also makes this clear. Section 506(c) allows the trustee to recover the “reasonable, necessary costs . . . to the extent of any benefit.” By placing “benefit” in a phrase describing the amount of recovery, Congress indicates that the benefit is something that occurred, not something that was sought. The amount of the benefit is not measured by the benefit the trustee expected the secured creditor to receive; if it was, Congress would have made this clear by including a word like “expected” or “sought.” Instead, the actual benefit after the fact is envisioned. Through the location of “benefit” in § 506(c), Congress connects “benefit” less to the motives of the trustee than to other, possibly more obvious, drafting possibilities. In contrast, if Congress had worded this part of the statute as “secured creditors may be surcharged for reasonable, necessary, and beneficial expenses,” then it would be ambiguous whether the trustee’s intent should be considered. This hypothetical construction does not clearly refer to either the trustee’s subjective belief that the expense was beneficial or the expense’s actual beneficial results. But the actual text of § 506(c) clearly refers to the latter, focusing itself entirely on whether there was an actual benefit.

In addition, § 506(c)’s other two requirements do not rely on trustee intent or creditor consent. Whether an expense was “reasonable” and “necessary” is an objective test that a court can evaluate after the fact.165 It is reasonable to expect that “benefit” would also be an objective test that can be evaluated after the expense is incurred. Instead of forcing courts to evaluate the “reasonable” and “necessary” prongs before switching gears and inquiring into the trustee’s state of mind or a possible implied contract between the secured creditor and the trustee, the collateral-expense-connection approach keeps the court’s task equally simple for all three factors.

Furthermore, reading into § 506(c) a requirement that the trustee exclusively intends to benefit the secured creditor or that the secured creditor’s consent is necessary could allow unjust enrichment. A secured creditor could observe an expense being incurred and wait—not exercising its tools of protection despite the knowledge that the expense may benefit it—in the hopes of paying no costs because the trustee could not prove consent. Consider the facts of Domistyle. Under an approach that required exclusive intent in order to surcharge, Southwest Securities would have been content to let the trustee keep paying expenses, knowing that he could never surcharge them. If Southwest Securities had used the tools that the Code gives it,166 it could have regained the asset. But, if exclusive intent is essential, Southwest Securities would not use those tools when it could leave the trustee looking elsewhere to cover the tab. The desire to avoid unjust enrichment led the Fifth Circuit (rightly) to reject Trim-X’s forward-looking approach to surcharges.167

Perhaps it seems that noting the role of the collateral-expense connection in § 506(c) removes consent from the benefit inquiry entirely. Not so. This recognition dispels only the notion that consent is a hard-and-fast requirement. Consent still may be relevant for two reasons. First, if the creditor and trustee agree that the trustee will undertake expenses and the creditor will reimburse those expenses, such an agreement forms an enforceable contract. Second, if the creditor consented to be surcharged, such consent demonstrates that the creditor expects some benefit to be gained from the expense for its collateral. Thus, consent may still be one method of proving “benefit.” But the text makes clear that it is not the only way.

Frustrated secured creditors might accuse this reading of missing a key temporal aspect of what it means to benefit a secured creditor. Like the creditor in Domistyle, such creditors may argue that they cannot benefit unless the collateral is abandoned as soon as possible.168 They would contend that if the trustee holds onto the property any longer than it takes to abandon the collateral, the secured creditor cannot benefit from the delay. However, “benefit” in § 506(c) does not include a temporal connotation. In a similar context, the Supreme Court held that secured creditors could receive “adequate protection” to prevent lost value but excluded the time value of money from the adequate-protection guarantee.169 Thus, secured creditors actually lost value—a dollar today is more valuable than a dollar tomorrow. The instant abandonment that the creditor in Domistyle sought would have been more valuable than their recovery from a later abandonment. The Supreme Court has made clear that courts should not read a temporal element into the Code if it is not present in the text. Moreover, the secured creditors have the option to bring a motion to abandon under § 554(b). Such a motion would allow the secured creditor to redeem its property if it is of “inconsequential value and benefit to the estate.”170 Courts stay true to the Code when they encourage motions to abandon collateral rather than reading into § 506(c) a requirement that the trustee must sell or abandon the property.

Congress may have intended secured-creditor surcharges to be a narrow exception to bankruptcy funding, but the collateral-expense-connection approach does not improperly expand the exception. It is true that the unsecured creditors generally cover the expenses of bankruptcy, and courts have sometimes seen § 506(c) as a narrow exception to that general rule of bankruptcy funding.171 The “exclusive intent” or “creditor consent” alternatives might further restrict the number of surcharges compared to a collateral-expense-connection approach. But this Comment’s solution retains § 506(c)’s status as a narrow exception—perhaps even narrower than its competitors—because many possible expenses have no connection to the collateral. For example, if a secured creditor that was aware of the attorney’s fees did not object as they were incurred, a court using a backward-looking approach could find implied consent, which would allow the surcharge. But a court adopting a collateral-expense-connection approach would not seriously entertain the surcharge. Regardless, courts should adopt the best reading of the text, not just the reading that creates the narrowest exception.

B. The Pre-Code Case Law Supports a Collateral-Expense-Connection Approach

Pre-Code cases follow a collateral-expense-connection approach, though without naming it as such. A vast swath of cases relies on the connection between the expense and the collateral that the trustee is attempting to surcharge to prove secured-creditor benefit.172 Legislative history from both the House and the Senate noted that § 506 “codifies current law” regarding secured-creditor surcharges, amplifying the importance of pre-Code case law.173 This Section demonstrates that the typical pre-Code case used a collateral-expense connection, which exposes Trim-X’s reliance on pre-Code cases as unsupported, even by the cases it cites.

1. Numerous pre-Code cases follow a collateral-expense-connection approach.

Courts followed the collateral-expense-connection approach by permitting money spent directly on encumbered property to be recovered. Courts often assumed that these expenses benefited secured creditors without much discussion, typically noting briefly that the amount of a surcharge was the cost of preservation and sale of a piece of property.174 For example, the property in In re Myers175 was sold for more than the mortgage amount, so the expenses spent on the property not only benefited the secured creditor, but also the unsecured creditors.176 Yet Judge Learned Hand still permitted a surcharge of the “expenses of sale and of so much else as actually helped to preserve the property or its proceeds.”177 In another case, Gugel v New Orleans National Bank,178 the Fifth Circuit determined that the lienholder could be charged with the “reasonable costs of [bankruptcy proceedings] as are appropriate to foreclosing the lien and selling the [e]ncumbered property.”179 However, this did not include general expenses.180 Likewise, in Miners Savings Bank of Pittston, Pa v Joyce,181 the Third Circuit reasoned that a secured creditor’s delay in moving for foreclosure should not force it to cover the general expenses of the bankruptcy because such a surcharge would penalize the secured creditor for allowing the property to possibly benefit unsecured creditors.182 But the court continued, “This of course is not to say that the lienholder should not bear the reasonable expenses of preserving the property, which expenses were clearly for its benefit.”183 Though “for its benefit” could indicate that the trustee spent the funds in an attempt to benefit a secured creditor, the context shows that the court was merely recognizing the actual beneficiary, not the intended beneficiary. If the court did rely on the trustee’s intent, it failed to mention that logic in the opinion; the trustee is not even mentioned in the relevant paragraph.

Although these pre-Code cases relied on a collateral-expense connection to decide whether the secured creditor benefited, consent could still be important. But creditor consent was never a requirement, despite the Trim-X court’s belief. Before 1973, secured creditors could foreclose on collateral in state court; since the advent of the automatic stay, secured creditors no longer have that option.184 The ability to foreclose in state court made consent more relevant in the pre-Code era, compared to now. Secured-creditor inaction meant the creditor turned down an opportunity to retrieve the property—an opportunity that secured creditors do not enjoy today. But courts did not rely on this inaction, and the implied consent it could indicate, in evaluating the viability of a surcharge. Despite the ability to foreclose, consent was not a requirement. The only cases that turned on consent were general-expense cases, in which the trustee sought attorney’s fees or taxes that the estate paid. The norm in general-expense cases was to prohibit surcharges without the consent of the secured creditor because such a general expense did not benefit the creditor.185 However, if the expense was to preserve the value of a specific piece of property or to sell it—and thus not a general expense at all—it benefited the secured creditor and could be surcharged regardless of consent. So consent was not a requirement even in an era when consent was more relevant.

Overall, these pre-Code cases demonstrate that the “benefit” inquiry must center on the connection between the expense and the collateral. No case turned on the intent of the trustee. While secured-creditor consent was important in some cases, it was simply an alternative way to demonstrate the benefit of general expenses—that is, expenses that could not otherwise be surcharged due to a lack of collateral-expense connection. By consenting to expenses or actively causing them, the secured creditor indicates that those general expenses accrue to its benefit. In sum, the actual pre-Code practice reflects a collateral-expense-connection approach, even though the courts did not use that precise terminology.

2. Despite Trim-X’s claims, pre-Code case law does not support the forward-looking approach.

Though the text of the Code is consistent with a collateral-expense-connection approach, Trim-X argued that the pre-Code case law supports requiring consent to prove a “benefit.”186 This Section dissects the pre-Code case law that Trim-X cites; upon close examination, it does not support a focus on consent. Rather, these pre-Code cases do just the opposite—they reveal that the key to secured-creditor surcharges is the connection between collateral and expense.

Trim-X cited six cases to support its forward-looking approach and reliance on secured-creditor consent: Textile Banking Co v Widener,187 First Western Savings and Loan Association v Anderson,188 Robinson v Dickey,189 Equitable Loan & Security Co v R.L. Moss & Co,190 In re Tyne,191 and In re Atlantic Boat Builders Co.192 But none truly supports Trim-X when held up to scrutiny. Instead, they prove that consent is a possible alternative method to prove “benefit” but do not hold that consent is necessary. Nor do any of these cases indicate that the trustee’s intent can affect the “benefit” prong of a surcharge claim. Rather, they look to the connection between the expense and the collateral.

The various holdings of these cases demonstrate how their conclusions differ from the conclusion that Trim-X drew. In Textile Banking, the Fourth Circuit reversed a $1,600 nonconsensual payment, not because nonconsensual surcharges are per se unacceptable, but because the court took issue with the manner of calculating the $1,600.193 The Ninth Circuit in First Western used an approach to surcharging expenses that weighed the equity of a surcharge.194 This flawed approach,195 not even adopted by Trim-X, asked whether the secured creditor had consented.196 But the surcharge was still prohibited because the trustee’s and attorney’s fees were general expenses—in other words, not for the “preservation, protection, and benefit of [the secured creditor’s] property.”197 So, when the court weighed the equities (under the flawed approach), it still considered whether there was a collateral-expense connection as part of its balancing. Equitable Loan ordered a secured creditor to pay for expenses it had previously consented to pay.198 The Fifth Circuit authorized other expenses surcharged, without any instruction that a search for consent was required, indicating that consent was merely an alternative way to prove that the secured creditor benefited.199 In Tyne, the Seventh Circuit held that the consent of a first creditor could be passed to a second creditor, because the second creditor voluntarily assumed the interests of the first, who had consented; whether the first person’s consent was required to surcharge went unconsidered.200 Finally, in Atlantic Boat, a nonconsenting secured creditor was surcharged the cost of rent for a property because the creditor held a lien on inventory stored within it.201 The bankruptcy court for the Middle District of Florida thus relied on a connection—albeit a tenuous one—between the rent expense and the benefit to the secured creditor’s inventory collateral.

On first glance, Robinson seems to support Trim-X’s holding, but context dispels the notion. In that case, secured creditors sought to foreclose on a property in state court.202 Though there was clearly no consent—the creditors wanted nothing but foreclosure—the Third Circuit allowed a surcharge for the “expenses incurred to save their property.”203 The court began by noting that unsecured creditors should typically pay for the bankruptcy expenses because the trustee is “acting in their behalf and spending money for their benefit.”204 The court noted one exception: when the secured creditor “expressly or impliedly consent[s].”205 Read in isolation, this paragraph may support Trim-X’s idea that consent is a requirement. But in the next paragraph, the court held that this case fell into another exception—an exception within the no-surcharges-without-consent rule—because “[the secured creditors] would have been compelled to expend the money here in question in their own interest had the foreclosure not been stayed.”206 In other words, the secured creditors still could be charged the expenses because they were the beneficiaries. Though the court’s use of a “general rule of law”207 with multiple exceptions is confusing, the rule Robinson advocates is the collateral-expense-connection approach. Because the expense was something the creditor would have incurred itself had it foreclosed, there was a connection, and a surcharge was permissible.

In all, these cases do more to undermine Trim-X than support it. None saw consent as a requirement; instead, most saw it as an alternative way to collect expenses that could not otherwise be surcharged. Consent was merely an alternative way to show that the secured creditor benefited; if there was no benefit, there would be no consent. Trim-X went awry with two key errors. First, it misunderstood the possibility of using consent as an alternative method of showing “benefit” and instead exalted it as a requirement. Second, it ignored the key difference between general-expense cases like First Western and cases with a collateral-expense connection. Under the collateral-expense-connection approach, the only possible proof of “benefit” from a general expense is the secured creditor’s consent. Trim-X imported that rule from general-expense cases to all cases. Perhaps these flaws are explained, in part, by Trim-X’s rush to examine pre-Code cases without first carefully examining the text of the Code.

C. The Collateral-Expense-Connection Approach Suggests a Comprehensive Surcharge Solution

The text of the Code and the pre-Code case law support a collateral-expense-connection approach to the surcharge question. If an expense is connected to the collateral, then the creditor benefited and the creditor can be surcharged; the trustee’s intent at the time of the expense is irrelevant.208 This clear rule would facilitate prebankruptcy negotiations that often swap § 506(c) waivers in exchange for bankruptcy financing. With a settled rule, the debtor and creditors would know which of the bankruptcy’s expenses would be subject to potential surcharging. This knowledge clearly establishes the stakes of the financing negotiations.

In short, the key to the solution is the connection between the expense and the collateral. The first step is ensuring that the expenses are reasonable and necessary (§ 506(c)’s other requirements). Then the court should determine whether there was express consent; if so, a surcharge is appropriate. Otherwise, consent is irrelevant. The court then must distinguish between general expenses and expenses specific to the secured creditor’s collateral. A general expense can never be surcharged unless extraordinary circumstances mandate an exception. But expenses spent on collateral can always be surcharged. The amount of the surcharge depends on the percentage of the total recovery the secured creditor received.

If every court focused on the collateral-expense connection, most decisions would eventually reach the same ultimate conclusion.209 Courts err when they dwell too much on consent, regardless of whether they find it. This laser focus on consent is a result of the influence that Trim-X holds over the “benefit” prong in § 506(c) surcharge cases, whether they are general expenses, such as attorney’s fees, or expenses spent directly on collateral.210 Because of Trim-X, many courts today believe a trustee must prove consent to meet § 506(c)’s “benefit” requirement. Consequently, these courts feel compelled to explain why there was no implied consent in each instance.211

Yet the fixation with consent sends the wrong message to trustees. Many erroneously think they can prove implied consent, even for a general expense (such as the trustee’s own fee), likely leading them to bring more surcharge actions. In every surcharge action, the trustee can say the creditor could have done more to stop the expense and that its failure to do so constitutes implied consent. The expectation of more surcharge actions adds another level of uncertainty to the critical financing negotiations that often precede large bankruptcies. In addition, the courts’ focus on consent might incentivize secured creditors to be underinvolved with a reorganization for fear of the perception of consent, even though their industry insights could provide valuable assistance.212 In short, the focus on consent could be harmful unless it is truly required by the Code. And as it is not, courts must instead focus on whether an expense is spent directly on collateral.

Noting this key fact—the reliance on the collateral-expense connection—presents a comprehensive solution for courts determining when secured-creditor surcharges should be available. Courts should begin with the reasonable and necessary factors contained in § 506(c). The reasonable and necessary prongs prevent a trustee from freely spending funds on collateral, hoping against hope that the property will eventually yield a return to unsecured creditors. In most instances, these two prongs will remain as easy to prove as they have always been, and the parties will continue to only rarely contest them.213 The few cases in which the expenses are neither reasonable nor necessary will be fairly obvious. If the secured creditor argues that the expense should not have been incurred, regardless of who pays it, one can surmise that the two prongs are not satisfied. In contrast, in Domistyle, the secured creditor tried to prevent the trustee from ceasing payments for the security staff, a clear indication of the reasonableness and necessity of that expense.214

Next, a court should pursue another simple inquiry: Was there express consent? If so, there can be a surcharge.215 This is a fair result; forcing the estate to pick up expenses that the secured creditor caused the trustee to incur would create perverse incentives for creditors. Besides, consent indicates that the secured creditor considers the expenses to be a benefit. Rather than this simple inquiry into express consent, most secured-creditor surcharge cases today focus their discussion on the issue of implied consent.216 The extensive attention that consent receives in these cases indicates that if its role and rationale were clearer, the trustee would never attempt the surcharge. Instead of hoping to prove implied consent, the trustee would know that the alleged surcharge would fail the collateral-expense-connection test. This solution would discourage these long-shot surcharge actions, reducing judicial decision costs and simplifying prebankruptcy waiver negotiations.

In the absence of express secured-creditor consent, the court should determine whether the expenses are general, affecting all the assets of the estate, such as attorney’s fees and the trustee’s fees, or whether they are spent directly on collateral. Typically this will be easy, but there is the occasional tough call. For instance, if the trustee spent five hours selling a piece of property, are her fees for those five hours general or specific to that property?217 It’s a tough question, but one with fairly few permutations, so courts can quickly build precedent around them. If the court decides that an expense is a general expense, this rule should apply: no general expenses can be considered beneficial (and therefore recoverable) except under extraordinary circumstances.

By definition, the extraordinary exceptions should be few, though there are at least two that should apply. First, imagine a secured creditor that holds a lien over all the assets, or essentially all the assets, of an estate.218 In that instance, all general expenses effectively benefit that secured creditor, so it would be equitable to surcharge them.219 Such a lien over all the assets of the estate justifies treating the entire estate as the creditor’s collateral. Thus, even a general expense, such as the trustee’s fee, is essentially connected to the creditor’s collateral even if it is not connected to any one piece of property. In addition, the secured creditor with a lien over all the assets typically holds considerable influence over the debtor and can probably dictate which expenses are incurred.220 Second, consider the factual situation from Bob Grissett.221 A secured creditor who advocates for a trustee’s appointment or some other expense while it knows, or reasonably should know, that the estate could never cover those costs can justifiably be charged its fair share.222 In both situations, given the secured creditor’s control over the decision to incur the expense, it is more equitable to surcharge the secured creditor than to force the debtor to pay.223

If the court determines that the trustee incurred the expense directly on encumbered property, then it should allow a surcharge anytime the property is worth less than the claim.224 For example, if a secured creditor’s claim is for $110 and the property is sold for $100, a trustee or debtor in possession can surcharge the secured creditor for the property taxes. This is justified because the increased value of that property directly benefits the secured creditor.225 Therefore, courts should ignore the intent of the trustee.226

The more complex question comes when the property is sold for more than the value of the secured loan. For example, consider a case in which the secured claim is for $110 and the property sells for $120. In such a case, the court can surcharge the secured creditor for part of the expense by balancing the value the expense preserved for the secured creditor against the amount of recovery obtained for other creditors. The best solution would be to surcharge the secured creditor a percentage of the expense, based on the percentage of the asset’s value they received. Consider two examples: in one, the secured creditor is owed $900 and the property sells for $910; in the other, the secured creditor is owed only $50 (after years of repayment) and the asset sells for $1,000. So in the first example, the secured creditor would pay 98.9 percent of any expense spent on the collateral and in the second example just 5 percent.227

The following decision tree in Figure 1 illustrates the chain of decisions that the court should make.

Figure 1. Surcharge Decision Tree

D. Potential Shortfalls of a Collateral-Expense-Connection Approach

The proposal is essentially textualist: the collateral-expense-connection approach is the better reading of the text, as well as the pre-Code case law that § 506(c) codifies. Support for a textualist approach is found in the Supreme Court’s decision in Hartford Underwriters, which held that any question about who has standing to bring surcharge claims under § 506(c) must begin with the text.228 But textual decisions in bankruptcy have flaws.229 Often, they create unintended downsides because appellate judges, who rarely see bankruptcy cases in action, do not take into account the dynamism implicit in bankruptcy.230 Unlike most other areas of law, a bankruptcy decision is not a ruling on events that occurred in the past; it is an ongoing proceeding in a lower court. A strict rule, based on the text, can ruin the flexibility that an ongoing reorganization may require.231 In other words, the best reading of the text might not always develop the most efficient rule for bankruptcy. In fact, Justice Elena Kagan, in a recent colloquy with a bankruptcy attorney, questioned whether close adherence to the Code was actually the most efficient approach or whether another approach—one less bound by the text—might be better.232 Whether or not she believes the answer to her question is that the textual solution nevertheless is always better, the mere fact that she asked the question is noteworthy.

There are two potential shortfalls to the textualist solution suggested by this Comment. First, the solution could lead to trustees pursuing fewer avoidance actions, which recover assets of the debtor that were improperly distributed before the bankruptcy filing. Second, it could lead to the hasty abandonment of valuable property by the trustee or a premature grant of a secured creditor’s lift-stay motion by the bankruptcy court. Both consequences could flow from the secondary and tertiary effects of the Comment’s surcharge rules.

The first concern is that a collateral-expense-connection approach would lead to fewer avoidance actions, which bring assets into the estate for distribution to the creditors. Most bankruptcies cannot proceed as reorganizations and must convert to Chapter 7 liquidations.233 Many Chapter 7 liquidations do not have unencumbered cash available to cover the general expenses of the bankruptcy, including the trustee’s fees.234 But every Chapter 7 needs a trustee to manage the liquidation.235 Trustees may take on bankruptcies that appear to have no unencumbered cash due to the possibility of avoidance actions.236 If successful, an avoidance action brings funds back to the estate,237 allowing the trustee to receive her expenses and increasing the recovery for general creditors. There are two types of avoidance actions. Fraudulent transfers are exchanges that “unfairly or improperly deplete a debtor’s assets,”238 and preferences are payments made on account of antecedent debt in the ninety days before the bankruptcy filing.239 The trustee can bring suit to have the court rescind these prepetition transactions, returning the value to the estate.240 But such actions are complex and uncertain.241 The trustee would prefer a simpler way to be paid.

Section 506(c) waivers can be that simpler method of payment. As noted above, in large bankruptcies with the largest possible surcharges, secured creditors come to the negotiating table and agree to provide cash to pay trustees, as well as other expenses, in exchange for a waiver of all possible § 506(c) claims.242 Secured creditors may be even more eager to engage in these settlement agreements if courts adopt the simple collateral-expense-connection approach advanced by this Comment. Were courts to do so, secured creditors could be surcharged for any expense spent on their property, regardless of the trustee’s intent. Fearing this surcharge, the secured creditors will seek to negotiate a waiver. Meanwhile, the trustee, hoping to get her fee, will agree to a deal. Despite the duty of loyalty, the trustee may agree to this waiver even if it is not in the best interest of the unsecured creditors. Once the trustee has her fee secured, she may often not want to risk it by using the cash that the § 506(c) waiver generated on uncertain avoidance actions. Instead, she would play it safe by not deploying the cash in potentially expensive litigation, and then collect her fee at the end of the bankruptcy. The unsecured creditors would thus lose the chance to gain assets through the complex avoidance actions the trustee would bring if her fee was not secure.

The second possible flaw of this proposed solution is that secured creditors may overwhelm the trustee and bankruptcy court with attempts to regain their property as soon as possible. The secured creditor does not want to be surcharged, so it will pressure the trustee to abandon the property, arguing it offers no value to a reorganization. If the trustee declines to abandon the collateral, the secured creditor will make the same arguments to the bankruptcy court, arguing that the debtor has no equity in the property and should be forced to give up the property.243 Or the creditors will pressure the trustee to agree to sell their property quickly rather than attempt to use it in a reorganization.244 In principle, the trustee or the court will do so only when the debtor has no equity in the property and the property is meaningless to a reorganization. But the pressure from a secured creditor will occasionally lead to mistakes, despite the trustee’s fiduciary duty. Property that could return value for unsecured creditors would be abandoned without generating that extra value. That is a problem. This is especially true because the value of the property is often unknown at first and whether the property could be used in a reorganization is uncertain, which increases the likelihood of error.

Despite these potential drawbacks, the solution proposed in this Comment is the most efficient rule to govern secured-creditor surcharges. The first reason is common to both flaws: the creditors will help minimize these problems by exercising their powers under the Code. Both drawbacks involve trustee shortfalls. In the first drawback, the trustee prioritizes her fee and does not pursue avoidance actions once her fee is secure, while in the second she undervalues the property. A duty of loyalty exists to prevent trustees from falling prey to such decisions—the trustee must put the creditors’ interests first.245 In the event that the problems manifest, the unsecured creditors can bring suit against the trustee. These actions may succeed often enough to ensure the trustee’s loyalty and concern.246 Further, the unsecured creditors can contest the decisions of the trustee or the debtor in possession.247 To do so, unsecured creditors often form committees to pursue avoidance actions that the trustee does not want to seek.248 Thus, when the trustee moves to abandon property, or a secured creditor moves the court to lift the automatic stay, the unsecured creditors can present the court with reasons why such a move would harm a potential reorganization.249 While it is preferable that a trustee not misstep in the first instance, the creditors can always act to limit the damage.

In addition, there are counterbalancing reasons for secured creditors to be less concerned with surcharges if courts focus on the collateral-expense connection. This crosscutting effect reduces the fear that the trustee will abandon valuable property. Though this approach allows a surcharge any time that an expense is spent directly on the encumbered property, the propriety of a surcharge is easy to prove. This Comment’s approach also clarifies that general expenses, such as attorney’s fees, should almost never be surcharged. In fact, in most cases in which trustees seek to surcharge secured creditors, they pursue general expenses. Though most are unsuccessful, the trustees evidently believe that there is at least some chance that the surcharge will be permitted. Perhaps if the surcharge action’s impermissibility were laid bare, secured creditors would be less concerned about surcharges, making them less likely to push for inefficient abandonment or waiver agreements.

Conclusion