Banking on Preemption: Allowing National Bank Act Preemption for Third-Party Sales

I. Preemption, Usury, and the National Bank Act

The National Bank Act has emerged as a powerful tool protecting national banks from state regulation. Originally passed during the Civil War to provide a stable national currency and banking system, the Act provides national banks with a significant shield against intrusion by state regulations and consumer protection laws. This Part proceeds by first considering the origins of the NBA, and second discussing the preemption of state laws, both in general and with respect to the NBA. Finally, this Part concludes with a brief discussion of the history and purpose of state usury laws, followed by an overview of the growth of the consumer protection movement.

Congress passed the NBA at the height of the Civil War in 1864 to create a stable national currency and banking system during and after the Civil War.9 According to one congressman, the Act was supposed to create a national banking system “so perfect” that the state banking system would evaporate, because “the system of State banks [ ] ha[d] outlived its usefulness.”10 However, because the NBA was expected to significantly disrupt the state banking system, Congress worried that states would try to interfere with national banks.11 As such, Congress created the Office of the Comptroller of the Currency (OCC) to exercise oversight, supervisory, and regulatory power over national banks.12 To be overseen by the OCC (that is, to become a national bank), a bank needs to file its charter with the OCC.13

The OCC is responsible for supervising national banks, but it was also established to protect national banks from “hostile state interference.”14 Congress allocated substantially all responsibility for the national banking system to the OCC, as it believed that a national bank “must not be subjected to any local government, State or municipal; it must be kept absolutely and exclusively under that Government from which it derives its functions.”15 In some instances, the NBA makes certain areas off-limits to the states. Specifically, the NBA applies only the usury law of the state “where the bank is located” to a national bank, regardless of where the national bank conducts business.16

Given the regulatory advantages national banks had over state banks after the NBA’s passage, Congress expected the demise of the state banking system.17 Despite this expectation, most state banks did not convert to national banks immediately after the NBA’s passage.18 To encourage state banks to convert, Congress enacted a 10 percent tax on notes issued by state banks.19 Though the purpose of the tax was “scarcely concealed,”20 the Supreme Court upheld the tax, providing another example of Congress’s power regarding national banking.21 Going further, the Supreme Court has since said that national banks were “designed to be used to aid the government in the administration of an important branch of the public service. . . . [T]he States can exercise no control over them, nor in any wise affect their operation, except in so far as Congress may see proper to permit.”22 The Supreme Court, dating back to McCulloch v Maryland,23 has “held federal law supreme over state law with respect to national banking.”24 As a result, state laws are often considered preempted by the NBA.25 A proper understanding of this special standard, however, also requires considering the origins of national preemption laws.

B. National Preemption of State Laws

The Supremacy Clause of the Constitution establishes that national laws supersede state laws, and federal preemption doctrine emanates from the Supremacy Clause.26 The Supremacy Clause resolves the foreseeable conflict that can occur when two governments (national and state) are permitted to legislate on an issue, and it “provides a clear rule that federal law ‘shall be the supreme Law of the Land.’”27 Courts have established the doctrine of preemption to implement the clear rule of the Supremacy Clause. Preemption claims are evaluated based on three theories of preemption: express preemption, field preemption, and conflict preemption. Express preemption is found when Congress has “withdraw[n] specified powers from the States by enacting a statute containing an express preemption provision.”28 Field preemption has generally been found when “Congress has legislated so comprehensively that federal law occupies an entire field of regulation and leaves no room for state law.”29 Lastly, conflict preemption is found “when compliance with both state and federal law is impossible, or when the state law stands as an obstacle to the accomplishment and execution of the full purposes and objectives of Congress.”30

Despite a robust preemption doctrine, the Court has generally adopted a presumption against preemption.31 To rebut this presumption, the Court looks to congressional intent, calling it “‘the ultimate touchstone’ in every pre-emption case.”32 As discussed above, Congress’s intent in passing the NBA was to relieve future national banks from state interference.33 As a result, the presumption against preemption is generally inapplicable in NBA cases.34

Shortly after the NBA’s passage, the Supreme Court began establishing preemption standards for the NBA. In Tiffany v National Bank of Missouri,35 the Court addressed the question whether a national bank could charge a higher rate of interest than a state’s usury law permitted because it was located in another state.36 The Court upheld § 30 of the NBA (now 12 USC § 85), allowing a national bank to charge a higher rate of interest.37 The Court additionally declared that national banks were “[n]ational favorites” and were expected to “tak[e] the place of [s]tate banks.”38 While express preemption was at work in Tiffany, courts most often apply conflict preemption doctrine when determining whether the NBA preempts applicable state laws.39

C. The NBA and Preemption of State Laws

1. Marquette and the rise of national banks.

In the modern era, the Supreme Court has generally held, in line with Tiffany, that the NBA preempts state law. However, recent cases show that the preemption of state law is not a fait accompli upon the invocation of the NBA. Marquette National Bank of Minneapolis v First of Omaha Service Corp40 sets the stage. In Marquette, the Court addressed whether 12 USC § 85 allowed a national bank organized in one state to charge interest at a rate acceptable in the state where it was located to out-of-state customers.41 A unanimous Court declared that 12 USC § 85 “ha[d] been interpreted for over a century to give ‘advantages to National banks over their State competitors.’”42 The Court determined that the interest rate on interstate loans was “governed by federal law” and that “a national bank may charge interest on any loan at the rate allowed by the laws of the State in which the bank is located.”43 Despite the lack of relevant legislative history, the Court concluded that Congress was aware of a well-functioning interbank loan-trading-and-endorsing system when it enacted the NBA.44 As a result, the Court did not find Congress’s silence to be dispositive; rather, the Court held that the NBA did not exclude interstate loans.45

The Court’s decision in Marquette allowed national banks to export one state’s usury laws into all other states. Additionally, the Court rejected the argument that a national bank was located in the state in which the loan was made. Such a decision could “throw into confusion the complex system of modern interstate banking,” and the Court relied on administrability concerns to reject this argument.46

The Supreme Court’s jurisprudence with respect to the NBA, especially its decision in Marquette, led to a dramatic rise in the size and scale of national banks. Contrary to Congress’s expectations, nationally chartered banks did not initially overshadow their state-chartered peers.47 However, over time national banks have come to dominate the market, especially after Marquette. The ease of chartering a national bank,48 coupled with the general rule that the NBA preempts state consumer protection laws, led to significant growth in the amount of assets held by national banks during the latter part of the twentieth century.49 Due to consolidation and other factors, the proportion of assets held by nationally chartered banks increased from 56.3 percent to 69.4 percent of all assets held by banks from 1997 to 2009.50 Perhaps unsurprisingly, these banks have tended to be located in Delaware and South Dakota because of these states’ lax (indeed, almost nonexistent) usury laws.51

2. Preemption doctrine after Marquette.

Marquette sheds light on the Court’s preemption jurisprudence with respect to the NBA. Because congressional intent is the guiding light of preemption analysis, the Court’s focus on Congress’s knowledge during the passage of the NBA was paramount to its determination that the ambiguity within the statute should be resolved in favor of national banks.

The Court provided more-fulsome guidance on NBA preemption analysis in Barnett Bank of Marion County, NA v Nelson,52 in which the Court held that the NBA preempted a Florida law restricting national banks from selling insurance.53 Florida had passed a law that restricted national banks’ ability to sell insurance in Florida despite the fact that federal law permitted national banks to sell insurance.54 The Court concluded that neither explicit nor field preemption was applicable, and it therefore employed conflict preemption.55 Because federal law did not mandate that national banks sell insurance but only authorized them to do so, Florida’s restrictions did not expressly conflict with the NBA. However, the state law conflicted with the purpose of the statute unless the “federal purpose [was] to grant the bank only . . . permission to sell insurance to the extent that state law also grant[ed] permission to do so.”56

The Court sidestepped this argument, finding that, by giving a national bank permission to sell insurance, Congress was giving national banks an additional power.57 The provision of an additional power by Congress is important because the Court has traditionally interpreted a grant of power to national banks as preempting contrary state law.58 When Congress grants a power to a national bank, the Court assumes that Congress does not want state laws to impair either the functioning of national banks or the exercise of their powers.59 Noting that this presumption of preemption may limit a state’s ability to regulate a national bank, the Court stated that state laws are not preempted to the extent that state laws “do[ ] not prevent or significantly interfere with the national bank’s exercise of its powers.”60

Barnett Bank lays out the standard preemption analysis that the Court typically performs when presented with a conflict between state law and the NBA. To determine if the NBA preempts state law, the Court will first ask if the state and federal statutes are “in irreconcilable conflict” with one another.61 The most obvious form of irreconcilable conflict involves not just grants of power but affirmative mandates requiring the exercise of the granted power. For example, in Barnett Bank, this type of conflict would have existed if the NBA had mandated national banks to sell insurance while state law simultaneously forbade them from doing so. Even if this form of irreconcilable conflict is not found, the Court presumes “that normally Congress would not want States to forbid, or to impair significantly, the exercise of a power that Congress explicitly granted.”62 In Barnett Bank, the answer to this question was relatively simple: a state law prohibition of a national bank’s power significantly impairs the bank’s ability to exercise that power. Since the Court found that allowing national banks to sell insurance gave them the power to do so, the state law prohibition significantly impaired national banks’ ability to exercise their power.63 However, in other cases, the question whether a state regulation would significantly impair the power of a national bank turns on an intensely fact-based inquiry.

While national banks were protected from state interference after Barnett Bank, an open question remained: Do national bank subsidiaries receive the same protection? The Supreme Court answered affirmatively in Watters v Wachovia Bank, NA.64 The Court focused not on legal entity structure but on the powers of the national bank, similar to the Court’s focus in Barnett Bank. Wachovia acquired a mortgage lender in Michigan that had been subject to Michigan’s financial regulation.65 Upon acquisition, Wachovia informed Michigan’s financial regulator that it would no longer be submitting to state supervisory control because the subsidiary was now entitled to preemption against state regulatory authority.66 In determining that Michigan could no longer regulate the subsidiary, the Court reiterated that “federal control shields national banking from unduly burdensome and duplicative state regulation.”67 The Court concluded that national banks and their subsidiaries are allowed to “engage[ ] in the business of banking.”68 As such, the subsidiary had the power to engage in mortgage lending, as ongoing regulation at the state level would “hamper[ ] the federally permitted activities of a national bank.”69 The Court’s focus in the preemption analysis was “on the exercise of a national bank’s powers, not on its corporate structure.”70 Put another way, when a subsidiary is using a power Congress granted to national banks, preemption analysis continues as if the national bank itself were engaging in the activity. The same is not true of other powers. Thus, a national bank subsidiary that is engaged in selling computers would be subject to state regulation, because the sale of merchandise is not a power of national banks.71

The Court’s highly deferential posture when it comes to national banks stems from both Congress’s intent in passing the NBA and the idea that certain acts of Congress bestow powers on national banks that grant banks the presumption of preemption unless state laws do not significantly interfere with those powers. The Court’s deferential posture is not, however, without limits. In Cuomo v Clearing House Association, LLC,72 the Court determined that the OCC’s regulations had gone too far. Regulations issued by the OCC established that it was the only entity that could exercise visitorial powers73 over a national bank, even in cases of “[e]nforcing compliance with any applicable federal or state laws.”74 Applying Chevron deference,75 the Court determined that the OCC’s interpretation of the term “visitorial powers” was not reasonable given the historical context of the term.76

Despite Clearing House Association, the Court’s jurisprudence on NBA preemption is still highly deferential and suspicious of state interference with the powers of national banks. That stance remains unchanged by the financial crisis and the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act.77 Dodd-Frank did, however, amend the NBA by codifying a preemption standard in 12 USC § 25b.78 12 USC § 25b adopts the “significantly interferes” language of Barnett Bank after specifically citing that case as the applicable preemption standard.79 Further, the OCC may make preemption determinations on a case-by-case basis, but those determinations will still be subject to the Barnett Bank standard and traditional Chevron deference to the OCC’s interpretation of the NBA’s language.80 The codification of the Barnett Bank standard by Congress suggests that the associated powers were granted to national banks and that the OCC’s interpretation of those powers will continue to have significant force in preempting state laws.

The suspicion of state interference underlying the NBA did not extend to state usury laws. While the NBA restricted states from interfering with national banks, the states remained the source of interest rate limits.81 Therefore, the preemption of state usury laws can be fully understood only in the context of the history and purpose of usury laws.

D. The History and Purpose of Usury Laws

Usury laws have existed for most of recorded history.82 While usury laws emerged as a result of moral disapprobation of lending in general and lending at excessive interest rates in particular,83 they persist today to protect consumers. Without usury laws, consumer advocates believe consumers would be unprotected from disingenuous lenders.84 Advocates claim the average consumer does not have enough knowledge to fully understand the implications of most loans, especially the most pernicious lending practices such as payday lending and instant tax refunds.85 Further, advocates argue that extremely high interest rates can lead to a cycle of borrowing that unsophisticated consumers cannot understand when they initially take out a loan and cannot escape once they do.86 To protect these consumers, states limit the amount of interest lenders can charge via usury laws.

While these consumer protection arguments reflect what courts and academics typically acknowledge as the purpose of usury laws, some commentators have suggested that usury laws may also constrain or deter potentially risky behavior that results from the creation and continuation of the welfare state.87 Additionally, behavioral economics research continues to find that consumers may have time-inconsistent discount rates. That is, consumers value benefits received over time (such as dividends or annuity payments) in a way that is inconsistent, such that increases in value across the same period of time will be thought of differently depending on how much time has already passed. Such inconsistency is not the expected result under the traditional rational expectations approach to discounting.88 The presence of time-inconsistent discount rates may favor a paternalistic response in the form of usury laws.

Like any price cap, usury laws may also have deleterious rationing effects. For instance, potential borrowers whose risks warrant interest rates higher than the maximum rate set by usury laws may not be able to borrow money. Economic intuition makes clear that price restrictions reduce the quantity of goods supplied,89 and empirical evidence supports this on a microeconomic level: if the rate of allowable interest increases, more loans will be made.90 While this critique is attractive, it does not address the normative issue: Should governments enforce an artificial limit on interest rates to protect consumers? The classic libertarian response assumes that freedom of contract is supreme,91 and some commentators have gone so far as to suggest that the enforcement of closely related doctrines like unconscionability (and perhaps their very existence) harms consumers by “encourag[ing] irresponsibility and hence greater dependency” on the laws.92

Regardless of the market limitations and potential normative arguments against usury laws, they continue to exist, in some form, in all fifty states.93 While the NBA could have suspended all usury laws, Congress instead chose to adopt the state usury laws for its own purposes within the NBA.94 Of course, Congress did intend for the NBA to create uniformity,95 which cuts against the idea that Congress did not intend for the NBA to preempt state usury laws. Perhaps more persuasively, when Congress allowed banks to have interstate branches,96 Congress adopted a usury savings clause that, in no uncertain terms, reiterated that 12 USC § 85 would continue to have preemptive effect.97 However, courts remain split as to which usury law Congress intended to apply when a national bank–originated loan is transferred.

E. The Rise of the Consumer Protection Movement

The growing preeminence of national banks, coupled with their ability to avoid most state law consumer protection regulation because of preemption, has spurred increasingly vocal advocacy for consumer protection in the context of financial products. These advocates point to a growing body of empirical literature to illustrate the harms associated with an underregulated financial industry. This Comment straddles the border of this ongoing debate between advocates and critics—a debate that has not focused on usury, despite usury’s relationship to consumer finance, largely because the decision in Marquette allows national banks to import the lax usury laws of Delaware and South Dakota to the rest of the country.

A growing body of literature suggests that the growth of national banks has led to a growth in the availability of financing, which has caused consumer distress. These critiques focus on the growth of fees and short-term credit products with interest rates above 100 percent.98 While the criticisms of the banking system are varied, one argument is that preemption allows national banks to skirt state consumer protection laws. To consumer financial protection advocates, the prevalence of preemption within banking law has resulted in a situation in which “almost any state statute designed to protect consumers is preempted by federal law.”99 This critique does not rely on the assumption that state regulation is inherently good—advocates admit that “[i]n an era of interstate banking, uniform regulation of consumer credit products at the federal level may well be more efficient than a litany of consumer protection rules that vary from state to state.”100 Rather, these advocates cite the failure of federal regulatory agencies to provide adequate protection to consumers.101

Critics of the consumer protection movement reply to these concerns from many angles. Some posit that consumer financial “injuries” are not, in fact, injuries—injuries result in deadweight losses while, in consumer financial products, the harm to the consumer is a gain to the creditor, meaning that there is no deadweight loss.102 In areas such as tort law, in which harms produce deadweight losses, ex ante regulation is appropriate—but consumer financial products do not have the same attributes.103 Ex ante regulation will not result in increased efficient precautions but rather in reduced supply of the product, which may impact the most vulnerable consumers.104 Additionally, other critics respond to the preemption point by showing that curtailing preemption would reduce the availability of credit and, thus, would be inefficient.105 This debate persists even after the creation of the Consumer Financial Protection Bureau (CFPB), an independent agency created by Dodd-Frank that has been supported by advocates of consumer financial protection since before its inception.106 The legal question—whether preemption of state usury laws continues upon the sale of a loan to a non–national bank third party—implicates this debate in some sense, but courts, rather than Congress, will be the arena in which it is answered.

II. The Law of Third-Party Transfers of Nonusurious Loans

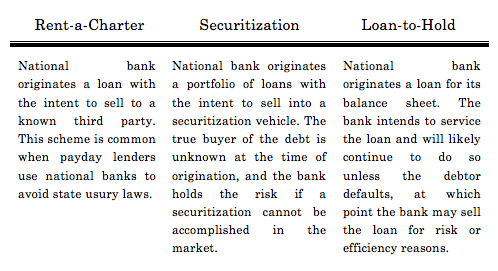

When making and processing loans, national banks are effectively immune from state laws via preemption.107 However, when a national bank sells a loan, it remains an open question whether the NBA’s preemptive effect continues. Effectively, given the preemptive force of 12 USC § 85, a Delaware-based national bank can make a loan to a New York resident at a rate of interest that would be usurious under New York law but not usurious under Delaware law. However, if the national bank sells the loan, can the third-party non–national bank buyer collect at an interest rate that is usurious under New York law—that is, does the preemptive power of the NBA continue upon the sale of the loan to a third party?

The Supreme Court has never decided this issue, but several circuits have reached diverging opinions. Specifically, the Fifth and Eighth Circuits have held that a nonusurious loan cannot be made usurious upon sale, while the Second Circuit has concluded that once a national bank is no longer affiliated with the loan, the loan may be made usurious.108 This Part examines the decisions of the Fifth and Eighth Circuits and shows that they lend support for continuing preemption after a loan transfer by adoption of the “once nonusurious, always nonusurious” doctrine. The Seventh Circuit, in a case unrelated to NBA preemption, also adopted the once nonusurious, always nonusurious policy, and the Seventh Circuit’s analysis is discussed and applied to the preemption issue in this Part. Next, this Part discusses the Second Circuit’s opinions on NBA preemption, culminating in Madden v Midland Funding, LLC,109 in which the court held that preemption does not carry forward posttransfer.110 Finally, it compares the different analyses conducted by the Fifth, Eighth, and Second Circuits and puts to rest any possibility for distinguishing the cases on the facts.

A. Initial Holdings Support Preemption Continuing Postsale

Neither the Fifth nor the Eighth Circuit has explicitly ruled on the question of NBA preemption in the context of third-party transfers. However, cases within these circuits suggest that they hold the view that, once a nonusurious loan has been originated, the loan remains nonusurious for the remainder of its life, regardless of whether the loan is transferred. The Fifth Circuit addressed a related transfer issue in Federal Deposit Insurance Corp v Lattimore Land Corp.111 Lattimore had taken out a note from the Hamilton Mortgage Corporation.112 Hamilton Mortgage Corporation was a Georgia-based financial company (not a national bank), which charged Lattimore an interest rate that was allowable under Georgia law.113 Hamilton fell into distress and transferred over 90 percent of the interest in the loan to a related entity—the Hamilton National Bank, a Tennessee-based national bank.114 The FDIC eventually put Hamilton National Bank into receivership and attempted to collect on the debt Lattimore owed Hamilton National Bank.115

Lattimore claimed Hamilton National Bank could not collect on the loan because the loan was usurious under Tennessee law, which Lattimore alleged applied to Hamilton National Bank per the NBA.116 The court found that the NBA did not apply and that normal choice-of-law rules suggested that the law of the state where the loan originated would control whether usury was an applicable defense to nonpayment of the loan.117 Summarizing its holding, the court stated that “the note, initially non-usurious, remains so.”118

The Eighth Circuit furthered this logic in Krispin v The May Department Stores Co.119 May Department Stores created an Arizona-based national bank to operate its credit card division. The national bank would assign the receivables from the origination of credit to May Department Stores. Cardholders brought suit against May Department Stores alleging a usurious interest rate because the rate charged was above the rate allowed in Missouri, where May Department Stores was located.120 May Department Stores asserted a preemption defense because the originator of the credit was the national bank, not May Department Stores.121 The interest rate charged was not usurious under Arizona law and, as such, May Department Stores believed the claim failed.

Focusing on Lattimore as persuasive precedent, the Eighth Circuit looked to the originator of the debt to determine if the loan was usurious.122 Because a national bank originated the loan, the Eighth Circuit held that the NBA applied and preempted Missouri state law usury claims.123 Even though May Department Stores purchased the loans from the national bank, the court determined that it was more appropriate to look to the originating entity than to the assignee.124 The bank’s origination of the loans and ongoing involvement in the servicing of the loans was determinative of the issue such that the court did not conduct a thorough conflict preemption analysis; instead, it asserted that complete preemption allowed the national bank to avoid the state law usury claims.125 However, the court did not rule on the other purely state law claims brought by the plaintiffs, including “breach of contract, breach of duty of good faith and fair dealing, misrepresentation, unjust enrichment, and civil conspiracy.”126 Thus, while the NBA may preempt usury claims, state law claims unpreempted by the NBA survive, and a national bank is likely subject to these types of claims.127

Thus far, only the Fifth and Eighth Circuits have analyzed preemption in the context of third-party sales of loans, but the Seventh Circuit has more generally adopted the once nonusurious, always nonusurious standard.128 In assessing whether a nonusurious loan becomes usurious upon sale to an unregulated entity (which could not charge the same higher interest rate that the regulated entity could charge), Judge Richard Posner asked, “Why should the interest rate be lower if instead of collecting the debt directly the credit card company assigns (sells) the debt to another company, which hires the lawyer to collect it?”129 Posner found no reason for this distinction; in fact, he asserted that specialization in the market (credit card companies specializing in originating loans and debt collectors specializing in collecting on delinquent debt) likely reduces the cost of credit for borrowers.130 If, on the other hand, the loan becomes usurious upon the transfer to a debt collector, the originator itself will have to collect the debt and will pass on the higher cost to the borrower.131 Posner’s argument did not rest solely on an economic analysis of the law; he went on to support his holding by asserting that “once assignors were authorized to charge interest, the common law kicked in and gave the assignees the same right, because the common law puts the assignee in the assignor’s shoes, whatever the shoe size.”132 Lastly, and perhaps unpersuasively, Posner argued that the debtor should not receive the benefit of a lower interest rate upon default as that would create an incentive to default.133

Against the administrative ease and economic rationale of the once nonusurious, always nonusurious doctrine, the Second Circuit determined in Madden that once a national bank is no longer affiliated with the loan, preemption by the NBA ends and state usury laws apply.134 Before presenting the Second Circuit’s rationale in Madden, this Comment explores that court’s prior NBA preemption jurisprudence.

The Second Circuit has found that the NBA preempts state law when the state law fully forecloses the bank’s opportunity to exercise its power. This standard was developed in several Second Circuit cases that attempted to implement the “significantly impairs” preemption standard adopted by the Supreme Court in Barnett Bank. In SPGGC, LLC v Blumenthal,135 the court addressed whether the sale of prepaid gift cards violated a Connecticut statute that banned gift card inactivity fees and expiration dates.136 SPGGC, an owner and operator of shopping malls, sold prepaid gift cards issued by a national bank.137 Because the cards were sold by SPGGC, a non–national bank, but were issued via a national bank, the court first had to determine how to treat the relationship between SPGGC and the national bank.138

NBA preemption analysis focuses on the power being wielded by the subsidiary and not the corporate structure of the entity.139 However, because SPGGC was a separate entity and not a subsidiary, the court determined that preemption would generally not apply, though it acknowledged that “[i]t is possible that, in certain instances, a national bank’s decision to carry out its business through an unaffiliated third party . . . might constitute an exercise of the bank’s incidental powers under the NBA.”140 Because the court did not consider this relationship with a third party an exercise of a national bank’s power, the court was left to “ask whether the regulation at issue actually affect[ed] the national bank’s exercise of any authorized powers or whether it limit[ed] only activities of the third party which [were] otherwise subject to state control.”141

The structure of the national bank’s relationship with SPGGC was such that the bank made money via interchange fees (fees charged to a retailer when the card is used), whereas SPGGC made money on the fees associated with the card (including the monthly service fee).142 Given this structure, prohibiting SPGGC from charging these fees should not have conflicted with the national bank’s power “to engage in [ ] offering ‘electronic stored value systems.’”143 The court noted the possibility that it might have come to a different conclusion, in line with the First Circuit’s conclusion in a similar case, if the national bank had issued the gift cards itself.144

On the issue of the cards’ annual expiration, the court remanded because the national bank’s relationship with Visa, the card processor, mandated the yearly expiration of the card as part of Visa’s fraud-prevention program.145 The court concluded that “an outright prohibition on expiration dates could have prevented a [national bank] from acting as the issuer of the [ ] Giftcard.”146 The court’s analysis of the relationship was highly focused on how the economic relationship would impact the bank’s ability to exercise its powers. Reducing or prohibiting SPGGC from collecting monthly fees would not directly impact the national bank; while SPGGC might respond by getting out of the business of issuing cards, the restriction would not directly prevent the bank from helping SPGGC issue those cards. In contrast, the prohibition against expiration dates would force the national bank out of the market because of its arrangement with Visa.147

Similarly, the Second Circuit focused on the relationship between a national bank and a third party in Pacific Capital Bank, NA v Connecticut.148 That case involved a challenge to a Connecticut law that limited the rate of interest an entity could charge on a refund-anticipation loan.149 The loan was originated by a national bank through a tax preparation service.150 The national bank alleged that the NBA preempted the Connecticut regulation, and the court agreed.151 While the state argued that the law applied only to agents of the national bank, the court determined that the NBA allows national banks to exercise incidental powers through the use of agents.152 “A state statute that forbade national banks to exercise their incidental powers through agents would thus plainly be preempted. . . . [I]t [is] equally plain that a state statute cannot be allowed to avoid preemption by imposing such a prohibition indirectly.”153 While the national bank could theoretically still make loans at a rate higher than that permitted by the Connecticut statute, the court concluded that “as a practical matter” the law either disallowed the national bank to use agents to make these loans or forced the bank to “forgo their NBA-permitted rates and limit themselves to the lower rates specified by” the Connecticut statute.154 Again, the court’s focus seemed to be on the economic impact on the national bank—effectively, under the statute, the bank could not offer these loans at the rates it otherwise would have charged, much as the bank in SPGGC could not issue gift cards under the state statute prohibiting expiration dates.

The Second Circuit has established that NBA preemption may apply when a national bank employs an agent to carry out its powers and when applying state law to the agent would effectively prohibit the national bank from exercising its powers. In Madden, the Second Circuit was asked to determine whether NBA preemption of state usury laws continued after the sale of a loan to a non–national bank third party. The Second Circuit, distinguishing this case from SPGGC and Pacific Capital Bank, held that declining to allow NBA preemption to transfer upon sale of a loan did not interfere with the exercise of a national bank’s power to sell loans.155

In holding that the NBA did not preempt the claim of usury, the Second Circuit looked to its holding in SPGGC. It compared the sale of loans to a third party to the monthly fee in SPGGC.156 Just as regulating the fees that an agent of the national bank could charge in SPGGC would not have prevented the national bank from issuing the gift cards, regulating a third party’s interest rate would not prevent the bank from selling the loans to the third party.157 While the court admitted the possibility “that usury laws might decrease the amount a national bank could charge for its consumer debt in certain states,” the court believed that “such an effect would not ‘significantly interfere’ with the exercise of a national bank power.”158 Further, the court distinguished this case from Pacific Capital Bank on the basis that third-party debt buyers are not the bank’s agents.159 While the bank could employ an agent to collect the debt—at which point the Second Circuit suggested preemption would continue—once the national bank sold the loan, there would be no agency relationship, and as a result the NBA would not have preemptive effect.160

Additionally, and contrary to Posner’s economic analysis of the issue, the Second Circuit worried not about the cost of credit but rather about the overextension of preemption by allowing national banks to run around state usury laws.161 The Second Circuit’s asserted policy goal led it to focus more on form than on substance; it distinguished Madden from the Eighth Circuit’s opinion in Krispin based on the fact that in Krispin the national bank retained some ownership in the loan despite the fact that the non–national bank entity had the full economic risk of the loan.162 Effectively, the court seemed to suggest that had the national bank retained any interest in the loans (through, for example, maintaining a modest ownership interest, servicing the accounts, or setting ongoing terms for the extension of credit), preemption would have been maintained.163 But if the Second Circuit were really interested in adopting a policy of avoiding overextensions of preemption, this modest difference in substance (some or minimal ownership compared to no ownership) does not perfectly capture the court’s preference—the court may be allowing preemption in effectively identical situations, such as when a national bank sells substantially all of the loan, due to its focus on form over substance.

By holding that preemption is not applicable when a national bank sells its loan, the Second Circuit created a fundamental difference between its policy and the policies adopted in the Fifth, Seventh, and Eighth Circuits—those circuits created a bright-line rule that once a loan is nonusurious, the loan is always nonusurious. To the contrary, the Second Circuit holds that so long as a national bank maintains some modicum of ownership (broadly defined) in the loan, preemption is applicable, but once ownership is fully extinguished, the NBA ceases to apply. As a result, a petition for a writ of certiorari was filed with the Supreme Court,164 but certiorari was denied.165

C. Reckoning with the Different Interpretations

The split in authority between the Second Circuit and the Fifth, Seventh, and Eighth Circuits is implied by the language of the opinions in the Fifth, Seventh, and Eighth Circuits. The Fifth, Seventh, and Eighth Circuits have not directly confronted the issue of whether a complete sale of a loan by a national bank to a third party removes the NBA’s preemptive effect on state usury laws. However, the sweeping language of those courts suggests that they would likely hold this to be the case, as they have adopted the proposition that a nonusurious loan does not lose its nonusurious quality upon transfer.

The Second Circuit attempted to distinguish these cases based on the full sale of the debt occurring in Madden (in which the Second Circuit found that the national bank maintained no ownership postsale) and some remaining ownership in the loans at issue in Krispin. Moreover, the Second Circuit characterized the bank in Madden as different from the bank in Krispin because the bank at issue in Krispin “issue[d] credit, processe[d] and service[d] customer accounts, and set[ ] such terms as interest and late fees,” which gave the bank an interest in the loan absent primary ownership.166

The cases are not as readily distinguishable as the Second Circuit made them seem. The Second Circuit claimed that, upon the sale of the debt, the national bank no longer has an interest in the loan. That is contrary to the typical transaction in which a seller sells an account to a third party: the seller of the account may still have a relationship with the buyer but not an interest in the loan once it is sold. For example, when someone purchases a car, the dealership or car manufacturer no longer has an interest in the car after the sale but may still have a relationship with the purchaser. Yet the Second Circuit failed to account for the Krispin national bank’s continuing relationship with May Department Stores in distinguishing Krispin from Madden. Because the national bank was a subsidiary of May Department Stores, the preemption framework outlined by the Court in Watters could be applicable—May Department Stores was merely carrying out the power of a national bank by acting as the bank’s agent. This distinction would help align the Second and Eighth Circuit decisions with Supreme Court precedent. Still, similar to Madden, the national bank subsidiary of May Department Stores was “required to maintain arms’-length transactions” with its parent.167 While there was an ongoing relationship between May Department Stores and the national bank in Krispin, the arm’s length nature of the relationship makes it similar to Madden. However, there is no explanation as to why an ongoing relationship should be a basis for preemption but a subsidiary relationship should not. As such, the cases may not be as distinguishable as the agency theory may imply.

Furthermore, the Second Circuit’s rejection of the analogy to Lattimore is misplaced, similar to its rejection of the analogy to Krispin. Lattimore is Madden in reverse, and holds that the originator, not the buyer, determines the interest rate. While the facts are in reverse, the principle adopted in Lattimore can be applied to Madden to achieve a fundamentally different result. It is not clear why the principle in Lattimore should not be adopted in Madden. As such, the Second Circuit, by not adopting this principle, created a break from the Fifth, Seventh, and Eighth Circuits.

III. Preemption Applies to Third-Party Sales

The difference of opinion between the circuits raises an important question for both consumers and the financial industry.168 The Second Circuit’s analysis of conflict preemption was cursory and did not explore the full implications of not allowing the NBA to continue to be preemptive in the event of a sale to third parties. This Part first provides a fulsome preemption analysis and then analogizes to the common law and constitutional law to support the Fifth and Eighth Circuits’ conclusions that the NBA should continue to be preemptive even after the sale of a loan to a third party. Finally, a transaction cost framework is presented to show that, contrary to the Second Circuit’s and academics’ assertions, the Madden holding may impact only the form and not the substance of debt sales to third parties. Effectively, national banks will employ methods to circumvent an inability to sell with preemptive effect. Those methods and the transaction costs associated with those methods will likely be passed on to consumers. Therefore, allowing preemption to continue upon sale may be not only the simplest solution but also the best one for consumers.

A. Standard Conflict Preemption Analysis Is Not Dispositive

While the Second Circuit in Madden determined that preemption did not continue because of the lack of an agency relationship, its preemption analysis focused on the sale of a defaulted loan, and, as a result, the opinion did not investigate the implications of the holding on other national bank powers. This Section conducts a more robust preemption analysis regarding all of the potential powers implicated by disallowing preemption posttransfer. This Section starts by confirming that preemption analysis is applicable in this scenario, and it then proceeds to determine the national bank powers that are implicated by loan sales. This Section concludes by showing the potential divergence of opinion regarding whether restricting preemption to only national banks severely impairs any of the identified powers.

Before determining which way preemption analysis cuts, the preliminary question whether preemption analysis applies to loan sales by a national bank to a third party must be answered. The usury laws at issue are being enforced against a third party, not against a national bank. Most circuits agree that the NBA still preempts state laws even if the law is enforced against only a non–national bank, because it may impact a national bank. The Supreme Court has never clearly ruled on this issue, but Watters is persuasive here, as it sets out national bank powers as the focal point of a preemption analysis.169 Some commentators have suggested that, under then-current case law, while the NBA would apply to regulation of a national bank’s counterparties, such regulation would not have preemptive force.170 However, such analysis has not generally taken the holdings of Krispin or Lattimore into account in the context of state usury laws.171 Further, even the Second Circuit agrees that, in some instances, the NBA can preempt state laws enforced against non–national banks.172 Regulation of national banks’ counterparties, especially regulation aimed at changing the national banks’ behavior, likely implicates the NBA.173 Accordingly, a conflict preemption analysis is in order.

Prior to determining whether the NBA preempts state usury laws, it is necessary to identify the powers of national banks that could conflict with state usury laws. The power to charge an interest rate that is permissible in the state where the bank is located may be implicated by the application of state usury laws to third parties, but other powers of a national bank are also implicated.174 A national bank has the power to “make, sell, purchase, participate in, or otherwise deal in loans and interests in loans that are not secured by liens,”175 as well as the power to sell and securitize loans176 and to sell loans associated with real estate lending.177 Effectively, Congress has given national banks the ability to lend money at the interest rate allowed in the state where they are located, freely trade loans, and, if necessary, sell loans for the purpose of securitization. All of these powers are potentially implicated if preemption does not follow loans made by national banks.

- The effect on national banks’ powers is significant.

When state laws potentially impact a national bank’s power, a preemption analysis is warranted. In Dodd-Frank, Congress clarified that a court’s inquiry in an NBA-preemption case is governed by the “prevents or significantly interferes” standard from Barnett Bank.178 This question, whether a state law “significantly interferes” with a national bank’s power, is intensely fact-specific, and courts’ decisions in these cases generally rest on their characterizations of the power and the interference. The Second Circuit’s characterization of the impairment in Madden is emblematic. In Madden, the court saw the harm as changing the price at which banks could sell their debt, not an inability to sell debt.179 The impairment in Madden can be analogized to the types of impairments found in other cases. For example, the Ninth Circuit found that the NBA preempts state laws prohibiting banks from charging nondepositors ATM fees.180 The question that the Second Circuit addressed in Madden is similar to the question in the Ninth Circuit case—whether a state’s usury laws prevent a bank from charging an interest rate that it is permitted to charge under the NBA.

Similarly, courts have recently held that the NBA has preemptive effect with regard to check-cashing laws. These laws provide that a bank must cash a check at par value.181 Courts have held that state laws prescribing that banks cash checks at par are in conflict with regulations promulgated by the OCC under the NBA.182 These state laws do not stop a national bank from charging fees but rather prohibit a specific type of fee. Similarly, in the case of loan transfers, holding that preemptive effect does not carry over may not stop a national bank from selling the debt; it will just restrict or impair the bank’s ability to do so. While in the check-cashing cases the OCC’s interpretation of “customers” was at issue,183 the courts nonetheless held that the OCC’s interpretation was warranted and that state laws “prohibit[ed] the exercise of a power which federal law expressly grants the national banks.”184 Madden is a similar case, albeit without an interpretation by the OCC: The NBA permits a national bank to sell loans.185 Allowing the loan transfers to decrease the permissible interest rate impairs the bank’s ability to sell those loans, though it does not eliminate the ability—just as regulating the amount for which a bank can cash a check does not prevent the bank from imposing other fees on its customers. However, in the check-cashing cases, the Fifth and Eleventh Circuits saw such an activity as impeding the powers of a national bank and, as such, determined that the NBA was preemptive. Similar logic should apply upon the transfer of a loan.

The Supreme Court has not drawn a clear line as to what constitutes “significant impairment” of a national bank’s power. As shown above, the characterization of the facts is important, and judges may import their policy preferences into the characterization of the facts to obtain their desired outcomes. In close cases, any potential to definitively answer the preemption question by characterizing the facts in a certain way seems dissatisfying and can likely be improved upon by looking for alternative paths of analysis. In that vein, Marquette provides another avenue for preemption analysis.

The petitioners in Marquette claimed that a national bank should be considered located wherever the creditor does business.186 The Court rejected this because it would “throw into confusion the complex system of modern interstate banking” and create a great deal of uncertainty for national banks when they originated loans.187 Similarly in the context of third-party loan sales, banks would need to take into account the debtor’s location when selling the loan and, potentially, when originating the loan. Perhaps more worrisome is that the bank would need to track the debtor (in this case a defaulted debtor), as it is unclear which state’s usury law would apply: the state where the debtor opened the account, the state where the debt was sold, or the state where the debtor brought his usury claim. While the debt buyer may be more concerned about this ambiguity, the bank would also need to be concerned in order to provide the potential debt buyer with this information. Such an administratively complex system predicated on the application of state law may run afoul of the proscription in Marquette.

Lastly, national banks, in addition to having the power to sell loans, have the power to securitize assets. In general, securitizations occur when a bank pools assets together (in this case, loans) and sells them to a special purpose vehicle (SPV). The SPV is able to purchase these assets from the bank by issuing debt to investors. Securitizations generally occur shortly after the origination of loans, at which point the bank sells the loans at par (that is, at 100 cents on the dollar).188 If preemption were not carried forward, then the bank either could not securitize certain assets (assets that would be usurious once owned by a non–national bank entity) or would have to stop underwriting loans at an NBA-permissible rate if it wanted to securitize those loans. Either way, the national bank’s ability to securitize loans would be hampered. In fact, the effect would be similar to what the Second Circuit observed in Pacific Capital Bank. In that case, because usury laws were enforced on the bank’s agent, the bank was forced to either not make loans or make loans at a rate below the rate allowed under the NBA.189

Similarly, in the securitization context, if preemption does not continue after the sale of the asset to a third party, the bank will have to either get out of the business of securitization or (more likely) lend to some consumers at rates below the rate allowed under the NBA. The same choice presented in Pacific Capital Bank exists in this situation, but the choice is starker. Conceivably, in Pacific Capital Bank, the bank could have set up a tax return business that, in addition to filing tax returns, offered refund-anticipation loans. Here, on the contrary, if the Second Circuit’s holding stands, a national bank would not be able to perform one of its powers—securitization—without taking the state usury laws into account.

- Through the NBA, the federal government is imposing a price cap on national banks that should not change upon sale.

Usury laws can be conceptualized as price caps—the permissible interest rate is the price ceiling for a national bank. This price cap inevitably affects the price at which banks can purchase (underwrite) and sell loans. In this sense, allowing individual state usury laws to apply to national banks has the same effect as allowing individual state check-cashing laws to apply—it restricts national banks’ ability to exercise their power. While state usury laws may be viewed as background contract principles that are generally exempt from preemption absent explicit federal law intervention,190 they are in fact another form of consumer protection laws.191 Allowing state usury laws to control the sale or transfer of debt would “impose state requirements that differ[ ] from” federal law.192

The case for federal preemption of usury laws is, in many respects, no different from the case for federal preemption of state tort claims in medical-device cases.193 In the medical-device space, the federal government has set a minimum safety standard and has preempted state laws to the extent they impose a higher standard on the device manufacturer, as allowing states to impose higher standards would “disrupt[ ] the federal scheme.”194 This makes sense—if every state imposed some higher safety standard, medical-device manufacturers would be forced to either produce fifty different products or, more likely, conform to the highest safety standard. States would be able to regulate in an area in which the federal government has made clear that there should be only national regulation.

Similarly, the NBA was enacted to create a federal banking scheme insulated from state interference.195 Just as the federal government set national safety standards for medical devices, the NBA sets standards for national banks, including a price cap on the products they offer. In the medical-device field, allowing state law to increase safety standards may lead to state law superseding federal law in application. In medical devices, the worry is that states will raise the safety floor. In the national bank context, the worry is that states will lower the usury ceiling. National law must, then, preempt state law. Otherwise, the fear of state law creeping into and dominating an area in which the federal government has established a national rule is likewise apparent.

But the Court has acknowledged that there are occasions when state regulation of medical devices is not preempted. According to the Tenth Circuit’s interpretation of Supreme Court precedent, when the duty owed by manufacturers under state law parallels the duty owed under the federal law, the federal law does not preempt state law.196 In providing some clarity on what types of laws parallel state laws, the Court’s decisions, as interpreted by the Tenth Circuit, have specified that state and federal laws parallel one another “not only when they are identical, but also when state law imposes duties on the defendant that are ‘narrower, not broader’ than those” imposed by federal law.197 For example, if federal law imposed a strict liability regime on a medical-device manufacturer but state tort law imposed a negligence standard, all else equal, the laws would parallel each other because the state law was “narrower” than the federal law.198

Admittedly, this analysis applies imperfectly to the NBA context. Medical devices are traditionally national products produced for a national consumer base.199 And while the growth in national banks means that large multistate banks dominate the lending market today, historically bank loans have been more local in scope.200 Nonetheless, the analogy helps clarify how the Court employs preemption analysis to a law meant to create a uniform system of regulation. And, while not discussed in any court, a medical-device manufacturer does not lose the preemptive force of federal law because it sells the product into the market. Medical devices are regulated for the purpose of being put into the market and used by medical practitioners—eliminating preemption upon the transfer of the device would negate the purpose of the enterprise. Applying the analogy to national banks, the loans underwritten by the banks are similarly conceived of as products to be put into the market.

Loans may not typically be thought of as products, but from the banks’ perspective, loans are a product they are selling. Banks compete on price just as manufacturers do; the price just happens to be the interest they charge. There is nothing conceptually different about what manufacturers and banks are doing—the former sell products and the latter sell money, but they both sell something. In a medical-device case, an injured patient could not sue the doctor due to the medical device’s malfunction if the device adhered to the federal regulation. Similarly, the preemption of usury in the NBA should not fall because of the sale of the bank’s product—a loan. Applying the same logic that the Supreme Court applied to medical devices supports a finding of preemptive effect.

- Preemption analysis, and the “significantly impairs” test specifically, does not yield a conclusive answer.

Despite the above analysis, how best to interpret preemption of state usury laws remains unclear. Some commentators have suggested that state regulators can regulate bank counterparties to prevent a bank from exercising some powers, such as the power to sell loans to third parties.201 However, these commentators admit that regulating a national bank’s counterparty (in this case by enforcing state usury laws) “might constrict the secondary market for consumer debt and thereby lower the resale price of the debt.”202 At first blush, this does not appear to be regulating the national bank but instead modestly changing the market for the bank’s credit. Yet this change may have broader implications: reducing the price at which banks can sell loans into the secondary market may incentivize banks to change the terms of their initial loans. Therefore, by regulating counterparties, states are implicitly regulating national banks203 —an outcome the NBA was enacted to avoid.

In terms of formal preemption analysis, the question is at what point state laws “significantly impair” the bank’s ability to sell loans and to set the terms for loans. In Madden, the court found that allowing state usury laws to apply to third-party debt purchasers would “limit[ ] only activities of the third party which are otherwise subject to state control.”204 On the surface, the argument that a decrease in the interest that can be charged from 27 percent to 25 percent likely does not “significantly impair” a bank’s ability to either originate or sell loans is persuasive. But there are two problems with this line of reasoning. First, following this reasoning to its logical extreme would allow state usury laws to creep from just impairing a bank’s ability to originate and sell loans to “significantly impairing” a bank’s ability to originate and sell loans—line drawing in this case would have to turn on the specific facts of the state’s laws, the national bank’s location, and the amount of business a bank does in the state. Moving forward in this fashion would be cumbersome, but a focus solely on the preemption analysis leads to this conclusion. If the Second Circuit’s logic is pushed to this extreme, fact finding regarding what significantly harms a national bank would best be left to either Congress or the OCC.

Second, this line of reasoning belies the realities of bank regulation. The Second Circuit has admitted that applying state usury laws to third-party sales “might decrease the amount a national bank could charge for its consumer debt in certain states.”205 Stopping there, the court found that this decrease in price would not “significantly interfere” with a national bank’s powers.206 The reality of bank regulation offers a more complex view.

Several US regulators, including the OCC, the Federal Reserve, and the FDIC, regulate national banks. This regulation is done via minimum-capital requirements.207 Effectively, regulators force banks to risk weight their assets and to hold capital against their assets on a risk-weighted basis. Risk weights encourage certain types of lending over others.208 Regulators have chosen risk weighting as a way to confront the inevitable moral hazard problem in banking—government insurance, in the form of deposit insurance and bailouts, allows banks to take excess risk because the bank captures the upside but is insured on the downside by the government.209 The risk weights are expected to proxy the riskiness of the loans. So, for example, a US Treasury bill will have a risk weight lower than a loan to a highly indebted corporate borrower.210 The risk weight is then multiplied by the face value of the loan. To continue the example, if a bank held $100 of US Treasury bills and $100 in risky corporate loans with risk weights of 20 percent and 150 percent, respectively, the bank would have risk-weighted assets of $170 on $200 of assets at face value.

Once a bank determines the amount of risk-weighted assets it holds, it must then ensure that it has enough capital relative to its risk-weighted assets. Here, regulators provide a rule, such as a 7 percent capital ratio. The capital–asset ratio represents the amount of equity a bank must hold relative to its risk-weighted assets. In the above example, if the required capital–asset ratio were 7 percent, the bank would need to hold $11.90 of capital. This capital represents the amount of downside risk a bank can withstand—the value of the bank’s risk-weighted assets can decline by 7 percent before the bank will be insolvent. The price other banks will pay for defaulted loans (like those at issue in Madden) with high capital requirements, and thus high equity requirements, is limited by the capital requirements—a lower price will increase the expected return and may make the purchase attractive despite the large capital requirements.

After the global financial crisis of 2008, US regulators imposed updated risk-weight requirements on banks.211 Presently, a ninety-day defaulted, unsecured loan has a risk weight of 150 percent.212 This means that for every $1 of defaulted debt, a bank must hold $1.50 of equity.213 Effectively, the expected return on defaulted debt will be significantly reduced because of the increased capital requirement. Assume that the initial risk weight on the asset was 100 percent, so that for each $1 of loan, the bank held $1 of equity. If the expected return on the loan were 10 percent, the bank would expect a 10 percent return on its equity, because the loan was fully funded with equity.214 If the creditor defaults, the risk weight would jump to 150 percent (such that the bank would then need to fund the loan with $1.50 of equity for every $1 of loan). That will reduce the bank’s return to 6.67 percent, assuming the expected return of the loan remains constant.215

This has implications for the price of the loan that a bank in the Second Circuit (under Madden) is attempting to sell. Other banks216 will not be able to purchase the debt at its intrinsic value because of this regulation, so debt purchasers may be the only natural buyers left. At this point, nonbank debt purchasers have a solid advantage over banks in the market for these loans: they can already drive the price down, and allowing usury laws to apply to their purchases will only decrease the price they are willing to pay.

This discussion ends where it started—the extent to which applying usury laws to debt sold by a national bank will impair the bank’s ability to exercise its powers is an empirical question. Under the Second Circuit’s analysis, a court’s ability to answer such a question will either require extensive expert analysis or deferral to administrative agencies or Congress. As a result, turning to other analogies and analyses of this issue may create a more robust and administrable solution for courts. Of course, the Court has not typically used this line of analysis, instead resting on a more formalized idea of whether the application of state law conflicts.217 However, turning to other analogies in the next Sections—including to the common law, to constitutional law, and to a transaction cost framework—may help provide further support to this analysis.

Prior to the passage of the NBA, the Supreme Court issued various rulings indicating that a loan, once nonusurious, could not become usurious upon a subsequent transaction. Congress legislated against this backdrop. While none of these cases has facts similar to Madden, some suggest in dicta that the Court has always presumed that a loan’s usurious quality could be assessed only at the time of origination. Common-law precedent is bolstered by indications that the Court views the NBA as a national law governing contracts. As such, allowing state usury laws to impair a contract may run afoul of the Contract Clause of the Constitution.218 This Section first explores the common-law precedent and applies it to the question of preemption. Then, this Section examines questions related to the fact that the NBA could be interpreted as a federal law governing a contract, specifically discussing choice-of-law rules and the Contract Clause.

The early nineteenth-century Court addressed the issue of usury in broad language. These cases generally involved allegations of usury as a result of a discount on a note from the original holder to a third party.219 Essentially, the claim was that while the original interest rate was nonusurious, the note became usurious because the third party’s rate of return would be higher than allowed by state law once the discount was taken into account. In multiple cases, the Supreme Court rejected this notion and noted in dicta that “the rule cannot be doubted, that if the note be free from usury, in its origin, no subsequent usurious transactions respecting it, can affect it with the taint of usury”220 and that “a contract, which, in its inception, is unaffected by usury, can never be invalidated by any subsequent usurious transaction.”221 Perhaps most explicitly, the Court stated that “[i]f the bond was free from usury in its inception, no subsequent transaction between other parties could invalidate it.”222 And in the canonical case of Ogden v Saunders,223 the Court propounded that usury laws “declare [a] contract to be void in the beginning,” not after the contract has been established.224

Despite the Court’s strong language, these holdings are persuasive but not absolute authority on the matter of usury—these cases are set in a historical context in which notes traded freely between parties and were used as a form of currency.225 Prohibiting appropriate discounting of the notes in the nineteenth century would have reduced the amount of currency within the system and could have caused a run on coin money. However, modern contract law provides further support that, once a nonusurious loan is made, its nonusurious character is maintained in perpetuity. Historically, “[a]t common law, an assignee of a chose in action could enforce its right at law only in the name of the assignor.”226 While having to sue in the name of the assignor has become a historical relic, it provides some insight into the current dispute. Modern contract law allows a party to freely assign the right of the other party’s performance to someone else.227 In fact, the Uniform Commercial Code specifically allows a party to alienate his portion of the contract unless “the assignment would materially change the duty of the other party, or increase materially the burden or risk imposed on him by his contract, or impair materially his chance of obtaining return performance.”228 Not only can the contract be assigned but the damages resulting from a breach of contract can also be assigned.229 Allowing parties to freely alienate their contractual rights allows those rights to flow to their highest-valued use.230 Contract law has always presumed that “the assignee steps into the shoes of the assignor, assuming his rights as well as his duties.”231

While hearkening back to mid- and late nineteenth-century cases risks the claim of irrelevance, the Court has relied on and cited older cases in ruling on NBA preemption.232 The Court may be looking to these older cases because preemption focuses on congressional intent, and, given the limited legislative history available from 1864, these cases provide some of the best evidence of such intent. The decision in Marquette exemplifies the point: finding a lack of directly relevant legislative history, the Court turned to historical Supreme Court cases to support its inferences about what Congress knew about banking and how it intended the NBA to apply.233 Additionally, allowing claims to transfer with the same rights that the original contracting party had is a feature of both historical and modern contract law. While Congress adopted state usury laws, it did so against the backdrop of existing contract law, which adopted the once nonusurious, always nonusurious principle. As a measure of congressional intent and background rules governing contractual relationships, the once nonusurious, always nonusurious principle has ample support. Reading the NBA with this backdrop supports the transfer of the rights the contract has when initiated and allows preemption to continue postsale.

2. The NBA is a federal law that governs the contract from inception until completion.

Historical and modern contract law seem to suggest that usury is a question best decided at the inception of a contract. These issues involve questions of state law. While a generalization of the common law supports the adoption of the once nonusurious, always nonusurious policy, state courts may attempt to invoke the public policy of their states to find the usury laws of other states inapplicable.234

The potential for courts to invoke public policy to enforce their states’ usury laws may suggest that common-law analogies do not fully support allowing preemption to continue. This assumes that state law fully governs the loan contract, and the Supreme Court has suggested—though never fully confirmed—that the NBA and the usury law associated with it are national law, not state law. As such, the invocation of state law to hold the transferred loan usurious may conflict with choice-of-law principles and the Contract Clause.

There are many reasons why Congress may seek to incorporate state law into federal law, but regardless of the reason, “state law is generally borrowed with the understanding that it should serve federal interests.”235 The law governing the interest rate in a contract originating between a national bank and a debtor is federal law, and by means of 12 USC § 85, federal law imposes a choice-of-law rule on the contract’s interest rate: the law of the state where the bank is located governs. As national law governs the contract at inception, and the interest rate provision in particular, that law should continue to govern even upon the sale. As discussed above,236 basic contract law asserts that the rights of an assignor flow to the assignee and, as a result, the federal choice-of-law rule with respect to interest rate should continue to apply posttransfer.

If federal law governs the contract at inception, then there are two potential theories that explain why federal law should continue to control upon a sale to a third party. The first is a choice-of-law theory—the parties at the time of contract formation stipulated that federal law, for the purposes of the defense of usury, would apply. The Supreme Court has settled the issue of choice-of-law provisions relating to usury:

The general principle in relation to contracts made in one place to be performed in another is well settled. They are to be governed by the law of the place of performance, and if the interest allowed by the law of the place of performance is higher than that permitted at the place of the contract, the parties may stipulate for the higher interest without incurring the penalties of usury.237

In non-NBA cases, courts continue to enforce choice-of-law provisions allowing parties to stipulate which state’s usury laws will apply. When parties claim a usury defense that is not applicable under the chosen law, courts have rejected their claims.238 By adopting state law within the NBA, Congress applied a choice-of-law rule with respect to usury defenses—the choice-of-law rule should not change because of the transfer of the contract. And, as the Court has noted, the NBA provides the “exclusive cause of action for such claims” of usury against national banks.239 Thus, Congress’s rule is the exclusive rule for the disposition of these cases.

A second theory relates to both the Supremacy Clause and the Contract Clause of the US Constitution. The Contract Clause prevents a state from enacting a law that “impair[s] the [o]bligation of [c]ontracts.”240 Initial support for the Contract Clause applying to third-party sales comes from Ogden, in which the Court suggested that usury laws apply only at the inception of the contract.241 The Court noted that usury laws determine whether a contract is void or valid when it is formed. Because usury laws apply only at inception, they cannot impair the obligations of duly established contracts, and do not violate the Contract Clause. However, application of these laws after the contract’s inception would violate the Contract Clause.242

For the Contract Clause to be applicable, a state law has to “operate[ ] as a substantial impairment of a contractual relationship.”243 To find such an impairment, the court must find that (1) a contractual relationship existed; (2) “a change in law impairs that contractual relationship”; and (3) said impairment is “substantial.”244 For purposes of the NBA, the change-in-law prong will be paramount to finding a violation of the Contract Clause. The idea that federal law pervades the interest rate provision of a contract may seem abstract, but the Supreme Court has suggested that it understands the NBA to operate in such a fashion.245 The Supreme Court has repeatedly described the NBA as federal law that governs the contracts into which national banks enter.246 As a result, federal law at the time of origination has declared the contract valid and nonusurious. To find that the law changed upon sale to a third party suggests that there is in fact a change in law. This potential change in law is likely void, as the Supreme Court has determined that “if a law should declare that contracts already entered into, and reserving the legal interest, should be usurious and void, either in the whole or in part, it would impair the obligation of the contract, and would be clearly unconstitutional.”247 Further, while the Contract Clause has fallen out of favor with courts,248 the Supreme Court has noted that although the state has the power to impair remedies, its police power is weaker when it destroys a contract.249 Finding support for the second prong of the Contract Clause analysis nullifies the potential for states to apply their usury laws to transferred contracts.

Though this analysis suggests the Contract Clause is implicated, courts may choose to avoid the constitutional question.250 Nevertheless, the potential implication of the Clause continues to support an interpretation that the NBA should continue to preempt after a transfer of an originally nonusurious loan.

Simplified, the above analysis provides two insights into whether preemption should continue after a sale to a third party. First, the Court has adopted a view on choice-of-law rules in the specific context of usury that should be followed: parties may contract at the time of origination for a law that applies regarding usury. In the context of an agreement with a national bank, the applicable law is governing federal law—the parties agree to 12 USC § 85 as a choice-of-law provision that applies the laws of the national bank’s location to any defense of usury. This choice of law should not change upon a transfer. Second, if federal law declares a contract nonusurious upon origination, any subsequent state law impairment of the contract may run afoul of the Contract Clause.251

Both of these analyses divert from the conflict-preemption analysis that the Court has traditionally conducted in NBA cases. Nevertheless, they provide further evidence that congressional intent likely supports preemption—these background principles all support preemption carrying forward absent a contrary indication from Congress.

C. A Transaction Cost Framework Shows That Madden Will Not Impact the Secondary Market for Loans and Will Harm Future Consumers